What Our Signals Say about U.S. Dollar Risk

The recent surge in the dollar, driven by geopolitical tensions and the unique role of the U.S. in international financial markets, has brought currency hedging into focus.

Our strategic long-term orientation suggests that currency hedging should be a more frequent consideration when investing in foreign markets.

Here are two common methods to implement currency hedging and the rationales behind them.

1. Implementing Full 100% Hedging in Effort to Eliminate Currency Risk

A fully hedged approach perceives currency bets embedded in foreign equities as elements that do not contribute to expected returns or long-term value.

If your goal is to leverage the diversification potential of foreign stocks, which may be more affordable than U.S. markets and provide sector diversification, why introduce additional currency risk when investing internationally?

Furthermore, the S&P 500, which already has an overseas profit stream, inherently carries a weak-dollar bias in its earnings stream—earnings growth in the S&P 500 is significantly higher when the dollar is weaker rather than stronger. So why place further weak dollar bets?

This is why we fully hedge our investment in the WisdomTree Japan Hedged Equity Index. This strategy has proven successful as Japanese equity has performed well while the Japanese yen has continued to depreciate. Similar logic applies to European equities and broad-based international strategies—where we have fully hedged international quality indexes.

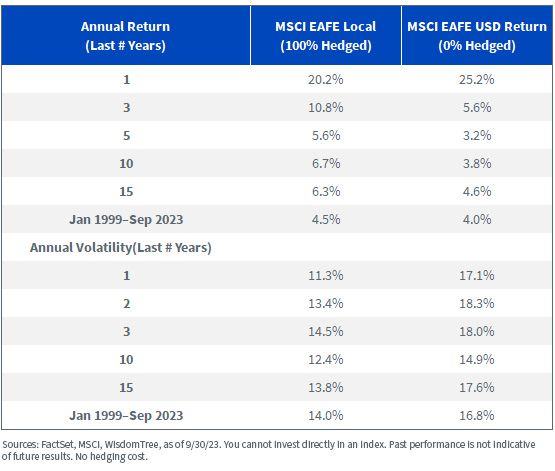

Figure 1: Local Return Is Considerably Less Risky after Full Currency Hedging

For definitions of indices in the table above, please visit the glossary.

Is Hedging Expensive?

There’s a common misconception that currency hedging is expensive. However, since hedging involves forward contracts, the relative interest rate differential between markets provides the best estimate for the cost (or benefit and implied carry from hedging).

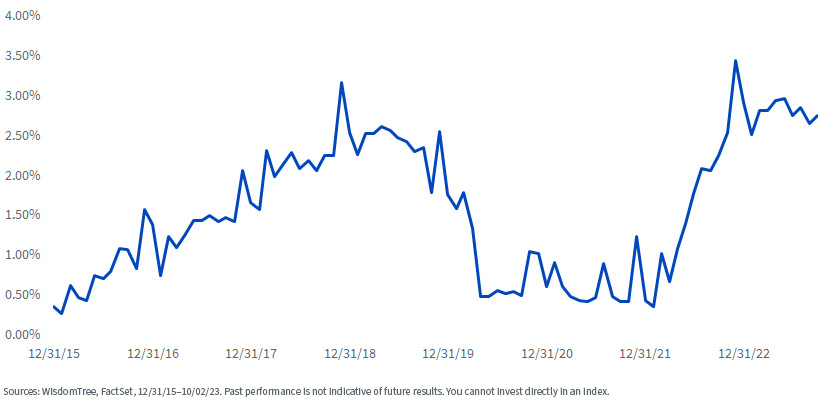

Over the past seven years, investors have generally received extra compensation for hedging. In Japan, for instance, the yield spread is over 5% today due to ongoing negative short-term rates in Japan, while the Federal Reserve’s rate has risen above 5%. For broader international markets and the MSCI EAFE Index, investors currently earn an annualized carry of around 3%.

In other words, for unhedged investors to match up to the carry collected by hedging, the dollar must decline by 3%. As the U.S. continues its policy of “maintaining higher rates for longer,” this interest differential is unlikely to shift soon.

Figure 2: Over the Past Seven Years, MSCI EAFE Investors Have Mostly Been Paid to Hedge against the Dollar.

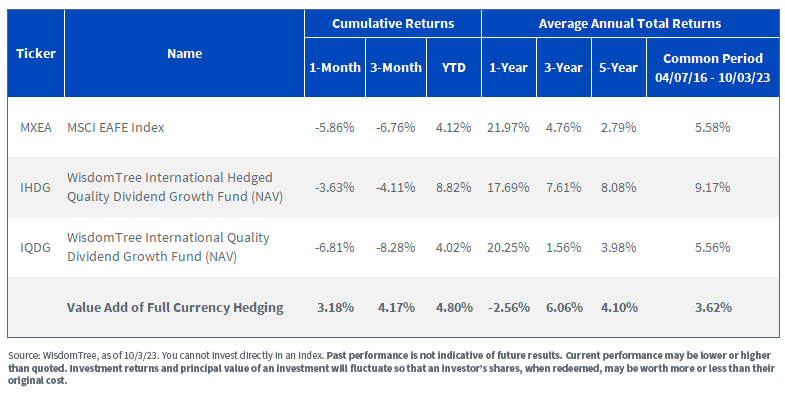

Figure 3: Fully Hedging International Quality Dividend Strategy Has Proven Beneficial

For the most recent month-end and standardized performance, click the respective ticker: IHDG, IQDG.

2. Dynamic Currency Hedging Using Common Factors Such As Momentum and Low Volatility

While we’ve made a strategic case for reducing volatility through hedging, some investors seek exposure to currencies when they deem it attractive. To assist these investors with their timing decisions, we’ve developed a multifactor currency model that dynamically adjusts our hedge ratios.

We apply dynamic hedging to both international and emerging markets equity portfolios using factors based on common human sentiment tendencies and historical analysis.

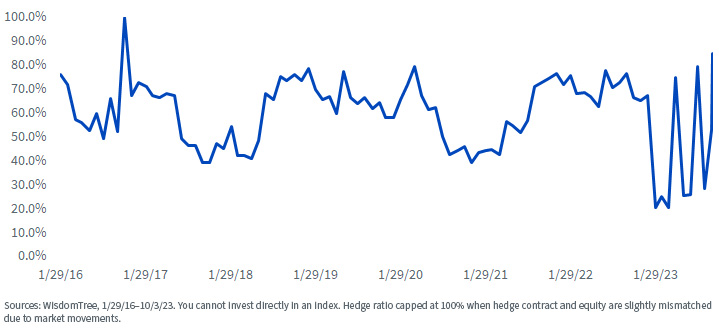

We’ve just rebalanced our dynamic currency hedges for various international and emerging markets strategies. Approximately 90% of those portfolios are currently hedged in both markets.

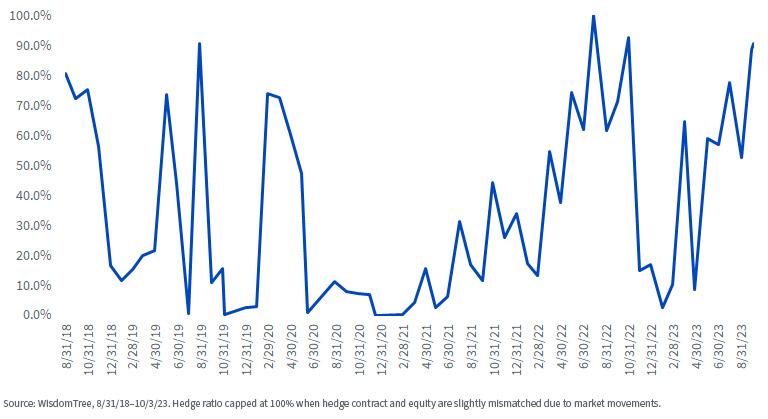

Figure 4: Hedge Ratio for WisdomTree Dynamic Currency Hedged International Dividend Equity Index

Figure 5: Hedge Ratio for WisdomTree Emerging Market Multifactor Strategy

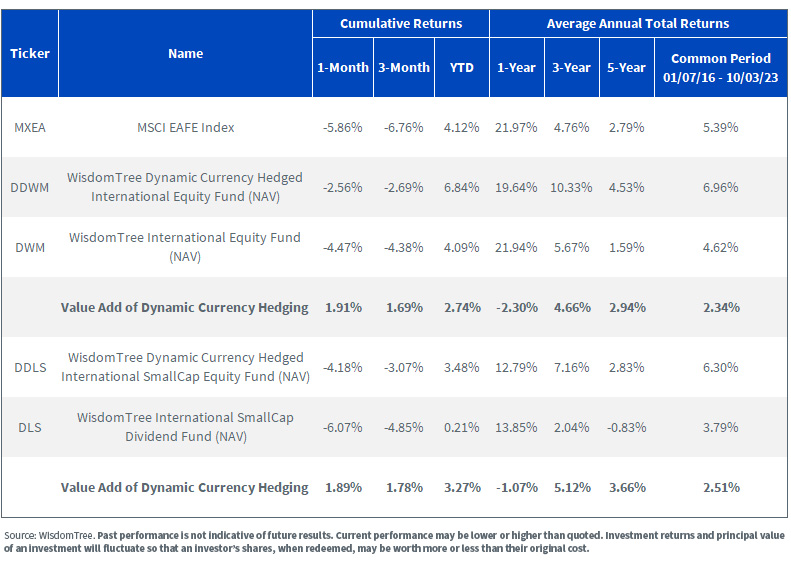

Dynamic hedging has proven beneficial for both large- and small-cap developed international strategies.

Figure 6: Performance, as of 10/3/23

For the most recent month-end and standardized performance, click the respective ticker: DDWM, DWM, DDLS, DLS.

In conclusion, we believe it’s time for investors to revisit the advantages of currency hedging in managing foreign investment risk.

Important Risks Related to this Article

IHDG/IQDG: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DDWM/DWM: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DDLS/DLS: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.