High Carry: King Dollar or Emerging Markets?

WisdomTree launched our first currency (FX) funds back in 2008, at a time when short-term interest rates were still anemic on account of the global financial crisis. Now, short-term rates have risen to levels not seen since the mid-2000s, while longer-duration fixed income strategies have gone negative three years in a row.

For clients looking for alternatives to traditional fixed income, we believe two of our strategies could fill an interesting need in their portfolios depending on their view of the U.S. dollar.

Looking under the Hood: T-Bills + Rate Differentials

All of WisdomTree’s currency funds are constructed exactly the same. For every dollar invested, $1 is invested in high-quality, U.S. dollar-denominated collateral such as U.S. Treasury bills. This position is combined with 1-month forward currency contracts that compensate investors for differences in short-term interest rates between markets as well as changes in the spot price of the currency. In essence, there are three sources of return: collateral, carry and moves in spot FX.

Long Dollar, Short Foreign FX

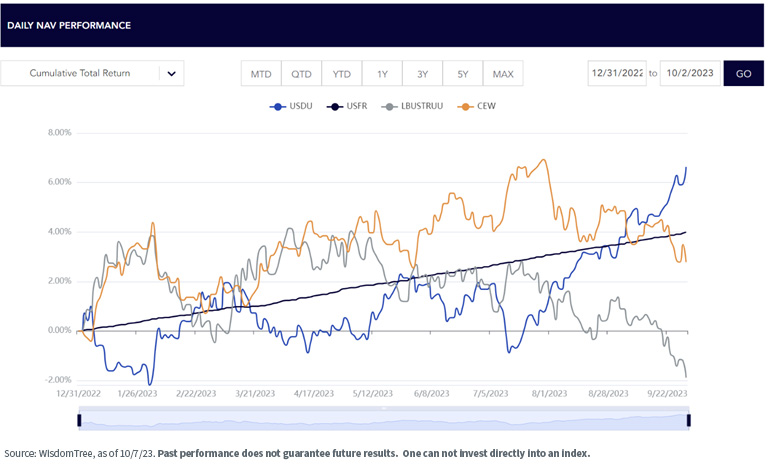

As we wrote about earlier, the spot prices of the U.S. dollar have risen dramatically over the last three months as expectations about a Fed pivot have been pushed further into the future. The WisdomTree U.S. Dollar Bullish Fund (USDU) is a direct exposure to this trend. USDU delivered returns of 7.6% versus a move in spot prices of 6.4%.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance for USDU, click here.

Short-term t-bills, represented by the WisdomTree U.S. Floating Rate Treasury Fund (USFR), had returns just north of 1% over this period, while the Bloomberg U.S. Aggregate (Agg) Index (LBUSTRUU Index) fell by 4.5% as longer-term U.S. interest rates rose.

Put another way, the dollar was one of the best hedges for rising rates over the period despite being one of the shortest in duration. Year to date, USDU is up 6.6%, while the Agg is down 1.9%. Additionally, our team has also previously written that a strong dollar is one of the bigger risks to U.S. corporate earnings, so there are further hedging characteristics that are attractive.

Long EM FX, Short USD

While the dollar has been on a tear recently, to start the year, we saw broad-based weakness. By contrast, the WisdomTree Emerging Markets Currency Fund (CEW) peaked on July 28 with returns of just under 7%. We contrast this to returns in core bonds of only 2%.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please click the respective ticker: USDU, USFR, CEW.

While spot prices could be seen as the primary driver of returns for the currency funds historically, investors should now be much more cognizant about the potential for returns from short-term U.S. collateral, as well as paying close attention to rate differentials.

Currency Fund Implied Yields

As shown in the chart above, we contrast the implied yield components of CEW and USDU after the launch of USDU in late 2013. Early in the period, CEW provided a significant yield pickup due to higher short-term rates in nearly all emerging market countries versus the U.S.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance & 30-Day SEC yield, please click the respective ticker: USDU, USFR, CEW.

After the Fed began its aggressive rate tightening cycle in 2022, implied yields in the U.S. increased versus foreign markets while at the same time providing meaningful levels of income on the underlying collateral that’s invested in Treasury bills. A 9% implied yield on CEW—with no duration—is an interesting carry rate when compared with other alternative fixed income strategies that yield 9%, like high-yielding bonds.

Conclusion

When investors are thinking about positions other than core allocations like stocks and bonds, they should be thinking about strategies that offer “carry plus” or some other driver of return. With short-term rates close to 5.5%, this baseline for returns appears attractive in real terms should the Fed ultimately prove successful in achieving its dual mandate. In response, the value of the dollar is likely to be one of the primary beneficiaries or casualties, depending on the amount of time it takes. In the short run, we believe dollar strength offers the path of least resistance. In the long run, EM currencies may offer value from higher rates and appreciation due to their structurally higher levels of growth and inflation.

Important Risks Related to this Article

USDU/CEW: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in specific regions or countries, thereby increasing the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effect of varied economic conditions. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements and may decline prior to the expiration of the repurchase agreement term. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Although the Fund invests in very short-term, investment-grade instruments, the Fund is not a “money market” fund, and it is not the objective of the Fund to maintain a constant share price. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates but may decline in value. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.