Take Note: A Technical Shift in Currency Markets

In 2022, a strong dollar was one of the best trades of the year until the fourth quarter. On the back of a rather quick shift in the U.S. bond market over the last several weeks, currency markets have taken note. In this piece, we examine the technical positioning in the U.S. dollar, euro, British pound and Japanese yen, which looks broadly supportive of continued strength in the dollar.

Broad Dollar

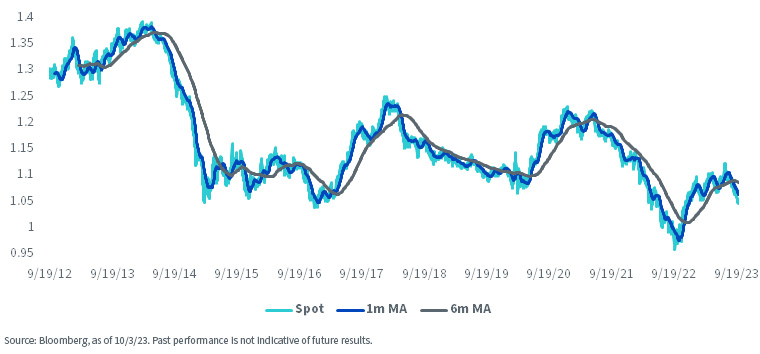

After an impressive run for the first three quarters of 2022, the dollar entered a corrective phase to start 2023. But sentiment changed as the market saw a strong U.S. economy and capitulated around the narrative of the much awaited “Fed pivot.” Additionally, expectations of rate cuts started getting pushed back further in time.

On August 24, the one-month (1m) moving average crossed the six-month (6m) moving average, signaling a potentially sustained move higher for the dollar.

Even though we’re looking at broad-based measures of the dollar as a signal here, virtually every currency has weakened versus the U.S. dollar on this move. Additionally, the dollar has also appreciated in 10 of the last 11 weeks.

Bloomberg Dollar Spot Index Technicals, 1m & 6m Moving Average (MA)

Euro (EUR)

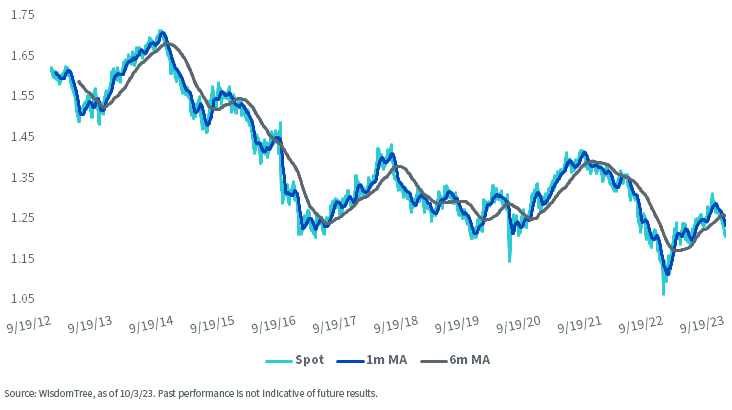

After breaking below parity in 2022, the euro experienced a rather rapid unwinding as the European Central Bank (ECB) signaled that it would be getting more aggressive to tamp down inflation across the eurozone. On August 31, 2023, the 1m moving average crossed the 6m moving average, signaling the potential for further weakness against the dollar in the coming weeks.

After the ECB instituted a pause at its last meeting, inflation data appears to have softened across the eurozone, falling to the lowest levels in a year. As global long-term rates have continued to rise, we believe Europe may be more vulnerable to this tightening in financial conditions, ultimately weighing on growth. As long as U.S. rates maintain their current carry advantage, we believe the trend in the euro may be poised to continue lower.

EUR Technicals, 1m & 6m Moving Average (MA)

British Pound (GBP)

In 2022, the British pound declined to a record low versus the U.S. dollar. With concerns about growth and the fact that the U.K. is a large net importer, the pound declined to 1.0689 on September 26, 2023. In what ended up being a broad-based reversal in the fourth quarter, the pound also entered a corrective phase. On September 14, GBP technicals signaled a bearish shift at 1.2607. More recently, JPMorgan released an update to their fair-value model for GBP of 1.20 versus the dollar, signaling a nearly 5% move from current prices.

GBP Technicals, 1m & 6m Moving Average (MA)

Japanese Yen (JPY)

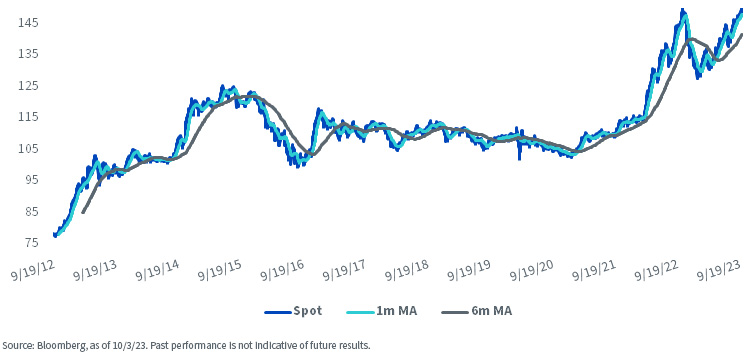

The Japanese yen is among the most sensitive currencies to rising U.S. interest rates. Even as the Fed has signaled a pause in policy tightening, the Bank of Japan has tolerated a weaker yen. After eclipsing 150 in 2022, the yen is right back up to these levels.

While it may be difficult to see substantial depreciation from this point, we still believe hedging exposure to the yen makes sense on account of the massive interest rate differentials versus the U.S. At present, that means the yen needs to appreciate approximately 6% to catch up to the carry earned by hedging.

JPY Technicals, 1m & 6m Moving Average (MA)

Summary

While many investors continue to view global asset allocation as a means of diversification, we believe they should also be cognizant of the potential risks present in the foreign exchange (FX) market. While economic narratives will eventually change, the technical picture for most foreign currencies versus the U.S. dollar are signaling U.S. dollar strength and foreign FX weakness.