Carry Effects on Hedged Equities

A currency-hedged equity index is designed to provide exposure to foreign companies while neutralizing exposure to fluctuations between the value of foreign currencies and the U.S. dollar.

In this sense, the index "hedges" against fluctuations in the relative value of foreign currencies versus the U.S. dollar.

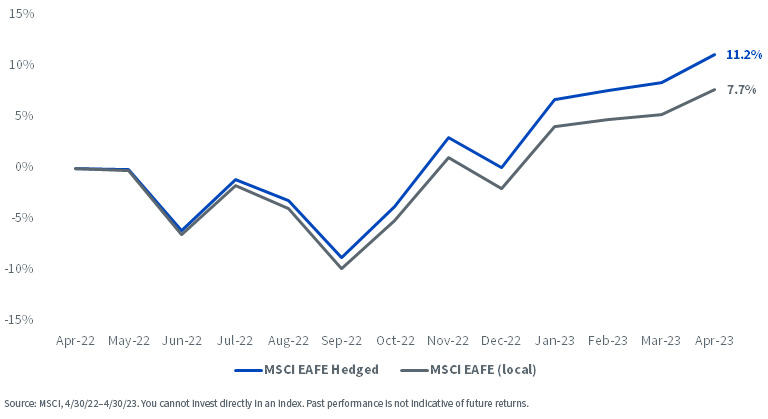

Over the last year, the MSCI EAFE Index returned 7.71% in local currencies, while its hedged counterpart returned 11.15%.

Hedbasis point outperformance come from?

The answer lies in currency carry.

Total Returns, MSCI EAFE Hedged vs. Local Index

Currency carry—also known as cost of carry—is driven by interest rate differentials between currencies and is reflected in underlying forward rates for currencies.

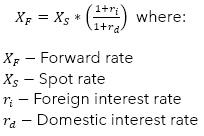

FX forward contracts are priced using the formula below, assuming a one-year contract:

The forward rate of a currency is priced at a premium or discount to spot, based on interest rate differentials.

Forward rates must reflect the relative interest rates available in each market—because arbitrages could exist if it was possible to put cash in a bank in a foreign market and have a guaranteed exchange rate at the end of a period.

Depending on the rate environment of the countries involved, the relative interest rates can provide either positive carry (added returns) or a cost to implement the hedge.

- When foreign interest rates are higher than U.S. interest rates (as in Brazil), it will be costly to hedge one’s currency exposure.

- When foreign interest rates are lower than U.S. interest rates (think Japan), one will be paid to hedge those markets.

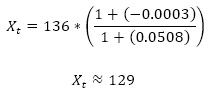

On May 18, 2023, the JPY/USD spot rate was approximately 136. The effective Federal Funds Rate was 5.08%, and the Bank of Japan Policy Rate was -0.034%. Plugging these values into the formula above, we can calculate:

Taking the above forward rate, we can calculate the carry as:

In other words, an investor is effectively paid 5.42% by trading the dollar-yen currency pair in the futures market.

Through currency-hedged strategies, investors can take advantage of favorable currency carry tailwinds, in addition to mitigating the negative effects of currency exchange rate movements, without performing complex leveraged carry trades that usually require the ability to deploy large amounts of capital.

In most developed markets today, one is paid to hedge currencies. Among those markets, Japan has the most attractive carry. The five largest currency exposures in the MSCI EAFE complex are shown below.

Interest Rate Differentials in Developed Markets

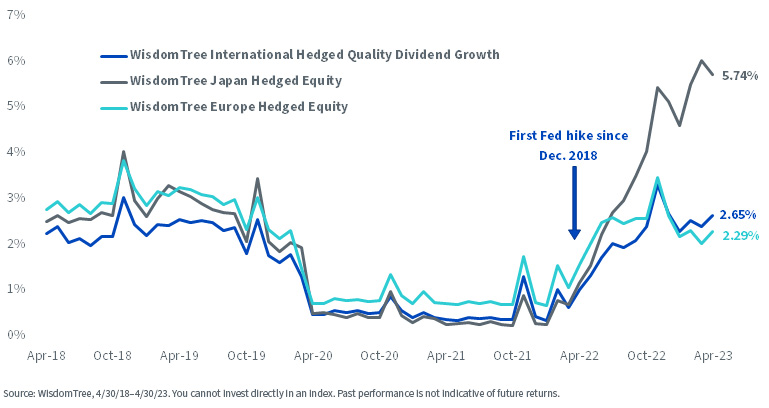

The WisdomTree currency-hedged equity family of Indexes enters one-month forward contracts to hedge against negative currency movements and reduce overall volatility. Due to steep Fed rate hikes following the peak of the pandemic, these U.S. dollar-denominated Indexes have been “paid” to hedge in recent years thanks to cost of carry (i.e., cost of carry has been positive).

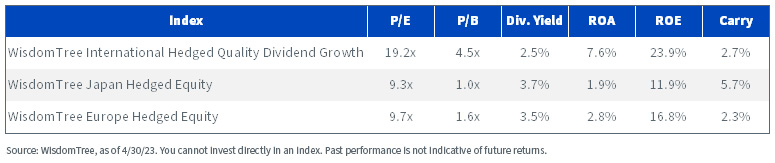

Carry and Payout of Hedge, WisdomTree Currency-Hedged Indexes

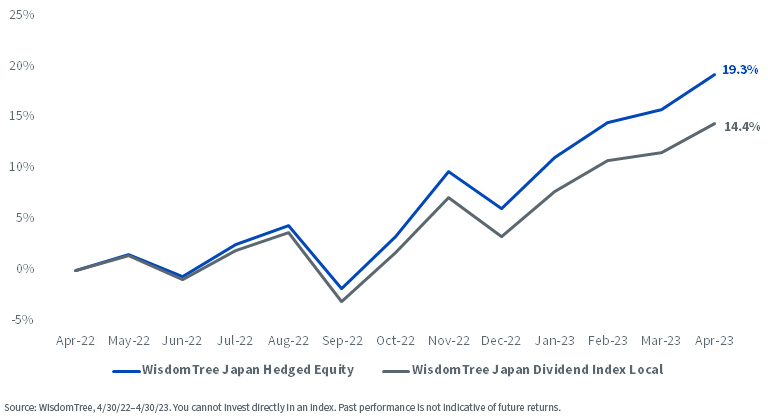

The below chart compares total returns for the WisdomTree Japan Dividend Index in local currencies. The difference in returns of 5% roughly matches the earlier carry calculated on the yen.

Total Returns, WisdomTree Japan Equity Index vs. WisdomTree Japan Hedged Equity Index

Fundamentals, Select WisdomTree Hedged Equity Indexes