New Models for Dynamically Hedging Currency Exposure

Two questions about a portfolio’s currency exposure are why hedge, and how to hedge.

1. Why should I hedge currency exposure?

Currency exposure is a non-trivial element of a global portfolio’s volatility, where a typical client has between 25% and 50% of foreign equity exposure. For that volatility, historical data suggests investors are not compensated with a currency ‘risk premia’ for taking on currency risk.

We believe currency exposure is a directional bet—and sometimes that bet pays off and other times it does not. Not hedging means directionally betting on foreign currency not depreciating. But should the euro, yen and pound increase/not depreciate relative to the dollar—forever?

In the developed world, the U.S. generally had higher interest rates than foreign markets for most of last few decades—which rebuts a belief that currency hedging is expensive. Rather, one was paid, on average, to hedge currencies in the developed world.

In emerging markets—because interest rates tend to be quite high—currency hedging can be expensive. This is why WisdomTree never launched full currency hedged strategies in emerging markets, but rather pursued a dynamic hedging model.

Recent Evidence of Hedging

Currencies can be quite volatile, so it should not be surprising that hedging generally reduces volatility in international investments.

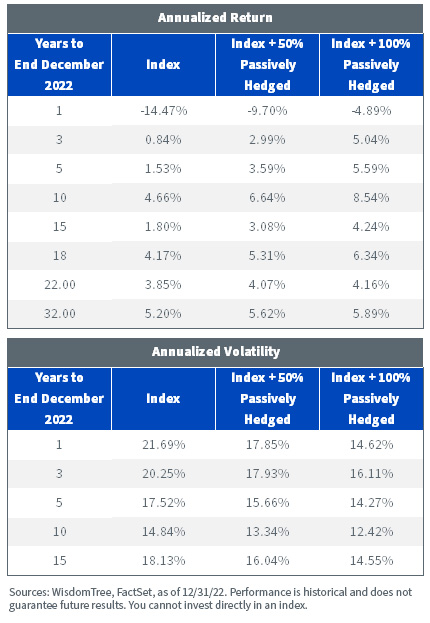

As the next table shows, for a U.S. investor over the last 15 years, hedging currencies provided higher returns and lower risk—with a particular benefit in 2022, when the dollar was strong:

Figure 1: Developed Market (MSCI EAFE) 0%/50%/100% Monthly Hedged Index Return and Volatility

2. How should I hedge currency exposure?

There are two broad and common hedging strategies: 100% hedged to the U.S. dollar, and 50% hedged to U.S. dollar.

We can argue in favor of being fully hedged to just get the stock diversification without any secondary currency bets. We can also argue that being 50% hedged helps minimize the possible regret of picking the wrong strategy.

But academic research shows that factors like momentum, interest rate carry, low volatility, cross asset returns and trend following signals can improve results in currency markets as well.

We have updated our dynamic hedging signal process to incorporate new research, and a composite strategy with diversifying signals.

A Multifactor Composite FX Hedge Ratio Derived from Five Components:

Broad trend in currencies: When the one-month moving average of foreign currencies’ spot prices versus the U.S. dollar is weaker than the three-month moving average (foreign currencies depreciating), a hedge ratio of 50% is applied to all currencies. This is to capture the broad macro trend of the dollar as 50% of the overall hedge ratio.

Momentum: When the one-month moving average of a currency’s spot price versus the U.S. dollar is weaker than the three-month moving average (a currency is depreciating), a hedge ratio of 12.5% is applied to the Index. This evaluates the momentum of individual currencies.

Interest rates: If the implied interest rate in the U.S. is higher than a targeted currency using one-month FX forward rates, a hedge ratio of 12.5% is applied to the Index. This signal helps manage the cost to hedge currencies.

Low volatility signal: Two-thirds of the currencies with the highest volatility over the last 24 months receive a hedge ratio of 12.5%. This signal helps lower the volatility of the basket overall.

Cross asset returns: A hedge ratio of 12.5% for currencies with negative predicted returns based on the past 12-month equity index returns. Capital flows globally and generally can find dynamic relationships between equity markets and currency markets that in part are tied to capital flows dynamics of moving chasing good returns in equity markets, helping support the currencies.

Research on Currency Signals

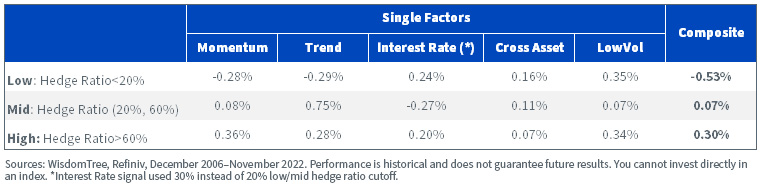

We show the average next-month returns to MSCI EAFE currencies for various currency hedging regimes by these new currency hedging signals.

The relationship is not linear, as the hedge ratio increases from low to high for single factors, but did become more strongly linear for the multifactor composite signal.

Figure 2: Average Monthly MSCI EAFE Basket of Long USD/Short Local Currency Returns with Regimes of Hedge Ratio

These updated dynamic currency signals are now incorporated in the WisdomTree large-cap and small-cap dividend ETFs.

DDWM: WisdomTree Dynamic Currency Hedged International Equity Fund

DDLS: WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund

We encourage investors to explore these Funds, especially if their portfolio has exposure to global investments and they want to move beyond simple 100% or 50% currency hedging.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.