Is Your Portfolio Properly Diversified?

Many invest abroad under the premise that foreign allocations provide diversification from the declining purchasing power of the U.S. dollar. However, 2022 shows that double-decker exposure to international stocks and currencies can be an extra downer.

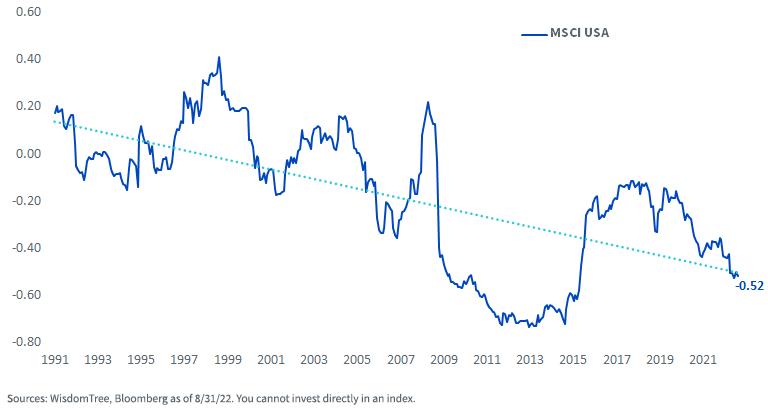

Dollar exposure has been one of the best diversifiers to declining equity and bond markets, and this is not a new trend. The greenback has become increasingly negatively correlated to U.S. stocks over the last three decades.

Rolling 36-Month Correlation: MSCI USA Index & U.S. Dollar Returns

For definitions of indexes in the chart above, please visit the glossary.

I view this negative correlation as neither accidental nor spurious, but rather based on fundamentals.

The latest earnings season was full of profit warnings from technology and consumer brand companies and illustrates how a strong dollar presents a powerful headwind to corporate earnings and stock prices.

A Morgan Stanley strategy team estimated the impact of 2022’s dollar strength as an 8% headwind to earnings for the S&P 500 this year.

If the S&P 500 and U.S. multinationals have a weak dollar bias embedded in their profit stream, why does it make sense to further pile on foreign currency risk when you invest abroad?

WisdomTree pioneered currency-hedged investing in 2009 to provide solutions for this precise challenge. A full currency-hedged strategy is positioned to be net neutral on currency movements—hedged strategies haven’t historically benefited when foreign currencies rise but haven’t suffered when the dollar has appreciated and foreign currencies have fallen, either. The latter scenario has characterized the first eight months of the year. After such a strong move in the dollar, it is natural to question if the move is over and you missed the ‘trade.’

Strategically, I think it is important to have at least a 50% hedge ratio when allocating overseas—this will provide extra dollar diversification relative to traditional unhedged foreign investing, as we show in the chart above on correlations of the dollar to U.S. stocks.

But there are some additional currency factors you can use to tilt the odds more in your favor with a dynamic currency hedge.

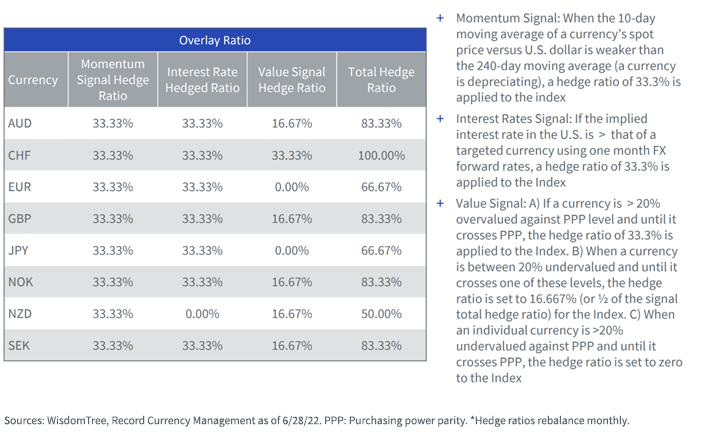

Just like there are factors used to invest in equities, there are currency factors as well that include value, momentum and carry (namely, interest rate differentials).

In 2016, we launched a dynamic currency-hedged family of ETFs that raises and lowers the hedge ratios when factors are most favorable. Today the broad, large-cap strategy (WisdomTree Dynamic Currency Hedged International Equity Fund, DDWM) is about 70% hedged.

Currency Factors

Right now, momentum and carry very much favor the dollar, while traditional currency valuation metrics otherwise suggest the dollar looks expensive versus other currencies.

Our value signal on the dollar can get to a half-hedged location when currencies are not more than 20% below purchasing power parity (PPP) levels.

Currently, the Swiss franc (CHF) still measures as expensive versus the dollar on a PPP concept, while the euro (EUR) and yen (JPY) look undervalued. Hwoever, other developed market currencies have a mixed value signal, resulting in a half hedge ratio for that measure.

Latest Currency Hedge Ratios* by Signal

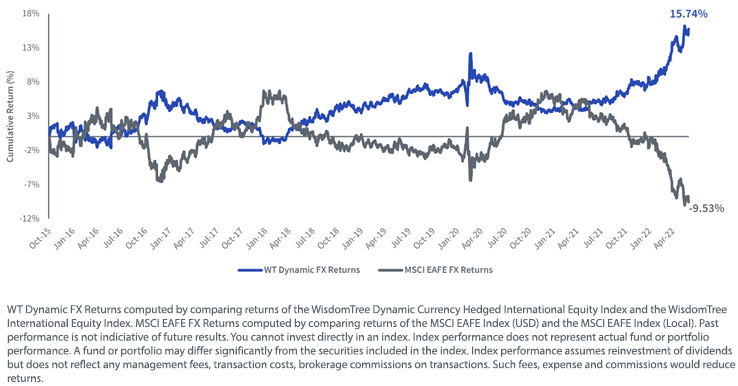

This dynamic hedging algorithm has worked out quite well over the last six years. While the MSCI EAFE currency impact shows a decline of 9.5% since inception of our Index family, the WT Dynamic FX returns are +15.7%.

Cumulative FX Performance, 10/31/15–6/30/22

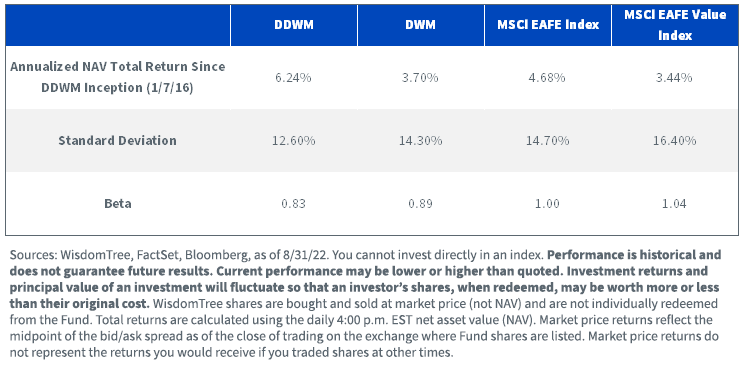

We have a broad international value strategy (DDWM) and international small-cap (WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund, DDLS) strategy with this dynamic hedge feature. Both strategies on an unhedged basis have 16-year histories that were part of the original 20 dividend ETFs WisdomTree launched in 2006.

Both Funds have received five-star ratings from Morningstar as of August, based on risk-adjusted returns in the Foreign Large Value and Foreign Small/Mid Value categories, respectively. See our Morningstar ratings page for more info1.

The stars are a quick way of summarizing these strategies as having delivered strong risk-adjusted returns, and there is a good emphasis on the risk-reduction properties that come with the dynamic currency hedge.

The dynamic currency hedge contained in DDWM—when compared to the same basket of equities without the currency hedge (available via DWM)—added about 250 basis points per year over the last six years.

The currency hedge value-add to returns was high over this period, but the risk reduction is what we would expect on a longer-run basis.

For the most recent standardized performance, 30-day SEC yield and month-end performance click the respective ticker: DDWM, DDLS, DWM.

Implementing a Rules-Based Approach

This year’s currency moves have caught most investors by surprise. But our dynamic hedging family has maintained hedge ratios above 60% all year long. These strategies incorporate a rules-based process to adjust currency exposure, rather than remaining completely exposed.

If going to currency-neutral using a fully hedged approach is a step too far from your status quo, I’d encourage you to evaluate our dynamically hedged family to incorporate an element of risk management and added diversification.

1 The Foreign Large Value category contains 317 funds. The Small/Mid Value category contains 56 funds. Ratings are continuously monitored and reevaluated at least every 14 months.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Funds invest in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Funds may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Funds is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Funds invest in the securities included in, or representative of, their Index regardless of their investment merit, and the Funds do not attempt to outperform their Index or take defensive positions in declining markets. Please read the Funds’ prospectus for specific details regarding the Funds’ risk profiles.

No amount of diversification or non-correlation can ensure profits of prevent loss.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.