Adding Meta to the WisdomTree Dividend Indexes

On February 1, Meta Platforms Inc. (Meta) declared the initiation of its quarterly dividend payment as part of its full-year 2023 results. The company announced a $0.50 quarterly payment, which represents an approximate $5 billion cash outlay and puts Meta in the top 30 of U.S. dividend payers and the top 50 of all dividend payers worldwide.

This is a major development for Meta, as a dividend payment signals that a company’s management has confidence in its business and the cash flows associated with it. It is also a major market development, as Meta becomes the largest company (measured in market capitalization) to initiate its dividend payment since Apple in 2012.

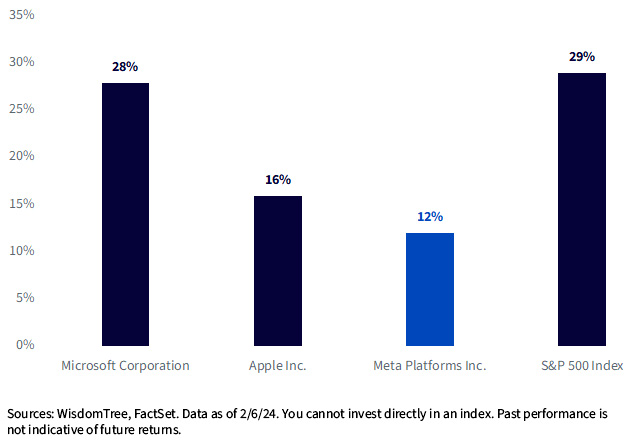

For context, Meta’s initial dividend payment represents about 12% of its annual earnings, which is still conservative with respect to its peers and the broader U.S. market. This means there is room for Meta’s dividends to grow.

Annual Dividend as % of Earnings

WisdomTree’s Reaction

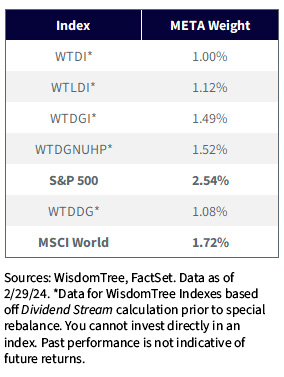

Given this major market development and WisdomTree’s emphasis on creating best-in-class dividend-focused strategies, we announced a special rebalance set to take place after the close of trading on March 15. As part of this special rebalance, Meta will be added to the following eligible Indexes and weighted according to its Dividend Stream®:

WisdomTree creates indexes with performance as the top goal. While we believe in passive methodologies, we always look for changes or unique market conditions that create opportunities. Meta’s first dividend was significant enough that it warranted an early addition to our index family.

Implications for Quality Dividend Growth Strategies

WTDGI, WTDGNUHP and WTDDG are all part of the WisdomTree Quality Dividend Growth suite. These strategies aim to invest in dividend-paying companies whose profitability and growth prospects indicate higher-than-market dividend growth.

Most competitors in the dividend growth space have backward-looking growth screens to determine a company’s eligibility. For example, the S&P U.S. Dividend Growers and S&P 500 Dividend Aristocrats Indexes (with a combined $88 billion plus of assets tracking them) have a 10- and 25-year dividend growth screen, respectively. This means that Meta will become eligible for inclusion in 2034 and 2049 if it continues to grow dividends annually.

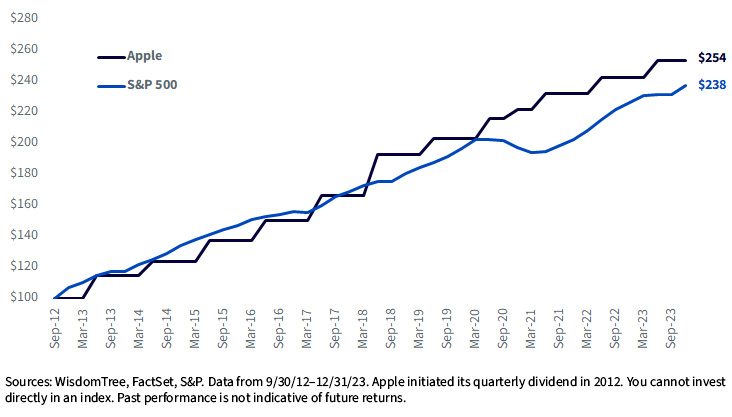

As we recently published, new dividend payers tend to grow their payments faster than the market. In the below chart, we can see how Apple’s dividend growth since 2012 has outpaced the broad S&P 500 by 0.6% annually.

Growth of $100: Cumulative Dividend Growth

Examining the performance of WTDGI versus the S&P 500 provides further insight into its methodology. Since its inception in April 2013, WTDGI has outperformed the S&P 500 by 34 basis points annually,1 doing so without holding non-dividend-paying tech companies like Amazon, Tesla, Meta and Google, which have been the main performance drivers for the market.

The quality dividend growth franchise selection process focuses on highly profitable quality businesses. We often allude to this as the Buffett factor in stock selection—as Buffett often talks about moving from the Ben Graham value school, which focuses on fair businesses at good value like prices, toward focusing on great businesses at fair prices.

In the latest Berkshire letter, Buffett wrote a tribute to Charlie Munger in the opening pages, calling Munger the architect of Berkshire Hathaway’s process that convinced Buffett he should not be buying cheap “value” like stocks but the high-quality businesses. Warren’s latest letter puts Munger as the original architect of our quality style of investing.

What are Meta’s quality and growth attributes that exhibit why it is a great business and make us confident it should be a dividend growth leader over the coming years?

- Efficiency: Meta was able to lower headcount by more than 20% while also growing revenue by more than 20% in the last 12 months—this is a sign of its scale and investments in technology paying off. Paying the first dividend is a commitment to shareholders that they will harvest their R&D investments over the years into cash flows for shareholders.

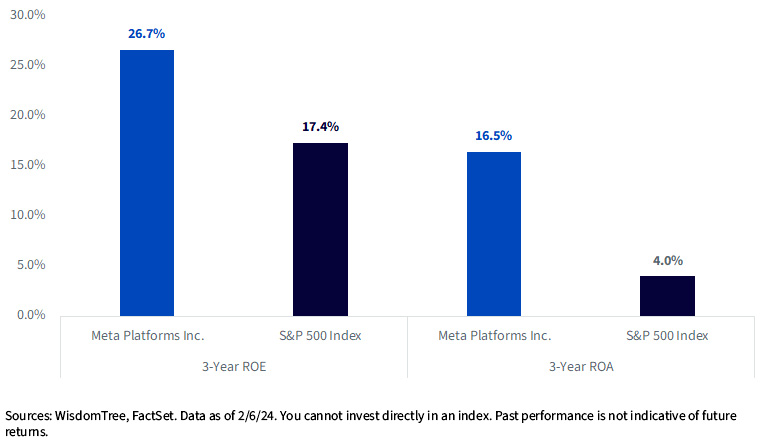

- Quality: Meta’s trailing three-year return on equity (ROE) and return on assets (ROA) exceed the market.

Quality Metrics

- Composite Rank: WTDGI uses a composite score combining a company’s quality (ROE and ROA) and estimated earnings growth to rank and select securities. Meta ranks in the top 20 out of 550+ securities in scope on this composite measure with its solid quality number and an 18% estimated earnings growth over the next few years.

Implications for Broad Dividend Strategies

The implications of adding Meta to WTDI and WTLDI can be analyzed in the context of holdings overlap and tracking error versus the broad market. At the time of Meta’s dividend announcement, its weight in broad equity benchmarks like the S&P 500, Russell 1000 and MSCI USA Indexes ranged around 2%. Upon inclusion in WTDI and WTLDI, we expect the under-weight in Meta to be significantly reduced but still exist, given its current market capitalization weight compared to its Dividend Stream weight.

1 Sources: WisdomTree, FactSet. Data from 4/11/13–1/31/24.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.