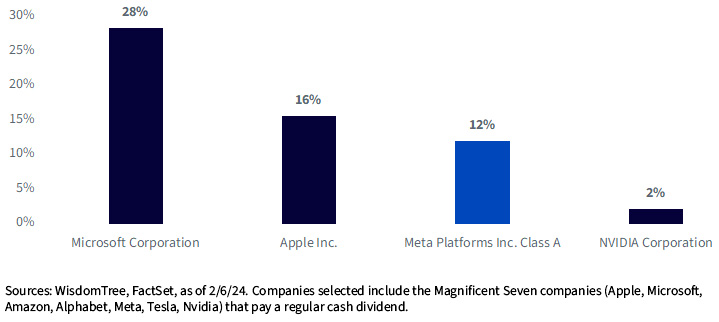

Meta Pays a Dividend

On February 1, Meta announced its first quarterly dividend. The dividend will be a $5 billion annual cash outlay, representing approximately 12% of its earnings.

This initial payment is an important step in showcasing management confidence in its high cash flow generating business. As is common, this initial payout is conservative relative to earnings.

For reference, Microsoft pays an annual dividend that is 28% of earnings. In contrast, Nvidia pays out a more modest 2%.

Annual Dividend as % of Earnings

Considering Meta’s inaugural dividend, we will examine the historical dividend growth trajectory of several other notable technology companies.

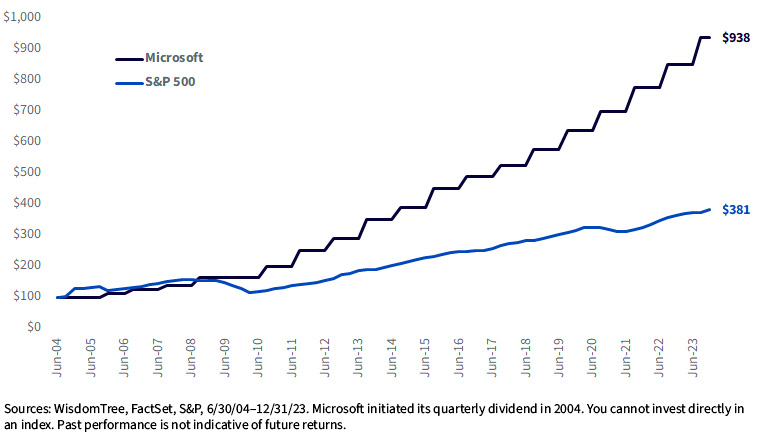

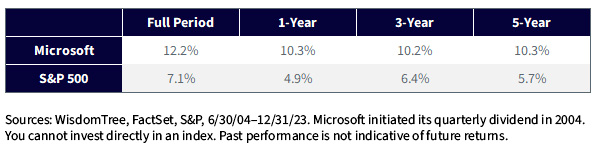

Microsoft

Microsoft began paying its first quarterly dividend in 2004. Over the last 20 years, the company has had remarkable consistency in growing its dividend at a premium rate year over year.

Growth of $100: Cumulative Dividend Growth

Over the full period, Microsoft has grown its dividend at a 12% annualized rate—over 5% better than the S&P 500 dividend growth.

Annualized Dividend Growth

Apple

Apple began paying its quarterly dividend in 2012 and was right away one of the largest cash dividend payers in the world.

Like Microsoft, Apple has consistently grown its dividend year over year. Its dividend growth rate has been higher than the S&P 500, despite continuing to invest in a fast-growing business.

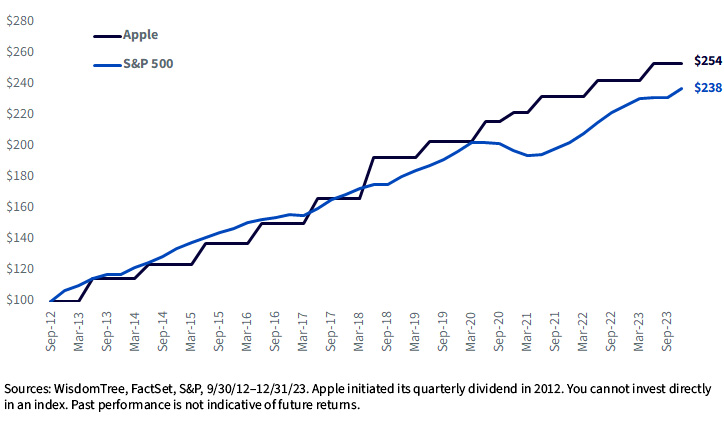

Growth of $100: Cumulative Dividend Growth

Apple’s dividend grew at a conservative rate for its first several years before surging ahead of the S&P 500. Between 2015 to 2018, Apple grew its dividend at 12% annualized, from $0.52 in 2015 to $0.73 by 2018. Meanwhile, the S&P 500 dividend grew at a lower than 7% rate.

This Apple example highlights a company that started growing its dividend relatively slowly from a conservative payout before jumping higher after a number of years of a regular dividend.

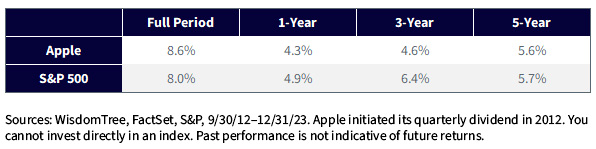

Annualized Dividend Growth

Nvidia

Like Apple, Nvidia also introduced its quarterly dividend in 2012.

During its first five years, Nvidia’s dividend growth significantly outpaced the S&P 500. From 2012 to 2018, its annual dividend increased by over 13% annually, rising from $0.075 to $0.16.

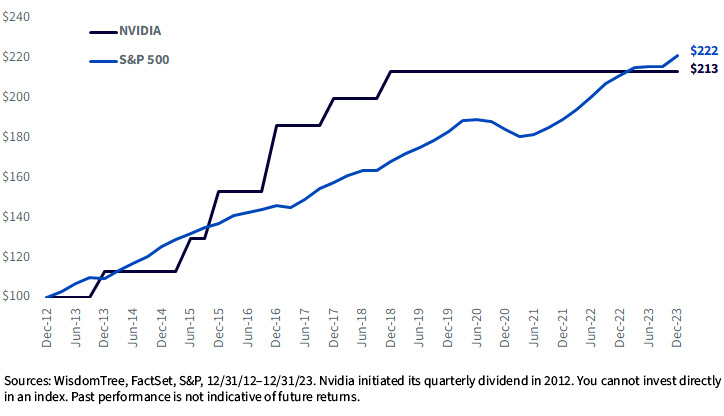

Growth of $100: Cumulative Dividend Growth

In the last five years, Nvidia has prioritized reinvesting in its market leadership within the advanced semiconductor chips space. Despite maintaining an unchanged payout since 2018, Nvidia’s dividend growth has remained close to that of the S&P 500.

This makes Nvidia an even more drastic example than Apple, illustrating how companies often front-load significant dividend growth during the initial years of dividend payouts.

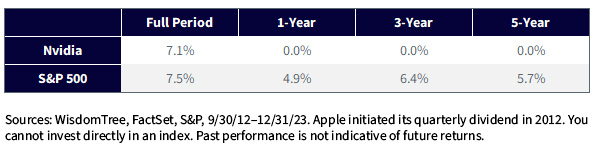

Annualized Dividend Growth

Information Technology Dividend Growth

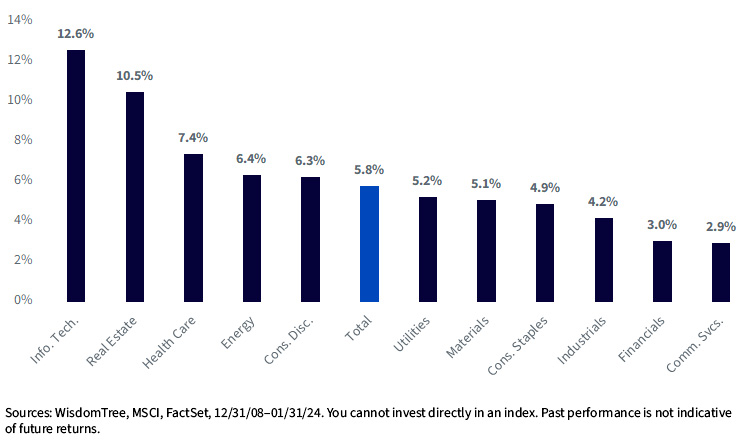

Over the last 15 years, Information Technology has experienced the fastest dividend growth of any sector, growing at a rate over twice that of the total U.S. equity market.

Sector Dividend Growth since 2008

Much of this growth has come from companies that initiated dividends in the last 20 years (such as Microsoft, Apple and Broadcom), that have not been eligible for inclusion in dividend growth indexes that require a consistent dividend growth history of anywhere from 5 to 25 years.

WisdomTree designed its dividend Indexes to be broadly inclusive of dividend payers, recognizing that some of the fastest dividend growth for companies can occur in the years immediately after initiating a dividend.

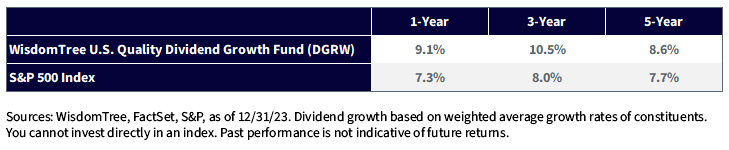

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) selects dividend-paying companies with high profitability and growth characteristics, without a requirement for historical dividend growth.

As a byproduct of our profitability and growth screens, the Fund has higher exposure to the companies that have been growing dividends at a faster rate than the overall market.

Annualized Dividend Growth

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.