WisdomTree Managed Futures Strategy—2023 in Review

Most managed futures strategies aim to generate returns by employing leverage and having a high degree of concentration in individual contracts and asset classes.

In 2022, the industry benefited from this leverage and continuing trend in rates and currencies, which saw a strong reversal during 2023.

The WisdomTree Managed Futures Strategy Fund (WTMF) is diversified across asset classes, does not use leverage and aims to deliver lower volatility and improved risk-adjusted returns. The strategy uses a comprehensive list of 21 commodities and individually determines long-short positions derived by subsector-specific momentum signals.

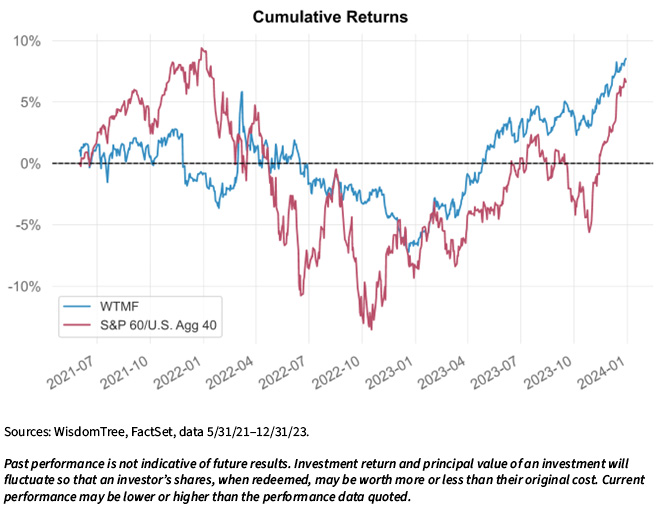

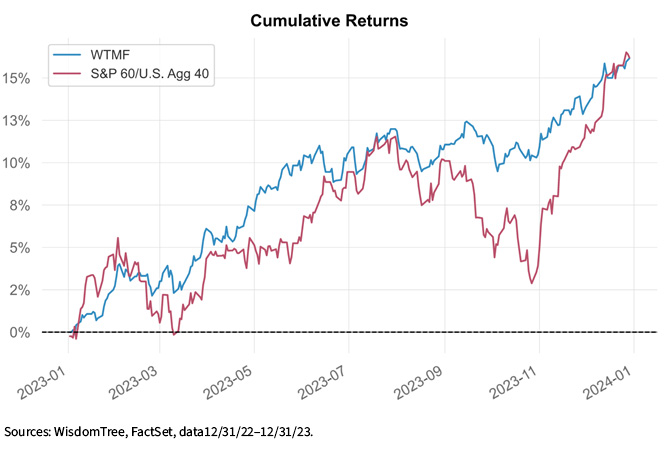

This approach contributed to the strategy having lower volatility than its peers and outperforming its benchmark, which is constructed by combining 60% in the S&P 500 Index and 40% in the Bloomberg U.S. Aggregate Index (S&P60/AGG40), on both a risk-adjusted and absolute basis over 2023.

WisdomTree Managed Futures Strategy Fund (WTMF)

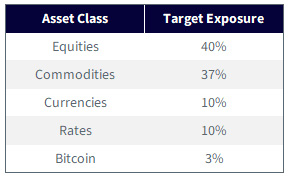

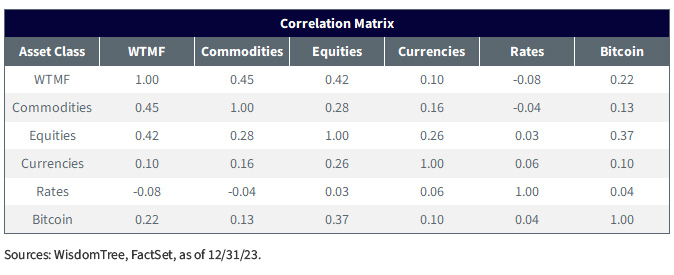

WTMF aims to outperform the S&P60/AGG40 benchmark on a risk-adjusted basis, while having low correlation to major asset classes like equities and bonds. WTMF has a target exposure to five asset classes with the weights listed in the table below. Exposure to each asset class, and contracts within asset class, is derived by subsector-specific momentum signals.

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click here.

Performance in 2023

In 2023, the strategy ranked at the top among its peer group according to Morningstar,1 returning 16.16%. Notably, the strategy also had a Sharpe ratio of 2.82 compared to 1.75 for the S&P60/AGG40 benchmark.

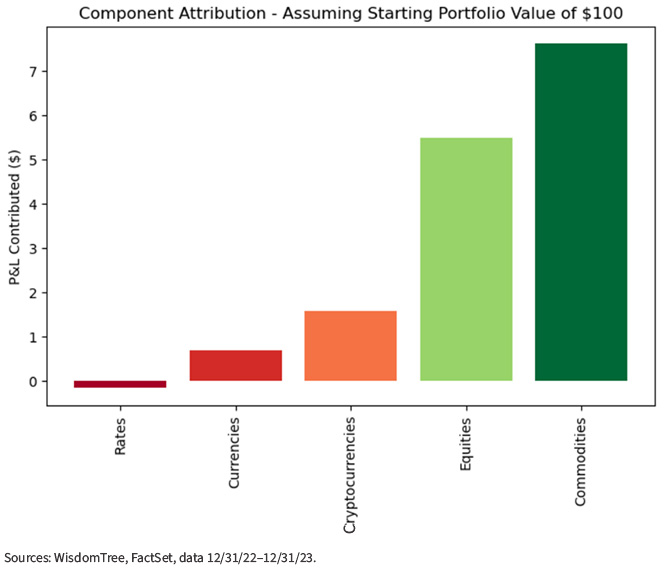

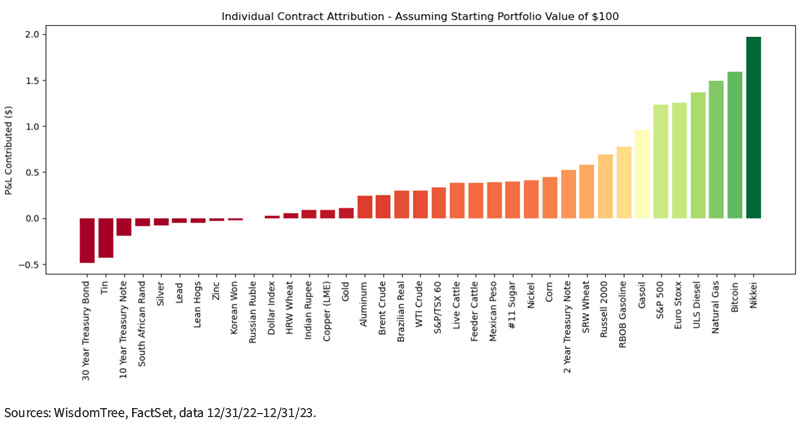

If we click into each one of the asset classes and look at individual contracts, we can see their contribution to performance. It is good to see that, for the full year in 2023, most individual contracts contributed to performance, showing the effectiveness of momentum indicators that are selected according to subsector.

Conclusion

WTMF provides investors with differentiated returns compared to the rest of the funds in the category. With a combination of macro signals and momentum indicators that are specific to each subsector for individual contracts, the strategy aims to blend macroeconomic outlook with idiosyncratic signals to achieve superior risk-adjusted returns relative to its S&P60/AGG40 benchmark.

A traditional S&P60/AGG40 portfolio aims to provide investors with exposure to equities with downside mitigation through an allocation to Treasuries.

We’ve made the case for the efficient use of capital through a leveraged S&P60/AGG40 portfolio, building on the seminal research of Cliff Asness, launching the WisdomTree U.S. Efficient Core Fund (NTSX) in 2018. A leveraged S&P60/AGG40 portfolio, combined with an alternative asset class such as managed futures, can allow investors to deploy their capital more efficiently than with traditional asset allocation.

With one of the lowest volatilities in its peer group and low correlations across its underlying asset classes, WTMF makes for an appealing allocation to improve diversification and risk-adjusted performance of an investor’s overall portfolio.

1 Source: Morningstar, as of 12/31/23. Category: Systematic Trend. Overall rank based on 66 funds in category, 3-year percentile rank based on 66 funds in category, 5-year percentile rank based on 64 funds in category, 10-year percentile rank based on 41 funds in category. As of 12.31.23

The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance.

The top 10% of products in each product category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- and five-year Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long only indexes rise (or short only) indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Morningstar percentile rankings are based on a fund’s average annual total return relative to all funds in the same Morningstar category, which includes both mutual funds and ETFs and does not include the effect of sales charges. Fund performance used within the ranking reflects certain fee waivers, without which returns and Morningstar rankings would have been lower. The highest (or most favorable) percentile rank is 1, and the lowest (or least favorable) percentile rank is 100. Past performance does not guarantee future results.

Morningstar, Inc. All Rights Reserved. The information herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The Morningstar Medalist RatingTM is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to global.morningstar.com/managerdisclosures/. The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.

Ayush is a Global Associate Director in WisdomTree's research and index teams, where he focuses on developing innovative quantitative strategies across asset classes and supporting WisdomTree's diverse range of products. He specialises in factor exploration, portfolio construction and optimisation, and risk management.

Ayush has over 7 years of experience in the financial services industry. Prior to joining WisdomTree, Ayush worked in investment research teams at J.P. Morgan and Franklin Templeton where he was responsible for developing and managing equity/fixed income smart beta products, as well as cross-asset risk premia products for global institutional and retail clients. His experience spans across a range of asset classes and investment styles.

Ayush holds a Bachelor's and a Master's degree in Engineering Physics from the Indian Institute of Technology, Bombay.