A Smoother Ride with Quality Dividend Growth

We are all familiar with the main equity market storylines of 2023:

- The recession widely anticipated by Wall Street and Main Street never materialized

- Better-than-expected economic growth resulted in robust gains across equity markets

- A select group of mega-cap growth stocks benefited from excitement around artificial intelligence (AI)

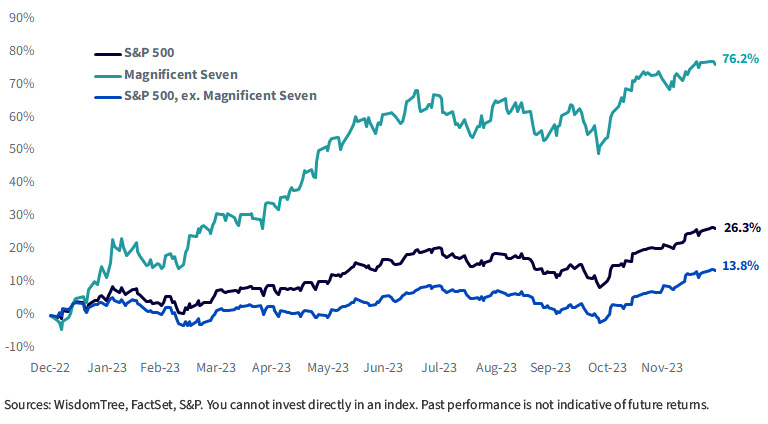

No segment of the market captured more attention than the Magnificent Seven: Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla.

These companies collectively accounted for 20% of the S&P 500’s weight at the beginning of 2023 (increasing to 28% by year-end) and drove approximately half of the Index’s 26% return.

Almost any investment strategy that wasn’t over-weight in this handful of names struggled to outperform.

2023 Cumulative Returns

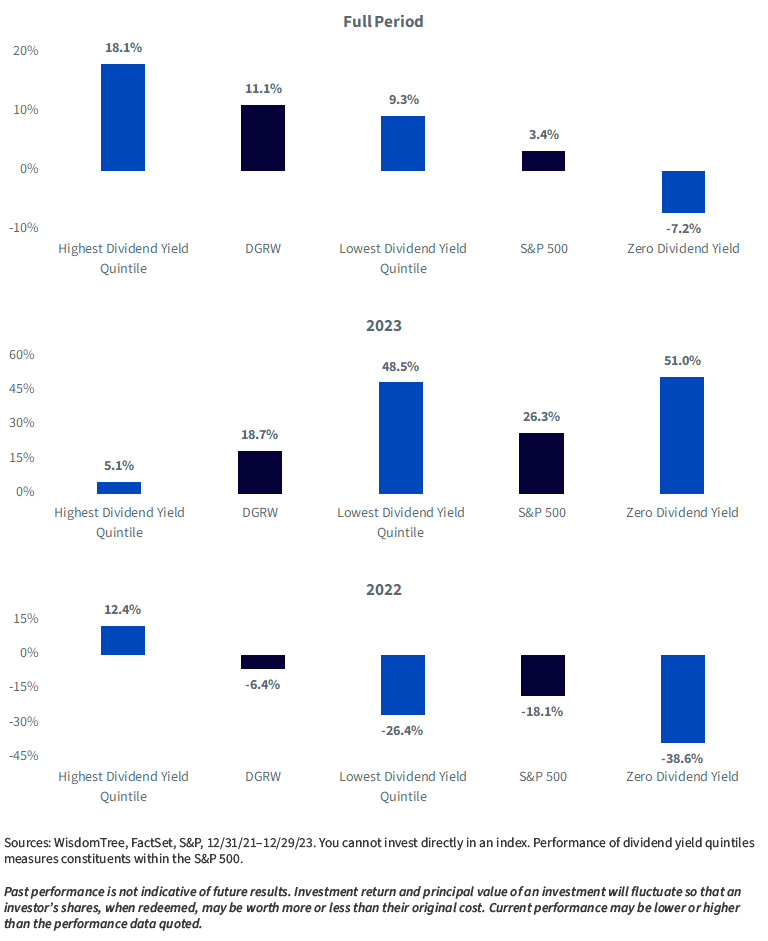

The market leadership was a 180-degree reversal from 2022, when companies that did not pay dividends experienced a decline of nearly 39%, significantly greater than the 18% drop in the overall S&P 500.

Conversely, companies with the highest dividend yields delivered a strong performance in 2022, with positive returns exceeding 12%.

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) strategically selects dividend-paying companies based on their high profitability and growth characteristics. In 2022, DGRW outperformed the S&P 500 by more than 11%, primarily due to its under-weight exposure to non-dividend-paying tech companies.

In 2023, the Fund lagged the S&P 500 by 7.6%. This underperformance was largely driven by its collective under-weight in the Magnificent Seven (averaging 10.5% under-weight), accounting for 5% of total underperformance (or nearly 70% of the total underperformance).

Over the full period, DGRW maintained an edge over the S&P 500 of more than 700 basis points cumulatively.

For the most recent month-end and standardized performances and to download the Fund prospectus, click here.

For definitions of terms in the charts above, please visit the glossary.

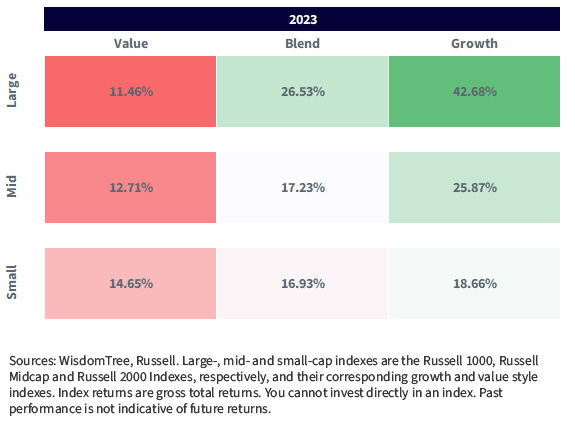

Though mega-cap growth garnered the most attention last year, investors should be reminded that each style index was up well over 10%.

Style Box Performance

Conclusion

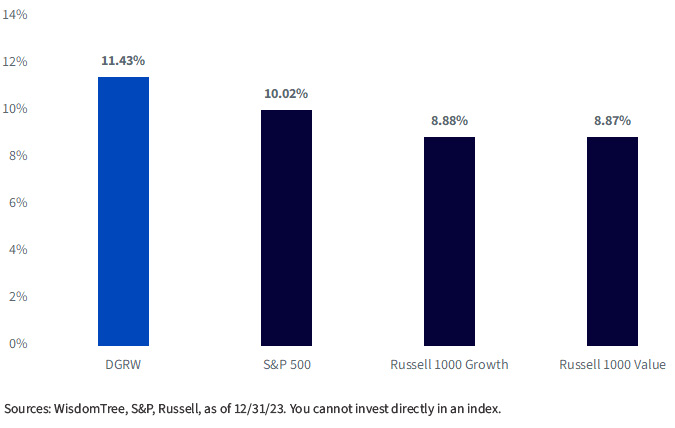

Through the choppiness of the last several years, DGRW outperformed the S&P 500 by more than 1.4% annualized. It has been a smoother ride through all the volatility when you zoom out.

Often, investors think a dividend fund requires value leadership for outperformance—this outperformance came amid a backdrop of a directionless market for value versus growth, justifying an allocation for DGRW at the core of an investor’s portfolio.

Annualized Three-Year Return

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.