Magnificent Seven Earnings (Mostly) Impress

Six of the Magnificent Seven have reported earnings so far this season, and the results have been largely impressive. Five out of the six exceeded analyst earnings and sales estimates.

Nvidia is the last company in this group to report, scheduled for after the close on February 21. Analysts are estimating an earnings per share (EPS) of $4.53, which would represent year-over-year growth of over 400%.

Tesla stands out as the outlier within this group. The company’s earnings miss of 3%, coupled with a year-over-year earnings decline of 40% and lowered forward guidance, has contributed to its 25% decline year-to-date.

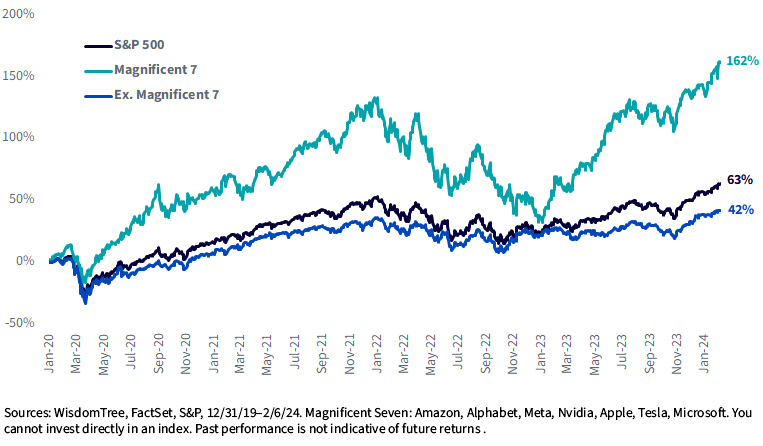

Tesla has become a victim of its own success. The outsized gains achieved by the Magnificent Seven over the past several years have raised expectations for their future earnings growth. These strong gains have also sparked discussions about “concentration risk” in the market during the early part of this year.

Cumulative Total Returns

Without the context of the earnings growth of these companies, the prior returns chart would naturally suggest an overheated market.

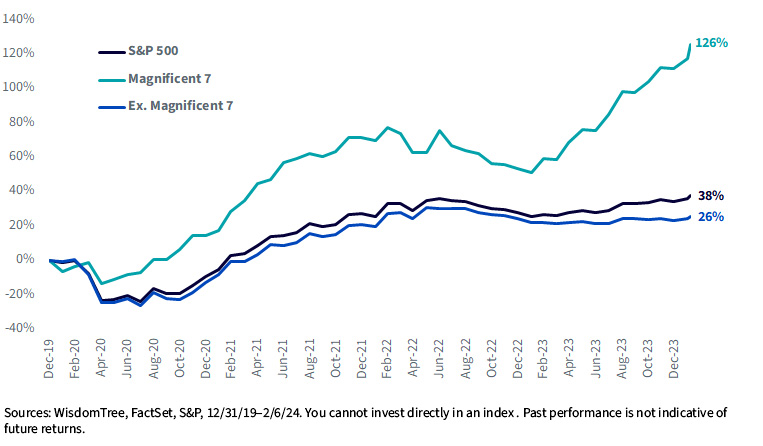

But alongside the large returns of these companies for the last several years, there has been synchronous earnings growth.

The 126% cumulative earnings growth since the start of 2020 is over three times that of the broader market and almost five times the S&P 500, excluding the Magnificent Seven.

Keep this chart in mind when trying to counterbalance the feeling that the run-up in these shares is purely based on multiple expansion related to artificial intelligence (AI) hype.

Cumulative Earnings Growth

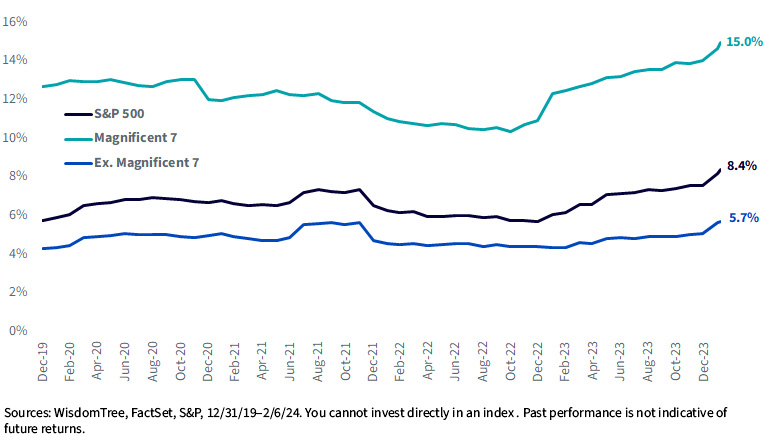

Speaking of AI, it is evident from examining research and development (R&D) spending as a percentage of sales that these companies are ramping up their investment while simultaneously delivering on earnings.

Investors’ anticipation that these investments will pay off in the years to come is certainly a contributor to the positive enthusiasm surrounding these names over the last year.

R&D as Percentage of Sales

The bottom-line question for many investors, particularly those under-weight in the Magnificent Seven over the last several years, is whether these names have become overvalued. Only time will give us the definitive answer.

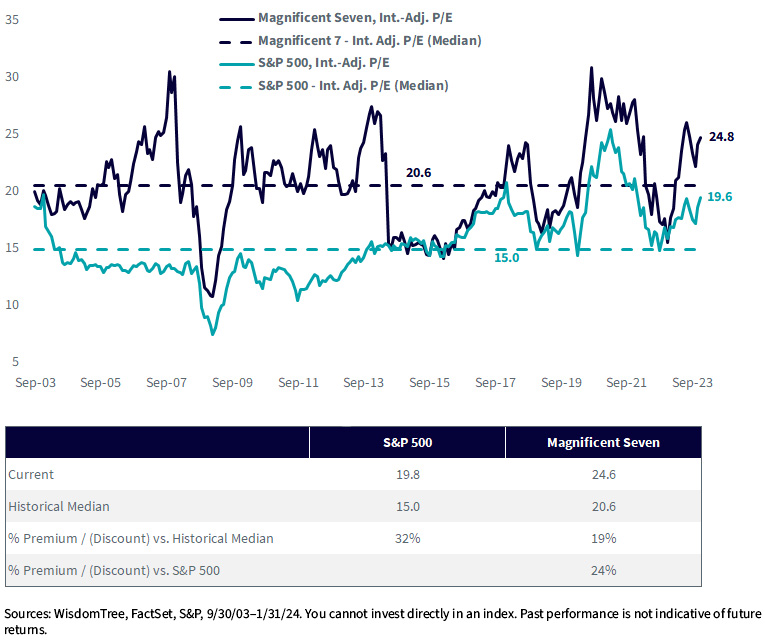

Looking at valuations that adjust for investments in R&D—a proxy for investments in intangible assets like those related to AI—our data suggests that the Magnificent Seven, as with the rest of the S&P 500, are at elevated valuations relative to history.

At the current 25 times P/E, the Seven are at a 19% premium relative to their historical median. Meanwhile, the S&P 500 is at an even steeper 32% premium relative to its history.

In short, after a strong run-up in large-cap U.S. equities broadly over the last several years, there aren’t necessarily many bargains to be had. However, if the Magnificent Seven continue to grow their earnings at the current impressive rate, they may justify their premium multiples.

Intangible Adjusted Price-to-Earnings