WisdomTree Managed Futures Strategy Fund—A New Perspective

The inclusion of a managed futures fund in a portfolio has historically been a contentious topic.

Once regarded by many investors to be the “best thing you were not invested in,” AUM (assets under management) in the managed futures space has stagnated in recent years. Years of unrivalled absolute returns in equities have made it difficult to justify the inclusion of alternative funds.

But as we mentioned in our previous blog post, low interest rates combined with fears of inflation, present a unique opportunity for managed futures to boost returns and diversification.

WisdomTree’s Approach to Managed Futures

Managed futures funds typically invest in a variety of uncorrelated asset classes through futures contracts. Most employ a long/short model, with the goal of profiting from both rising and falling markets.

Although not specifically intended for it, we believe a well-designed managed futures strategy should be able to detect inflationary or deflationary environments. These products also allow the investor access to the potentially attractive tax implications of futures investing.

The WisdomTree Managed Futures Strategy Fund (WTMF) aims to capture those benefits.

Effective June 4, 2021, we will be incorporating enhancements to the existing strategy that more closely align with investor objectives. After implementation, WTMF will hold a diversified set of equity, commodity, currency and Treasury futures contracts, outlined below.

Tactical Equity Model

The exclusion of equity futures in WTMF going back to its inception has left performance on the table. Our goal is to incorporate a tactical equity model into the Fund to enhance absolute returns, while prioritizing WTMF’s functionality as a diversifying alternative.

Our tactical equity model is a data-driven, systematic strategy that invests in a diversified basket of five broad equity index futures contracts (S&P 500, Nikkei 225, S&P/TSX 60, Euro Stoxx 50 and Russell 2000). The combined weight of this equity component of the model is limited to 40% of the exposure in the strategy.

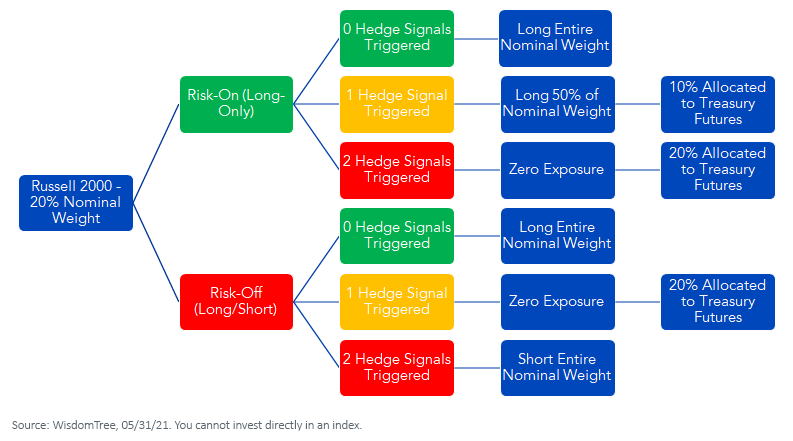

A general macro indicator based on the VIX and high-yield credit spread is used to rotate between a long-only (risk-on) and long/short (risk-off) strategy. The model also uses contract-specific signals based on momentum and correlation (a sign of stress in the market) to reduce exposure or go short.

Any excess collateral available after reducing equity exposure in the model from the 40% target weight is allocated to either t-bills, or Treasury futures contracts as additional diversification. An example of the Russell 2000 contract is illustrated in the figure below.

Shorting is used sparingly, with only one of the possible six scenarios allowing for shorting. For each index, the strategy partially hedges or fully hedges exposure in three of the six scenarios. The result is a strategy that seeks consistent equity exposures and significantly reduced correlation to broad equity markets.

Commodity Model Enhancements

We believe commodities are a crucial contributor to the return and diversification characteristics of the Fund and will continue to remain a substantial Fund component.

In June, we will incorporate a two-factor momentum signal that seeks to provide higher conviction when taking a certain position in a commodity contract. The two momentum factors use significantly different methodologies, yet both seek to determine the direction a commodity is trending.

When both signals agree, we take either a long or a short position in the contract. If the two signals differ, there is less certainty about whether there is a reliable trend to trade on, and the nominal weight of the contract will instead be allocated to t-bills.

A critical factor of commodity futures investing is the carry cost associated with commodities. The enhanced commodity model takes the carry cost of each commodity into consideration when determining positions. If fully exposed to all commodities, the strategy would target a commodity exposure of 40%.

Currency Model Enhancements

Currencies also may offer excellent diversification to broad equity markets. In the new model, currency exposure will be reduced from 30% to 10%. We maintain exposure to currencies for their diversification benefits, while allowing for a greater allocation to asset classes that historically tend to generate higher returns.

Prior to the model changes, the currency component of WTMF consisted purely of developed market currencies. However, research has shown that adding emerging markets currency futures would have boosted returns.

For the enhanced currency model, we will utilize a rotation strategy that is either bullish or bearish the U.S. dollar (USD). Long USD exposure is obtained through the ICE U.S. Dollar Index futures contracts. Short USD exposure is obtained through a diversified set of emerging markets currency futures. An optimized momentum indicator based on the ICE U.S. Dollar Index determines whether the Fund is long or short USD.

Conclusion

While in recent years the managed futures space has seen limited growth, we believe the current market environment presents an excellent opportunity for these strategies to potentially add uncorrelated returns and reduce risk in a portfolio.

We believe the low cost of the Fund, combined with timely enhancements to the strategy, make WTMF an ideal candidate for an investor looking to add diversification to their portfolio.

Important Risks Related to this Article

There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long only indexes rise (or short only) indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund's established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed, thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

Diversification does not eliminate the risk of experiencing investment losses.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.

Matt Aydemir began his career at WisdomTree as a Research Analyst in January 2020. He is responsible for quantitative research on WisdomTree’s products, as well as the maintenance and reconstitution of WisdomTree’s indexes. Prior to joining WisdomTree full-time, Matt worked in the research team as an intern, where he developed tools for portfolio analytics. Matt received his Master’s in Financial Engineering degree from Columbia University in 2020, and his Bachelor’s in Chemical Engineering degree from the University of Waterloo in 2016.