Gaining Exposure to the BioRevolution Megatrend

“If the 19th century was the century of chemistry and the 20th the century of physics, the 21st will be the century of biology.” – Jamie Metzl

Revolutionary advances across multiple fields including computer science, artificial intelligence, big data analytics, automation, chemistry, biology and engineering are creating previously unimaginable new opportunities to reengineer biological systems in ways that will revolutionize health care, agriculture, manufacturing, energy production, consumer services and data storage.

The revolution in our ability to read, understand, write and hack DNA, the genetic code of all life, will touch most aspects of how we live.

All organisms have their own genome, a complete set of DNA that contains instructions to develop and direct the activities of life.

Researchers can sequence DNA (determine the order and information carried in DNA) more rapidly and cost-effectively than ever before, which is driving transformations in health care and many other sectors of our global economy.

The development of Moderna’s COVID-19 vaccine is just one poignant example—it took the company only two days to design the sequence for its mRNA vaccine!1

Introducing the WisdomTree BioRevolution Fund

We believe the biology revolution is creating a historic investment opportunity equivalent to the industrial and internet revolutions, and the WisdomTree BioRevolution Fund (WDNA) may be uniquely positioned to capture the companies at the intersection of science, technology and engineering.

WDNA seeks to track the price and yield performance, before fees and expenses, of the WisdomTree BioRevolution Index (WTDNA), which provides targeted exposure to companies that we believe lead the transformations and advancements in genetics and biotechnology.

To construct the WisdomTree BioRevolution Index, we leverage data from leading technology futurist2 Dr. Jamie Metzl as a third-party consultant. Recognized as a thought leader on the biology revolution, Dr. Metzl authored Hacking Darwin: Genetic Engineering and the Future of Humanity, and he serves as a member of the World Health Organization’s expert committee on human genome editing.

Considering proprietary data from Dr. Metzl, WTDNA identifies the key sectors and industry verticals that are expected to be most significantly transformed by advances in biological science and technology, as well as the companies that WisdomTree believes are most representative of this wave of innovation.

Sector Diversification: The Impact of the BioRevolution Extends Far Beyond Health Care

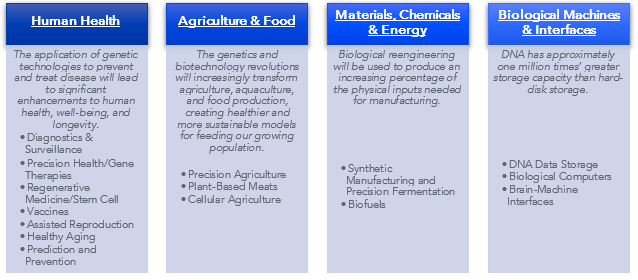

The technologies underpinning the biology revolution are connected and reinforce advancements across interdisciplinary fields. We have identified four key BioRevolution sectors, each including multiple subsectors of impact.

Human Health – The genetics and biotechnology revolutions are most often associated with health care because many of the most high-profile preliminary applications are health care related. The quantity and quality of these applications will increase significantly as our health care systems transition from generalized medicine based on population averages to personalized, or precision, health care based on each person’s individual biology. When the amount of data collected on the human genome reaches critical mass, our system will transition to a predictive and preventive health care system that will help us live healthier and longer lives.

Although health care is the most mature market to date, we expect other sectors to catch up.

Agriculture & Food – Technologies will supercharge the selective breeding process to accomplish in months or a few years what previously might have taken centuries or millennia. Pest resistance, yield and variety can be enhanced significantly for staple crops, which can also be engineered to significantly increase photosynthesis to slow climate change. Domesticated animals can be engineered to increase disease resistance, productivity and product quality through marker-assisted selective breeding targeting specific desired outcomes.

Materials Chemicals & Energy – The sourcing of industrial inputs for manufacturing is another area ripe for transformation. As the human population grows toward an estimated 10 billion people by mid-century, current resource extraction models will not be sustainable. The tools of the genetics and biotechnology revolutions, however, are making it possible to create materials at scale by manipulating genetic code rather than extracting them from nature. Instead of making plastic from petroleum and fragrances from flowers, for example, we can produce both through the genetic engineering of yeast and other microbes.

Biological Machines & Interfaces – Connection and communication between the biology of humans and computers, including the use of DNA for computing and storage, is increasing the potential to extract, store and process data from individuals.

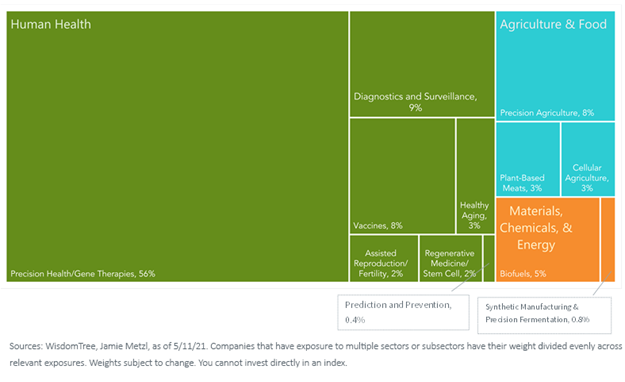

WTDNA currently holds approximately 80% of its weight within the Human Health sector. Over time, we expect the maturation of Agriculture & Food as well as Materials, Chemicals & Energy to drive their increased representation in WTDNA.

A Differentiated BioRevolution Investment Approach

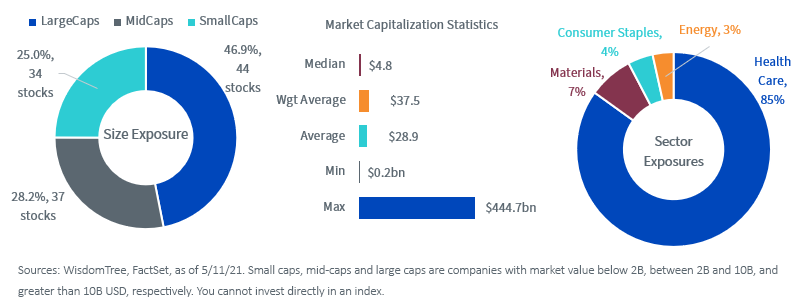

Although the general direction and accelerating pace of this revolution are nearly certain, the time horizons for how each specific application will play out will vary. Our approach targets dynamic companies deploying revolutionary technologies both in and outside of health care, and it invests in a wide range of 115 companies across the BioRevolution impact spectrum to reduce single-stock concentration risk.

We believe the diverse portfolio of companies captured in WDNA is the best way for investors to gain exposure to the biology revolution that we expect to fundamentally transform our world and lives over the coming years.

1As of 5/25/21, WTDNA held 0.6% of its weight in Moderna.

2An individual who studies or predicts the future based on current trends in technology

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in BioRevolution companies, which are companies significantly transformed by advancements in genetics and biotechnology. BioRevolution companies face intense competition and potentially rapid product obsolescence. These companies may be adversely affected by the loss or impairment of intellectual property rights and other proprietary information or changes in government regulations or policies. Additionally, BioRevolution companies may be subject to risks associated with genetic analysis. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.