Gold: Unique in Every Way

Gold is a special asset. Simultaneously a commodity and a foreign exchange instrument. Cyclical and defensive at the same time. Used as a store of value and medium for exchange for millennia. With references to the metal in the Torah, Bible, Qur’an and Bhagavad Gita, its historical allure to humans verges on empyrean.

Different and Resilient

In the financial world, its unique behavioral traits1 make it a perfect diversifier to a portfolio:

- It behaves differently to equities, bonds, commodities and crypto currencies

- It is a great inflation hedging instrument

- It is a great geopolitical shock hedging instrument

- It is a great financial shock hedging instrument

- It performs well in both recessions and strong expansions

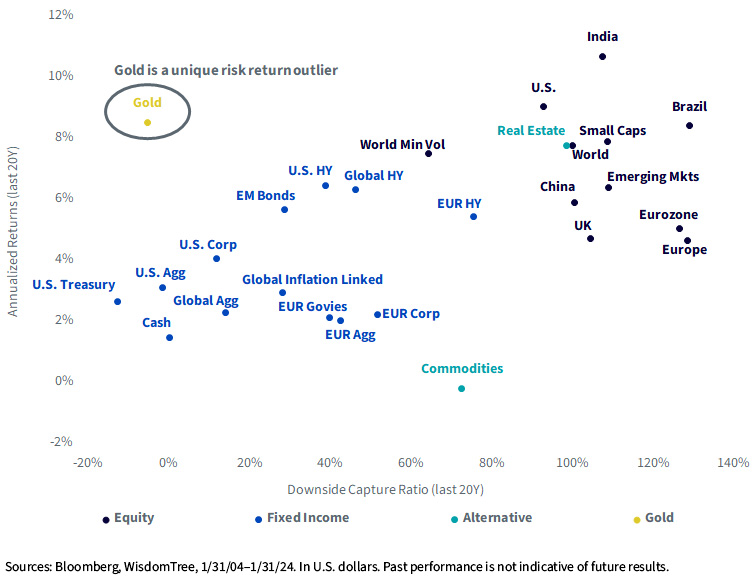

This balance between downside protection and capacity to generate positive return over the long term is unique to gold. As illustrated in figure 1, returns for most assets are broadly proportional to risk. Assets with high equity-like returns over the last 20 years have exhibited downside capture (vs. equity markets) of around 100%. Assets with lower downside capture, like fixed income, tend to have lower returns too.

Gold bucks these trends: it has exhibited equity-like returns of 8.5% per annum over the last 20 years with very minimal downside capture. Gold therefore is a uniquely suited asset to increase diversification and reduce risk in a portfolio without weighing on long-term performance.

Figure 1: Long-Term Performance and Downside Risk for Different Asset over the Last 20 Years

The Perfect Diversification Tool…

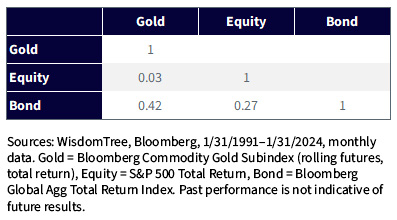

As the late Markovitz said, the only free lunch in the world of investing is diversification. That diversification is enhanced by low correlations. As figure 2 illustrates, gold’s correlations to equites and bonds are low.

Figure 2: Asset Correlation Matrix

…yet Shunned by Many Investors Today

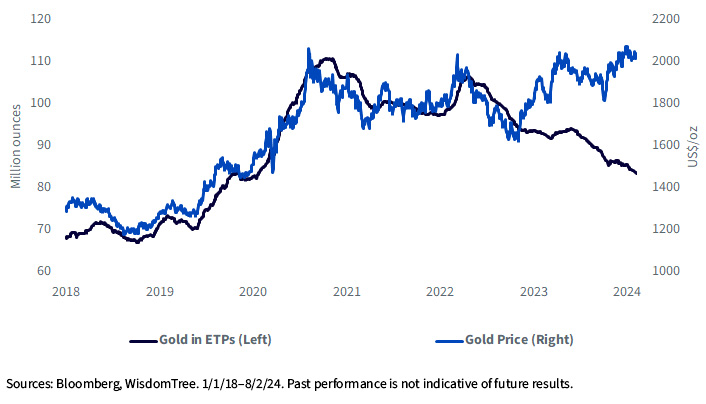

Judging by flows out of physical gold exchange-traded funds (ETFs) over the past three years, professional gold investors appear to have turned their backs on the metal (figure 3). With repeated attempts to break above the $2,050 per ounce mark, there has been no tailwind from the ETF market. If gold successfully gets above that level, we could see ETF investors return and that could fuel a stronger rally.

Figure 3: Gold Price and ETP Holdings

Gold Poised to Reach a New High

Although soft landings have historically not provided the best setting for gold to shine, in this rate cycle we have seen gold hit a fresh high in December 2023, when markets were expecting a decisive Federal Reserve (Fed) pivot in 2024. Some of those gains have been given back as markets reassessed the Fed’s urgency, but our Gold Model points to gold rising to a higher high by the end of this year, on account of bond yields declining and the U.S. dollar depreciating.

Gold could reach $2,210 per ounce, close to 10% higher at the time of writing (February 6, 2024). Achieving the lauded soft landing is easier said than done (and that is why we have so few observations to look at). We could face a bumpy road in 2024, with the Fed and markets clearly having a different view of the rate path ahead of us. Gold’s hedging capabilities may once again prove to be the antidote to volatility elsewhere.

Solutions

Despite the strategic and increasingly tactical benefits of having gold in a portfolio, finding a space for gold is always a challenge. With bond prices having fallen so much in October 2023, many investors have opportunistically filled the defensive portion of their portfolios with Treasuries, leaving less room for gold. In a year where rate cuts are widely expected, investors are keen to maintain a large exposure to equities.

WisdomTree has developed capital efficient solutions to address this problem. WisdomTree Efficient Gold Plus Equity Strategy Fund tracks a broad equity index and offers gold exposure through gold futures contracts. The inherent leverage in gold futures offers capital efficiency. For example, $100 invested would be split $90 in equity and a $90 notional exposure to gold futures ($10 in cash collateral). The solution allows investors to find room for gold without materially decreasing exposure to equities. The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund offers a similar solution, replacing the broad equity component with gold miners. Gold miners and gold futures perform differently in different parts of the economic cycle and the solution allows investors exposure to both in a capital efficient manner.

1 See: WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Investment Case

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“Gold Miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically, and have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of Gold Miners, the Fund may be susceptible to financial, economic, political or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic or regulatory conditions affecting that country or region, or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.