What’s Behind this Active Emerging Market Portfolio’s Outperformance

Two common inquiries from clients regarding an emerging markets portfolio are the appropriate weight for China and the extent of currency hedging required. In our most actively managed emerging markets multifactor strategy and corresponding ETF, we address these concerns.

China’s Weight

The weight of China in a cap-weighted portfolio has significantly decreased from over 30% to around 22%, due to the aftermath of its highly leveraged housing bubble bursting and the increasing worry over continued crackdowns on private businesses since 2021. Despite its lower weight in popular benchmarks, China continues to dominate headlines as the U.S. identifies it as a major competitor, and we see little sign of major improvements coming for the U.S.-China relationship.

While China is exploring fiscal and monetary policy remedies, we’ve previously discussed that it’s unlikely to pursue stimulated growth. Concurrently, the U.S. continues to impose negative tech and trade restrictions.

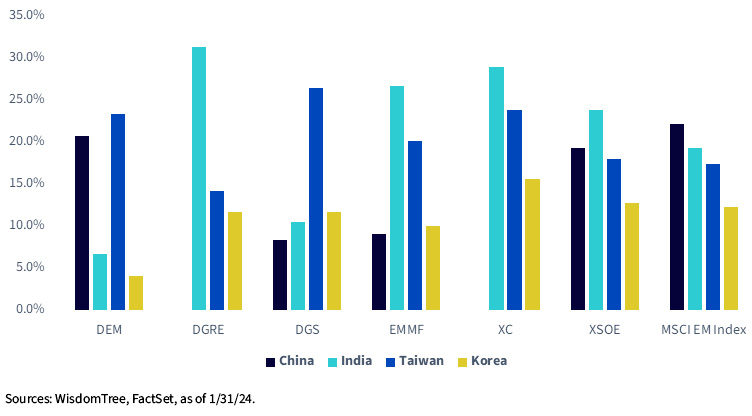

To address this ongoing tension and uncertainty for China exposure, we offer a variety of options for clients, ranging from completely excluding China, as seen in our growth-oriented ex-China Fund (XC) and EM Quality Dividend Fund (DGRE), to the dividend-weighted Funds like DEM and DGS that follow a factor strategy and determine China’s weight accordingly.

But in our most active multifactor strategy, EMMF, China’s weight is about 10%, which is an under-weight position but still significant enough to capture some upside.

Various Emerging Markets Funds with China Weights from 0% to Full Index Weight

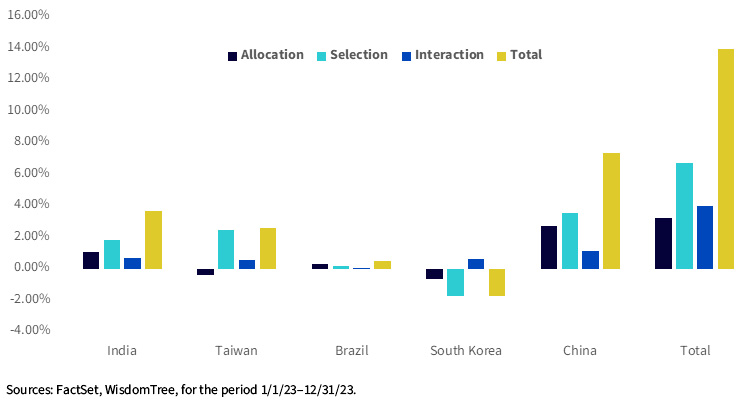

The under-weight position in China in 2023 benefited EMMF, as it outperformed the benchmark by approximately 14%. However, China isn’t the primary reason for EMMF's outperformance.

About 2.7% alpha resulted from the Fund’s under-weight in China and 3.54% came from stock selection among Chinese stocks. The allocation and stock selection for India/Taiwan also added value, indicating the effectiveness of the factor model. On net total, stock selection accounts for twice as much outperformance than active country allocations.

EMMF Attribution for 2023: China accounts for half of outperformance, and more than half came from stock selection, not just allocation

Currency Hedging

Hedging emerging markets currencies is typically costly. However, due to the higher relative interest rate in the U.S., hedging in several currencies, such as CNY and TWD, now yields a positive carry.

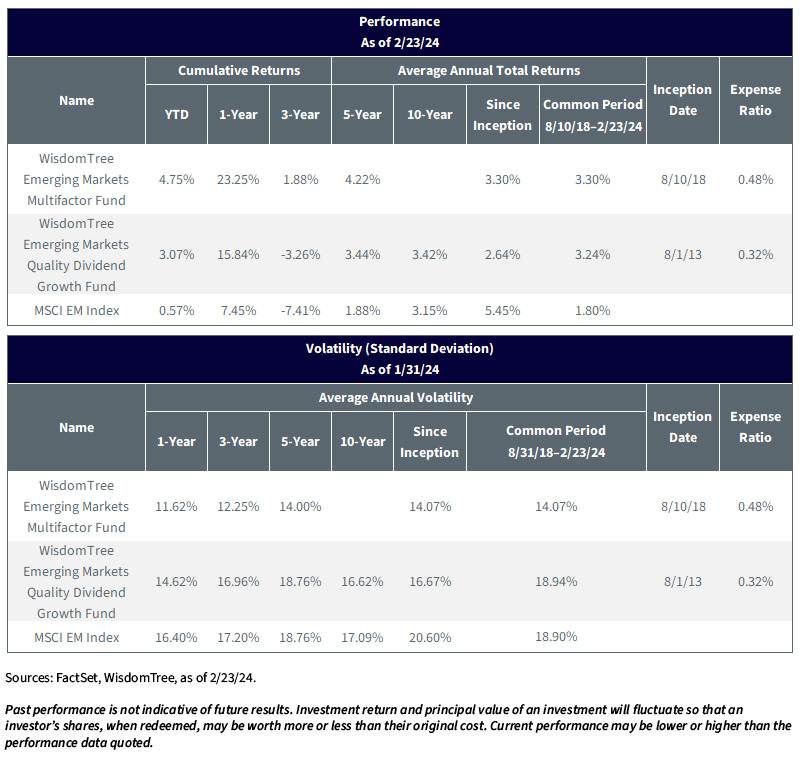

We employ a factor-based dynamic currency model which generally lowered portfolio risk by about 1% annually.

As the below performance characteristics shows, under-weight allocations to China, factor bets on momentum and correlation, not just quality and value, which was implicit in the other strategy (DGRE), and dynamic currency hedging has worked to significantly lower risk.

For the most recent month-end and standardized performances and to download the Fund prospectus, click here.

For definitions of terms in the tables above, please visit the glossary.

Factor Models in Stock Selection

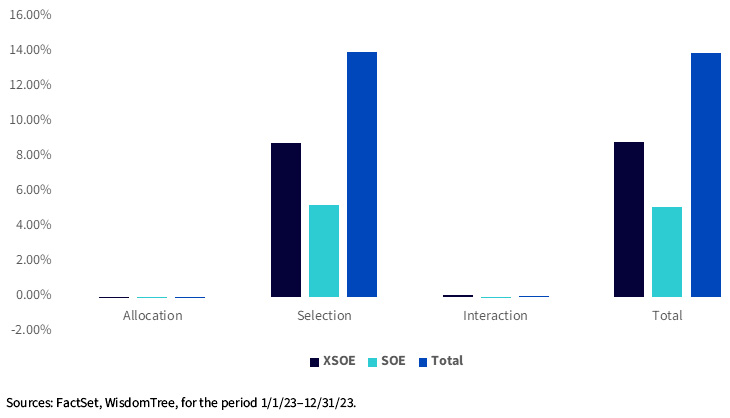

In the emerging markets, whether a company is a state-owned enterprise (SOE) greatly impacts its profit margins. For the EM Multifactor Fund, we maintain a neutral weight in SOEs. In 2023, the factor-based stock selection model added value for both the SOE and non-SOE universe, with higher effect in the non-state-owned universe.

EMMF 2023: Most outperformance came from stock selection, not allocation between SOE/XSOE

EMMF's multifactor strategy is over-weight in traditional factors (value, quality, momentum and correlation) from a bottom-up approach. The portfolio is typically over-weight in all four factors from the model that includes both deep selection of a multifactor score and then a weighting process that tilts weight to these factors and away from just market cap and size.

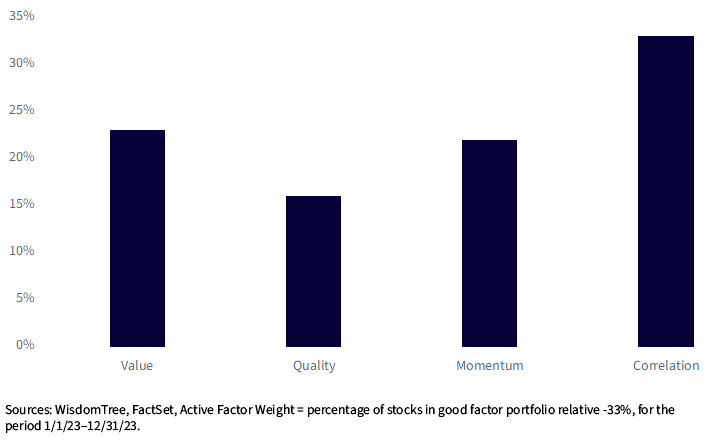

EMMF 2023: Active Factor Weight

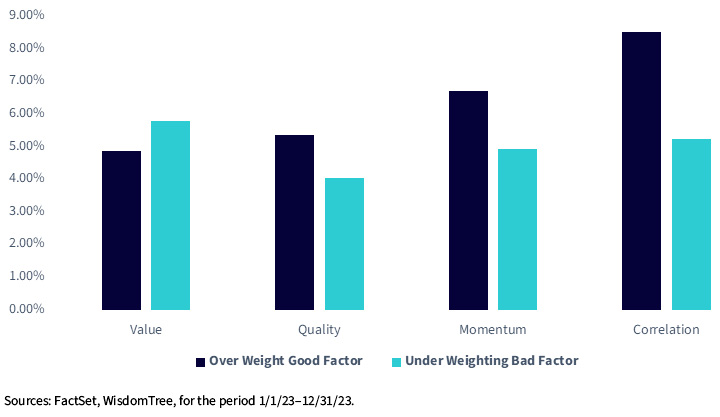

The allocation effect of all four factors added value. More importantly, the stock selection effects of the factors were even more significant for 2023. Across all factors, and from both ends, from the over-weight allocation of good factor stocks, and the under-weight allocation of bad factor stocks, it all added value.

2023: Outperformance from both the over-weight in good factor and under-weight in factor score stocks

In Conclusion

In 2023, our most actively managed emerging markets portfolio had a successful year. Almost all models performed favorably, except for the currency model, though it did reduce the overall portfolio risk on top of the equity model.

As the portfolio carries significant active weight, its performance can be excellent, as seen in 2023, or it can underperform significantly. However, we believe that over the long run, factor investing in both equity and currency will yield returns, and a moderate weight in China is appealing to investors concerned about geopolitical risk.

Important Risks Related to this Article

Investing involves risk, the including possible loss of principal. Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Derivatives used by the Fund to offset exposure to foreign currencies may not perform as intended. There can be no assurance that the Fund’s hedging transactions will be effective. The value of an investment in the Fund could be significantly and negatively impacted if foreign currencies appreciate at the same time that the value of the Fund’s equity holdings falls. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended.

Additional risks specific to EMMF include but are not limited to emerging markets risk. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.