Managing Currency Risk in an Emerging Market Portfolio

Emerging markets (EM) have traditionally had higher interest rates than the U.S. While hedging can reduce risk, it also comes with a significant cost, diminishing the benefits a U.S. investor can reap from hedging.

Consequently, we propose dynamic currency hedging in emerging market portfolios as a potential solution. This approach has been incorporated into our Emerging Markets Multifactor strategy (EMMF).

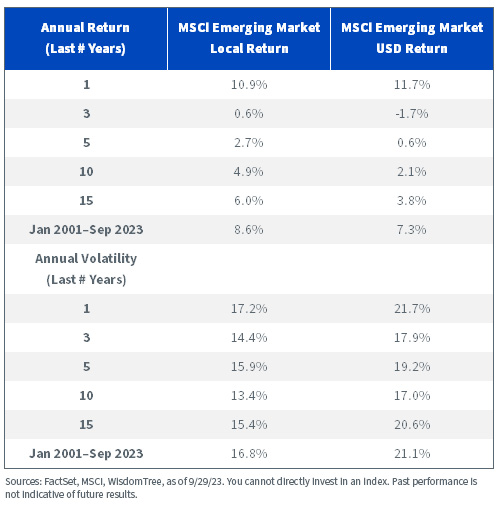

In the last 20 years, the U.S. dollar has seen an increase in value compared to most currencies. This implies that a completely hedged emerging market portfolio could, in theory, provide greater returns and significantly less volatility. However, the process of fully hedging an emerging market portfolio can be expensive. Often, the additional benefit from local return as compared to the dollar return is insufficient to offset the cost of hedging.

Figure 1: MSCI Emerging Market Index Local and Dollar Returns

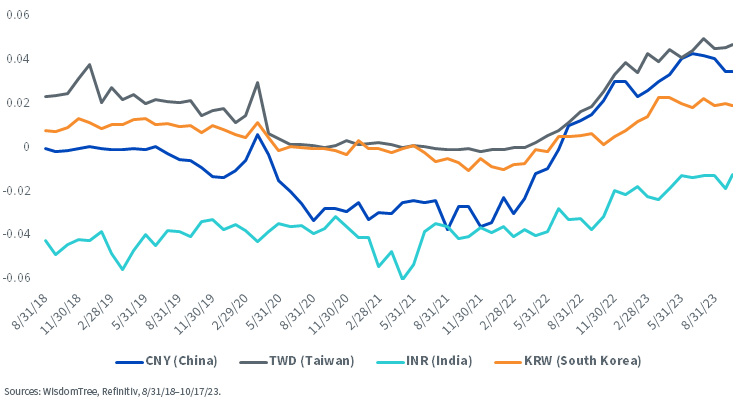

While the U.S. generally has higher interest rates than developed countries in Europe and Japan, allowing U.S. investors to earn carry from hedging these currencies, this is not the case for many emerging market economies. For instance, it was only when the U.S. significantly raised interest rates that a U.S. investor could be paid for hedging major EM currencies, such as the Chinese yuan.

Take India as another example—a country with historically higher interest rates than the U.S. This typically means that U.S. investors are expected to pay to hedge, as the hedging carry is usually negative.

Figure 2: Annualized Carry of Major Emerging Market Currencies

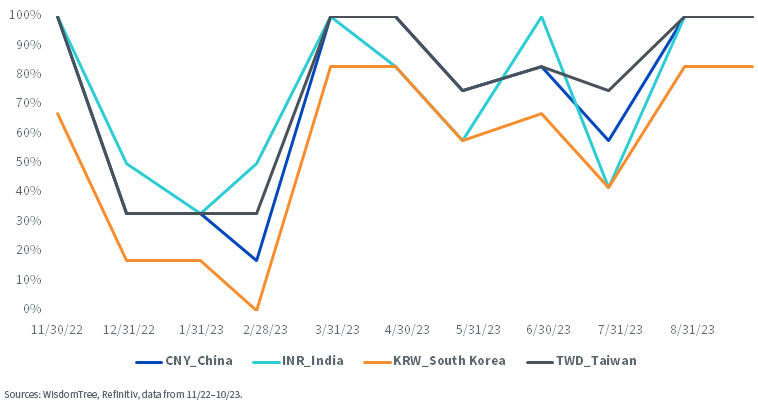

Considering the cost of hedging emerging market currencies, we’ve developed a currency model based on multiple factors, such as momentum, low volatility and the impact of equity markets on currencies.

The hedge ratio for the overall portfolio and each individual currency can range from 0% to 100%. Since its inception in 2018, EMMF's portfolio has been approximately 36.4% hedged, which substantially reduces hedging costs.

At present, the EMMF portfolio is hedged at 91%, and the average year-to-date hedging is at 51%. Despite the portfolio being nearly fully hedged currently, the cost of hedging is almost negligible. This is primarily because we are currently receiving payment for hedging currencies from China, Taiwan and South Korea because of the higher U.S. interest rate.

Figure 3: Dynamic Currency Hedge Ratios Used in the WisdomTree Emerging Markets Multifactor Strategy

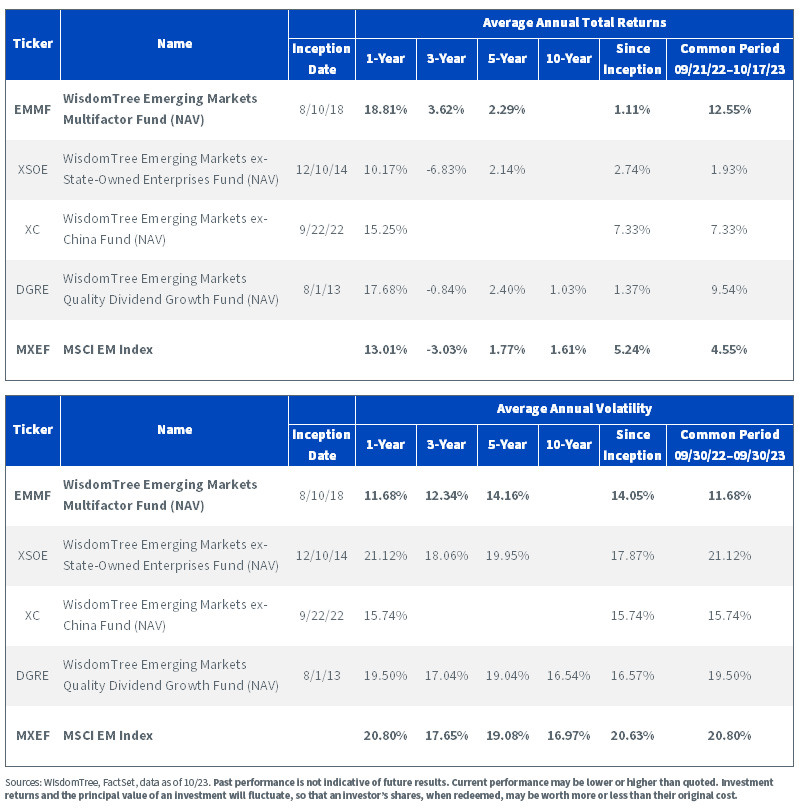

In our WisdomTree Emerging Markets Multifactor Fund, we employ multifactor methods for both equity and currency hedging. The past five years have been challenging, as mega-large cap and momentum have dominated investor attention. However, for patient investors, factor-based strategies have yielded similar or superior results with significantly less volatility.

Figure 4: The WisdomTree Emerging Markets Multifactor Strategy (EMMF) Has Delivered Lower Volatility and Higher Return over the Last Five Years

For the most recent month-end and standardized performance, click the respective ticker: EMMF, XSOE, XC, DGRE.

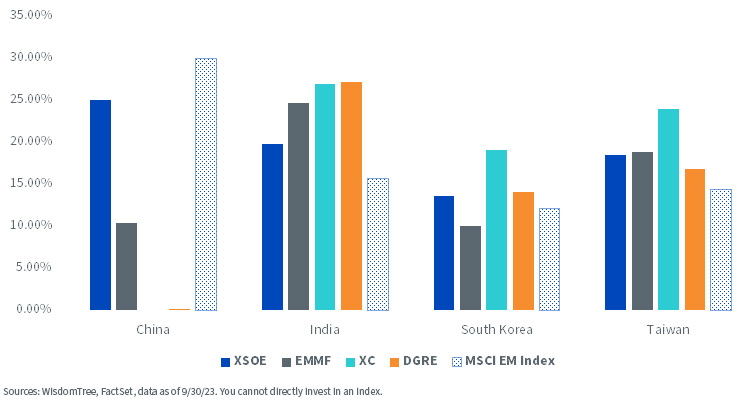

When discussing an emerging market portfolio, China is an inevitable subject. In addition to currency hedging to mitigate risk, we’ve also reduced some China exposure in the EM multifactor strategy due to the current economic slowdown in China and clients’ preferences for partial rather than full China weight.

We now offer a variety of strategies, ranging from 0% China exposure in DGRE and XC to full China weight in an emerging market portfolio like XSOE and DGS or partial China exposure like EMMF.

Figure 5: A Range of Emerging Market Strategies at WisdomTree, from 0% China to Full China Weight

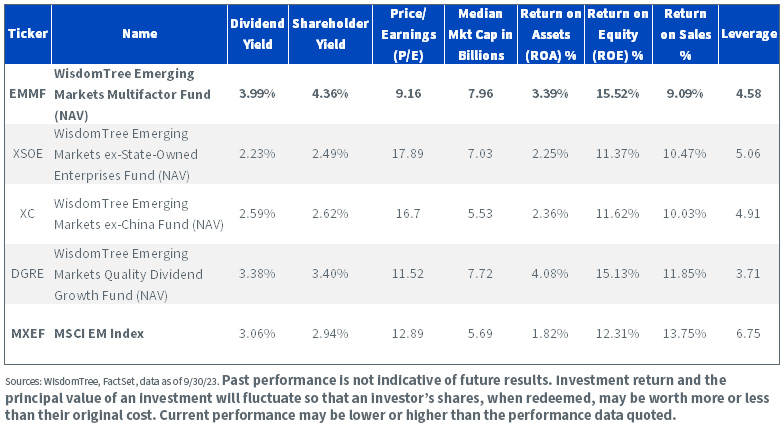

Emerging market portfolios, whether excluding China or not, still have lower valuation and leverage and higher quality than the benchmark, particularly multifactor-based strategies such as EMMF and DGRE.

Figure 6: Factor Portfolios Have Lower Valuation, Lower Leverage and Higher Quality

For the most recent month-end performance, prospectus and 30-day standardized yield, click the respective ticker: EMMF, XSOE, XC, DGRE.

In conclusion, we believe that there’s a balance to be struck between hedging some emerging market currencies and the high cost of hedging. We’ve implemented a factor-based dynamic currency hedging model in our emerging market multifactor strategy that could serve as a risk-mitigated starting portfolio.

Important Risks Related to this Article

EMMF/DGRE: Investing involves risk including the possible loss of principal. Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Derivatives used by the Fund to offset exposure to foreign currencies may not perform as intended. There can be no assurance that the Fund’s hedging transactions will be effective. The value of an investment in the Fund could be significantly and negatively impacted if foreign currencies appreciate at the same time that the value of the Fund’s equity holdings falls. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended.

Additional risks specific to EMMF include but are not limited to emerging markets risk. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

XSOE/XC: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as the risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.