Looking Back at Equity Factors in Q3 2023 with WisdomTree

After two quarters of strong equity performance, markets paused and reversed in the third quarter of the year. The MSCI World Index lost -3.5% over the quarter, despite gaining 3.4% in July. U.S. equities lost -3.2% and European equities lost -2.1%. Clearly, the change of tone at the U.S. Federal Reserve (“Fed”) played a role in that reversal. After 18 months of being laser-focused on fighting inflation, the Fed is starting to balance the risk of inflation with the risk of over-tightening.

This installment of the WisdomTree Quarterly Equity Factor Review aims to shed some light on how equity factors behaved in this complicated quarter and how this may have impacted investors’ portfolios.

- In the U.S., quality performed the strongest.

- In emerging markets, the picture remains quite different from the rest of the world, with most factors outperforming and growth being the standout loser.

Looking to the end of 2023 and beyond, the equity outlook remains quite uncertain. Easy fiscal policy in the U.S. contributed to offset the impact of tightening monetary policy in 2023. We expect the breadth of the U.S. market to improve, favoring value and dividend stocks. Given the strong manufacturing headwinds facing Europe, we expect weak growth in the eurozone for the remainder of 2023, favoring a tilt toward defensive stocks.

Performance in Focus: Has the 2023 Bull Run Come to an End?

Despite good performance in July, Q3 saw markets reverse course and post negative returns. After leading for the first seven months of the year, tech mega caps underperformed markets in July and August.

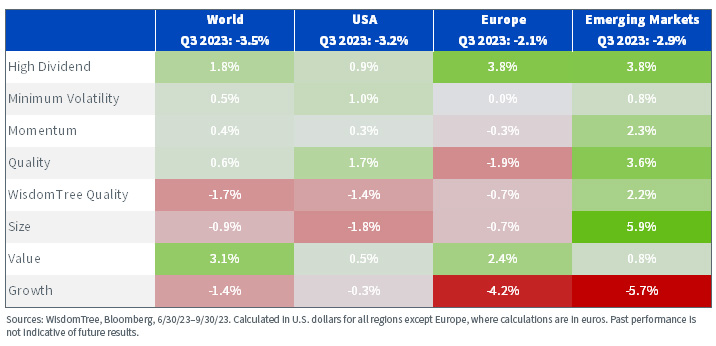

Q3 ended up being a more favorable period for factor investing in developed markets:

- In global developed markets, value and high dividend posted the strongest returns after two difficult quarters.

- In the U.S., quality posted the best return, followed by min volatility, value and high dividend outperformance.

- Size and growth suffered in both developed European and U.S. markets, posting underperformance.

- In Europe, high dividend and value also posted the strongest returns. However, growth and quality underperformed.

- In emerging markets, size continues to dominate, but like in previous quarters, most factors were able to produce outperformance over the quarter. Growth was the standout loser in the region.

Figure 1: Equity Factor Outperformance in Q3 2023 across Regions

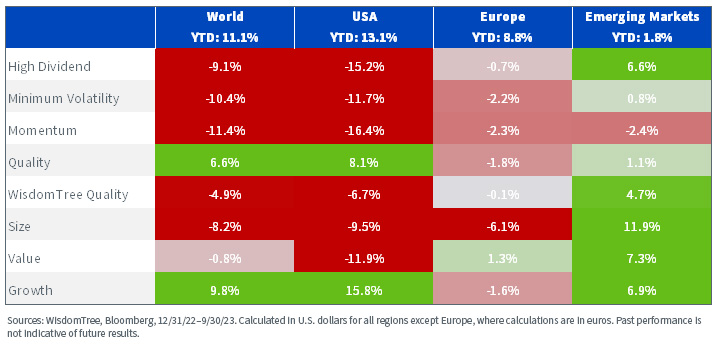

2023 Has Been Very Consistent Factor-Wise

Looking back at the full year, July and August were not enough to change the overall picture. Growth and quality are the stand-out winners in developed and U.S. markets. All other factors underperformed, with double-digit underperformance for most of them. European markets look quite different, with value dominating and the only factor to outperform. In contrast, growth stocks underperformed for the year. As discussed recently in our equity outlook for 2024, the fundamental difference is that the U.S. is mostly a service-driven economy that benefited from consumer strength in 2023 on the back of strong wage growth, increasing credit card debt and the spending of pandemic savings. Europe, by contrast, is a manufacturing-driven economy that suffered from a weak reopening of the Chinese economy and is now facing the consequences of monetary tightening.

In emerging markets, all factors but momentum did quite well in 2023. Small cap posted the strongest returns, followed by value.

Figure 2: Equity Factor Outperformance in 2023 across Regions

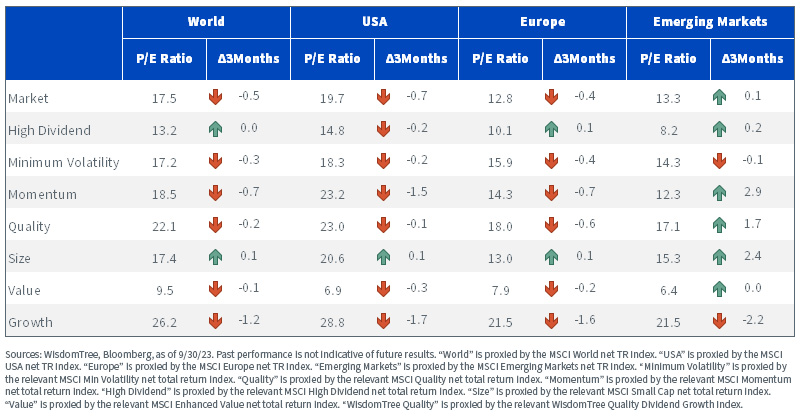

Valuations Decreased in Q3

In Q3 2023, developed markets got less expensive. Most factors saw the price-to-earnings ratio decline over the quarter. Growth saw the biggest decrease across regions, followed by momentum. In emerging markets, however, valuations increased, with momentum P/E gaining 2.9 and size gaining 2.4. Growth, on the contrary, got cheaper.

Figure 3: Historical Evolution of Price-to-Earnings Ratios of Equity Factors

Q4 and Beyond

Positive economic surprises helped push markets higher in the first seven months of the year. However, looking ahead, the outlook remains more uncertain. Easy fiscal policy in the U.S. helped offset the impact of tightening monetary policy. We expect the breadth of the market to improve, favoring value and dividend stocks. Given the strong manufacturing headwinds facing Europe, we expect weak growth in the eurozone for the remainder of 2023, favoring a tilt toward defensive stocks.

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree, Inc.