Navigating Volatile Markets with the Endowment Model

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

It has been almost a year since we last visited the WisdomTree Endowment Model Portfolios and, given current market conditions, we think it is high time to revisit and give them a closer look.

Let’s begin with a reminder of how we define an “endowment model” with respect to tax-paying individual investors (as opposed to the tax-exempt institutional world where they originated):

• Broad and global diversification

• Intelligent use of active versus passive investment strategies (i.e., a cost/benefit optimization of active management fees or, in WisdomTree’s phrase, Modern Alpha®)

• Prudent use of non-traditional or lower correlation investments in an attempt to improve overall portfolio diversification and maintain purchasing power (i.e., real assets and alternatives, or what we refer to collectively as the volatility management sleeve)

• A long-term time horizon

• Investment discipline through full market cycles

We manage our different risk-banded Endowment Model Portfolios in exactly this way. All these Models are multi-asset, with allocations to global equities, fixed income, real assets and alternative investments.

Somewhat uniquely, we believe, we are able to fund liquid, less-traditional asset class positions because we allocate to NTSX, the U.S. version of our Efficient Core strategies, which takes a leveraged 90/60 position in large-cap U.S. equities and U.S. Treasury futures. This provides us with a core allocation to stocks and bonds, while freeing up capital to allocate to diversifying strategies, all while maintaining a fully liquid portfolio.

Before we move on, let’s define what we mean by our volatility management, or “Vol Man,” sleeve – real assets and alternatives:

Real Assets are strategies that historically have proven to be sensitive to longer-term changes in inflation and may include, but are not limited to, gold, broad-basket commodities, real estate, energy master limited partnerships (MLPs) and diversified inflation-sensitive products. The use of these strategies is designed to (a) provide diversification to equity risk in the portfolio, (b) provide access to additional sources of potential return, and (c) protect purchasing power from the long-term effects of inflation.

Alternatives are strategies that may include, but are not limited to, equity long/short, global macro, managed futures, event-driven, short-bias, inflation hedge and options based. The use of these strategies is designed to (a) provide diversification to equity, interest rate and inflation risk, (b) provide access a more diverse set of potential sources of return, and (c) reduce the volatility of the overall portfolio over time.

This is just a summary of the potential strategies available—we may or may not deploy all of them in our Endowment Models at any given time, but we will include some mixture and combination of them.

Let’s now look at why we think the Endowment Model may be especially timely in the current market environment.

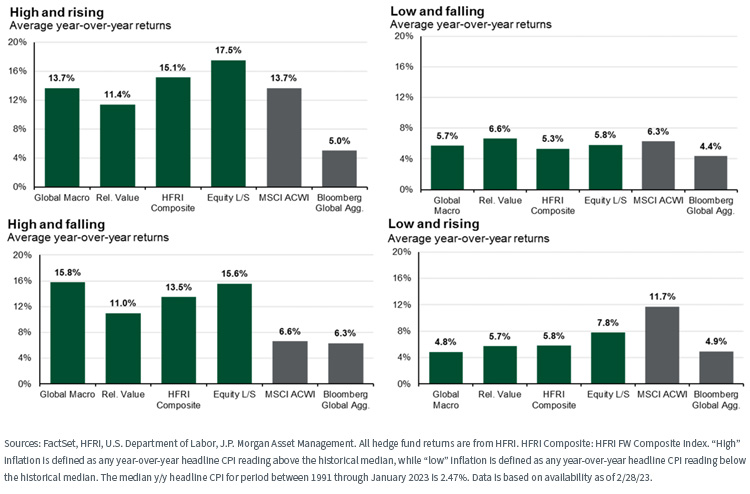

First, alternative investments historically have performed well in market environments that can be particularly challenging for traditional portfolios. This includes periods of high inflation risk (proxied by hedge funds below), rising interest rates and (to a certain extent) elevated volatility.

Hedge Fund Returns Across Inflationary Regimes

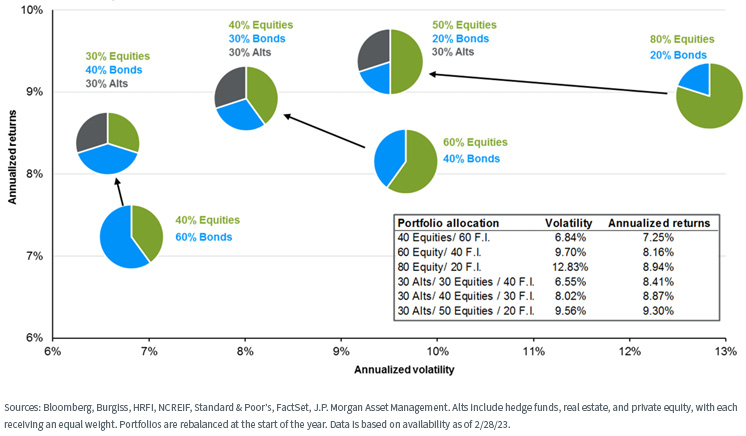

Over longer-term time horizons, there have been clear risk and return benefits in an endowment-like approach—we just forgot them during the decade from 2009 to 2019, given Fed-induced low interest rates and volatility.

These portfolio advantages are illustrated below, which shows how the incorporation of alternatives has enabled the construction of more efficient portfolios that experienced higher annualized returns for similar or lower levels of risk (annualized volatility).

Alternatives and Portfolio Risk/Return (Annualized Volatility and Returns, 1989–3Q22

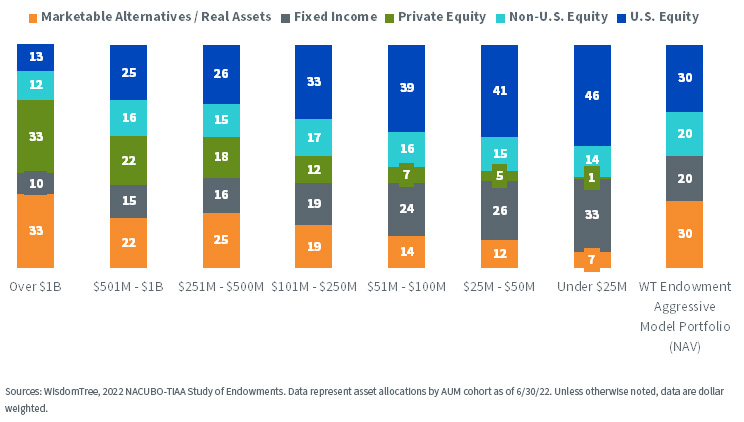

Now let’s look at actual asset allocations of U.S. endowment portfolios.

The following chart is from the most recent annual NACUBO (National Association or College and University Business Officers) TIAA Study of Endowments, as of June 30, 2022.

Fiscal Year 2022 Asset Allocation for U.S. Higher Education Endowments (AUM Cohorts)

Focus your attention on the “Under $25 Million” size (AUM) cohort, as these institutions invest primarily in liquid asset classes and represent the closest asset level to most HNW families and their advisors.

Relative to the WisdomTree Endowment Aggressive Model Portfolio, the average “small” U.S. endowment has a modestly higher allocation to public equities and fixed income and a lower allocation to alternatives and real assets. However, our Model Portfolios get additional fixed income exposure via the Treasury futures held in NTSX, and the level of alternatives within the Endowment Model Portfolio is largely consistent with the allocations seen in the larger cohorts.

In this sense, the Model Portfolios attempt to capture the key aspects of this institutional approach, while, like the smaller endowments, focusing on fully liquid investments.

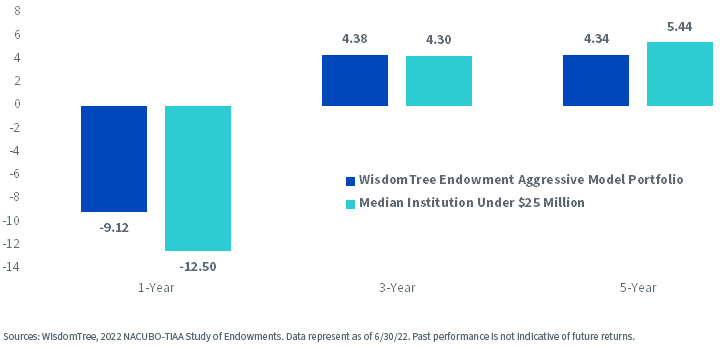

Since the inception date of our Endowment Model Portfolios back in 2016, performance has been very much as expected—they generally won’t and did not keep up with a raging bull equity market, but they provided risk mitigation and consistent performance throughout varying market regimes.

Below we compare the performance of the median institution in the same “Under $25 Million” cohort to our own WisdomTree Endowment Aggressive Model Portfolio.

Average Annual Net Investment Returns for Periods Ending June 30, 2022

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here.

As with all WisdomTree Model Portfolios, our Endowment Models share certain common characteristics:

1. They are global in nature

2. They are ETF-centric, to optimize fees and taxes

3. They are “open architecture” and include both WisdomTree and third-party strategies

4. They charge no strategist fee

Conclusions

We’ve been believers in an endowment-like approach to long-term portfolio construction for many years, and often had to defend ourselves against claims of “deworsification” during periods of low volatility, low interest rates and bullish equity markets. But we maintained our conviction that this approach has merit for long-term investors seeking to protect purchasing power and generate a more consistent performance profile over full market cycles.

Despite the liquidity and leverage constraints imposed by an ETF-only model, our portfolios have kept up with professionally managed endowment models. Given the liquidity advantages of ETFs, we believe that is a nice accomplishment.

Financial advisors interested in learning more about WisdomTree’s services can fill out the form below or send us an email at wtpg@wisdomtree.com.

Contact Us

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

There are risks associated with investing, including possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.