Unlocking Opportunities: Exploring the Potential of Emerging Local Currency Bonds

“I never invest my money in emerging markets (EM). EM is just an inferior asset class to high yield.” This is what a senior colleague told me angrily, in response to my suggestion of allocating to EM in an investment committee meeting years ago. I had just started my career in the financial industry and was in learn-everything-from-veteran-professionals mode. However, I’m glad that advice didn’t make its way to my principals of investing rulebook. Putting aside that this advice would violate rule #1 of investing (don’t put all your eggs in one basket), it would have made me close my eyes to one of the most attractive fixed income asset classes of today’s environment: EM local currency and specifically sovereign/uasi-sovereign bonds.

Breaking Down the Return

The risk and return profiles of EM local currency bonds are influenced by two factors, namely local interest rates and fluctuations in currency value. The component related to local interest rates encompasses both the yield earned from holding the bond (commonly referred to as carry) and the potential price appreciation or depreciation resulting from changes in local interest rates. This makes EM local currency bonds unique, in the sense that they have an inherent diversifier (in most instances a country’s local currency will move in opposite direction to its interest rates).

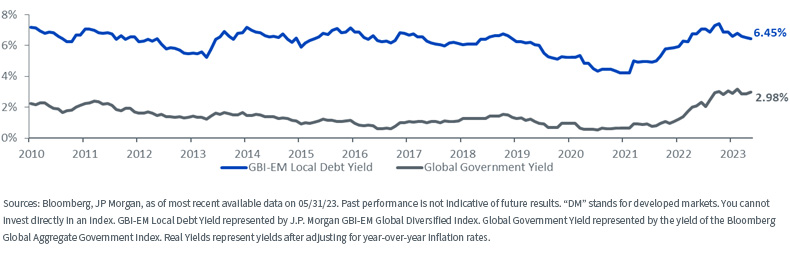

Over time, yields on EM local currency bonds have consistently exhibited a notable premium compared to government bonds issued by more developed governments. And this is while 87% of the weight of the index is in countries with investment-grade ratings by Moody’s (this figure is 79% based on S&P and Fitch, with the only difference being South Africa, which is rated as Baa3 by Moody’s and BB+ by the other two).

EM and EM Local Debt Yields

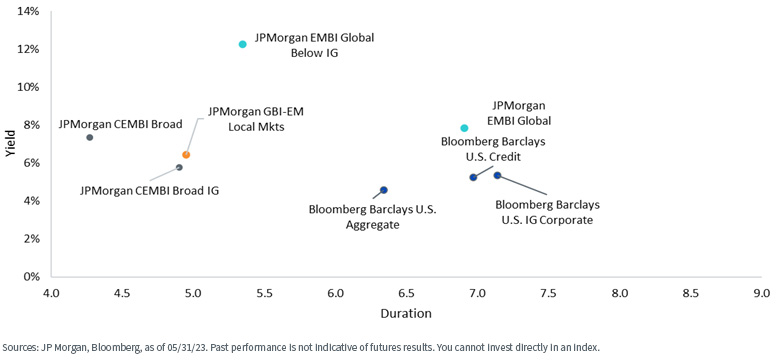

Also, this increased yield and carry associated with EM local currency debt come with a lower sensitivity to interest rate movements (duration) when compared to other asset classes within the fixed income spectrum.

Yield vs. Effective Duration

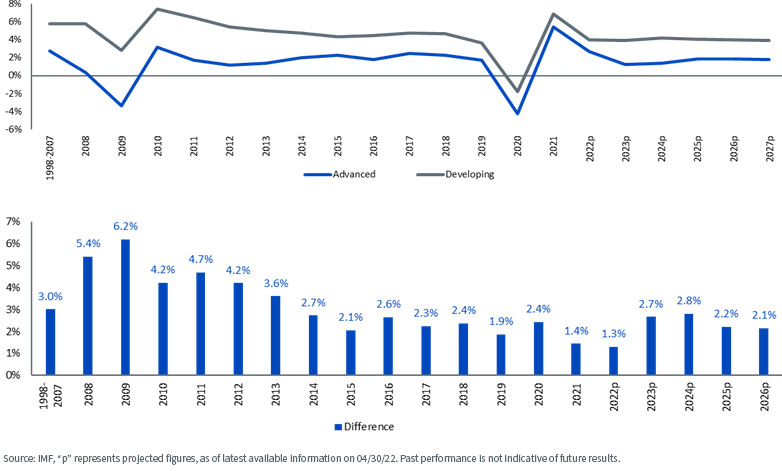

What’s even more interesting is that the enhanced yield offered by EM countries is accompanied by stronger fundamentals than developed markets, as evidenced by metrics such as debt-to-GDP ratios and improving economic growth.

GDP Growth Differential between Advanced and Developing Countries

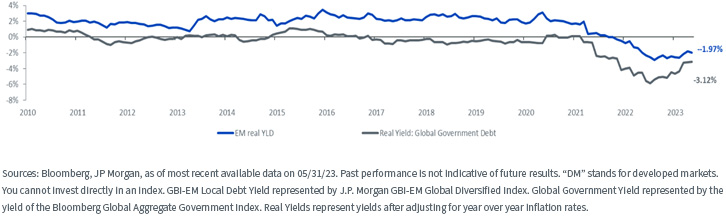

In terms of inflation in EM countries, their central banks took proactive measures by raising rates earlier than their counterparts in developed markets, aiming to combat inflation more forcefully. As a result, there has been a consistent and widespread decline in EM headline inflation. This disinflationary trend is also supported by the decrease in global commodity prices, as well as the slower economic activity due to lagged effect of monetary tightening. As a result, average real yield for EM local debt has stayed attractive compared to DM debt, albeit not as much as before. However, it is important to note that there are certain countries in the J.P. Morgan GBI-EM index that deviate significantly from the overall inflation figures. Among these countries, Turkey consistently reports the highest inflation rates. Nevertheless, due to its relatively small weight in the index, its contribution to the overall inflation and subsequent real yield calculations remains limited. Conversely, Eastern European countries, particularly Poland and Hungary, have a notable impact on the overall inflation and consequently on the calculation of real yields, given their elevated inflation rates and relatively higher weight in the index. In fact, if we were to exclude these two countries, the real yield for May 2023 would increase from -1.97% to +0.28%.

Yields for EM and DM Debt after Inflation

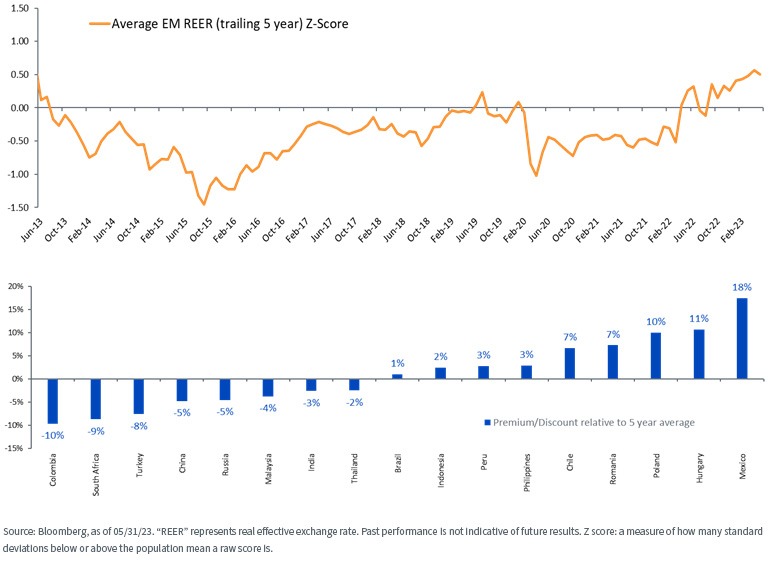

It’s not a secret that EM currencies have had a rough time in the past several years, mainly due to the strength of the greenback. However, we believe that EM currencies are bound to have positive performance in the near future due to different factors. The China re-opening will provide a boon for EM local currencies. Also, because of several years of underperformance, and even after the recent surge, they remain undervalued compared to historical levels.

Conclusion

Like any other asset class, there is a risk involved with investing in EM local currency debt. A more severe economic downturn in the U.S. would pose significant challenges for EM. However, this is not our base case, and we believe a mild recession in the U.S. (soft landing), coupled with sustained momentum in China, would establish a favorable backdrop for the continued positive performance of EM local debt. Currency appreciation and carry would act as the primary driving forces in this scenario. In spite of its recent outperformance, we maintain the view that valuations remain reasonable, potentially lending resilience in the event of a broader global economic slowdown.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.