It's Time to Give the Endowment Model a Closer Look

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional.

It has been more than a year since we last visited the WisdomTree Endowment models, and given the current market conditions, we think it is high time to revisit and give them a closer look.

Let’s begin with a reminder of how we define an “endowment model” with respect to tax-paying individual investors (as opposed to the tax-exempt institutional world where it originated):

- Broad and global diversification

- Intelligent use of active versus passive investment strategies (i.e., a cost/benefit optimization of active management fees or, in WisdomTree’s phrase, Modern Alpha®)

- Prudent use of non-traditional or lower correlation investments in an attempt to improve overall portfolio diversification (i.e., real assets and alternatives)

- A long-term time horizon; and

- Investment discipline through full market cycles

We manage our different risk-banded Endowment Models in exactly this way. All these models are multi-asset, with allocations to global equities, fixed income, real assets and alternative investments. Somewhat uniquely, we believe, is that we are able to fund the less-traditional asset class positions because we allocate to NTSX, the U.S. version of our “efficient core” strategies that takes a leveraged 90/60 position in large-cap U.S. equities and U.S. Treasuries. This provides us with a “core” allocation to stocks and bonds while leaving capital to allocate to other strategies.

Before we move on, let’s define what we mean by “real assets” and “alternatives”:

Real assets are strategies that historically have proven to be sensitive to longer-term changes in inflation and may include but are not limited to gold, broad-basket commodities, real estate, energyMaster Limited Partnerships (MLPs) and diversified inflation-sensitive products. The use of these strategies is designed to (a) provide diversification to the portfolio’s equity risk, (b) access additional sources of potential return and (c) provide purchasing power protection of the portfolio against rising inflation.

Alternatives are strategies that may include but are not limited to equity long/short, global macro, managed futures, event-driven, short-bias, inflation hedge, and options based. The use of these strategies is designed to (a) provide diversification to portfolio equity, interest rate, and inflation risk, (b) access a more diverse set of potential sources of return, and (c) reduce the volatility of the overall portfolio over time.

This is just a summary of the potential strategies available—we may or may not deploy all of them in our Endowment Models at any given time, but we will include some mixture and combination of them.

Let’s now look at why we think the endowment model may be especially timely in the current market environment.

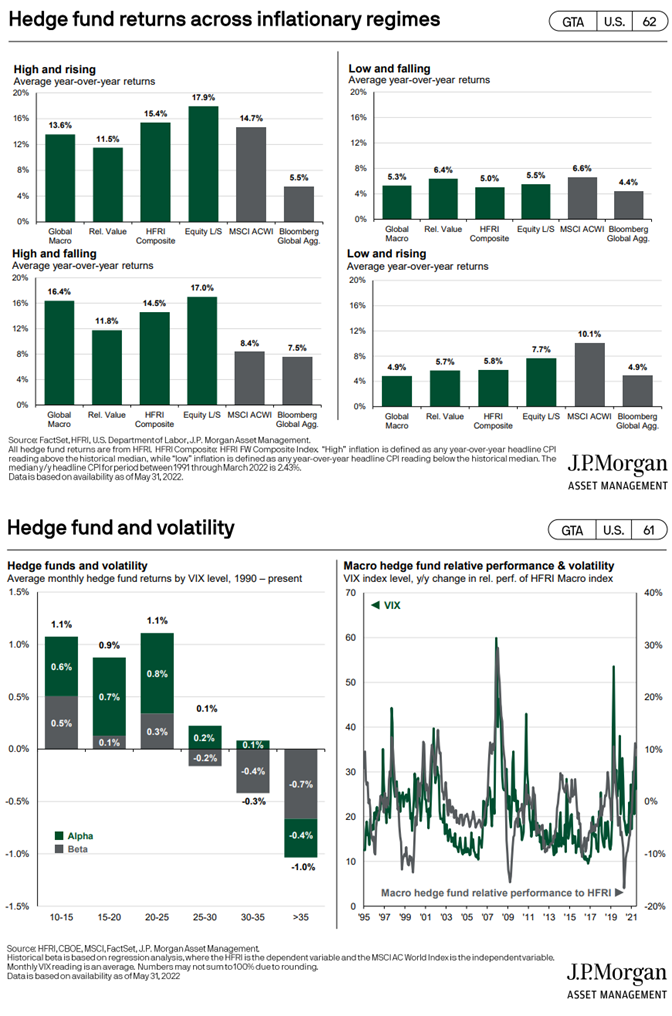

First, let’s remember that alternative investments historically have performed best when inflation, interest rates and volatility (to a certain point) are rising.

For definitions of terms in the chart, please visit our glossary.

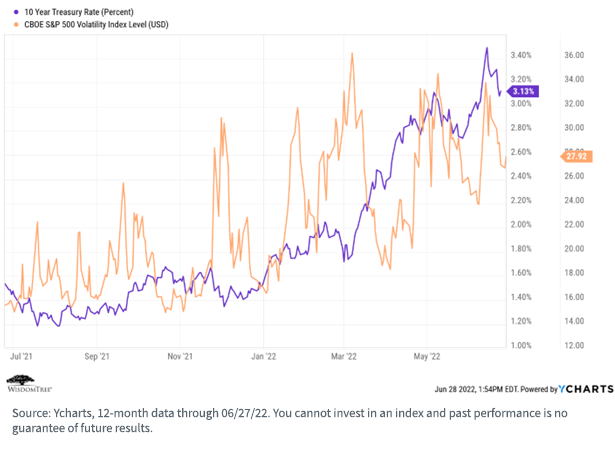

Currently, we certainly seem to be in a rising interest rate and volatility environment

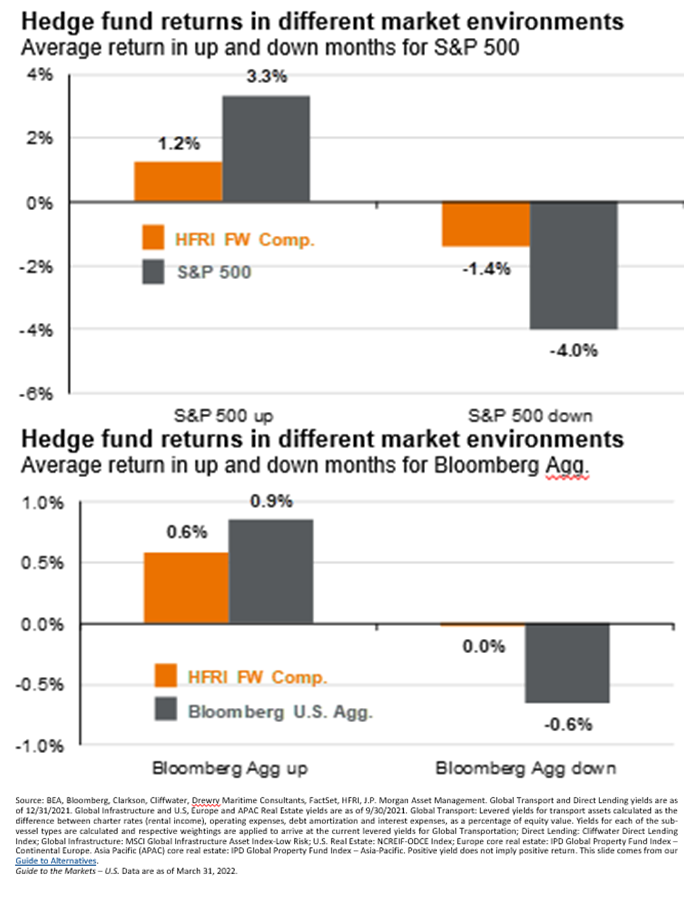

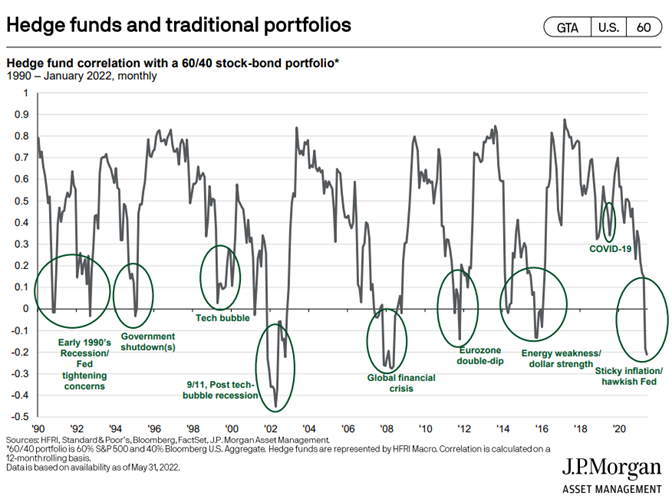

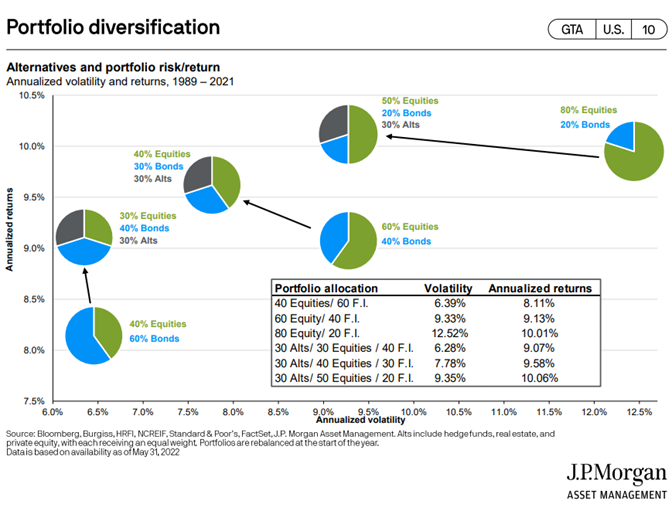

Second, it is important to remember that the use of alternatives is primarily about diversification—trying to improve the consistency of performance, regardless of stocks and bonds going up or down, by including lower-correlated strategies in the portfolio.

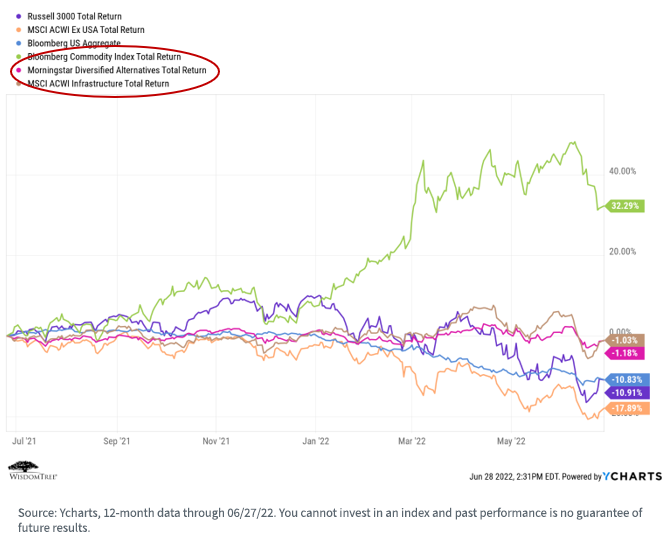

Finally, let’s look at the comparative 12-month performances across different global asset classes, focusing on the relative performances of commodities, infrastructure and diversified alternatives (i.e., “real assets” and “alternatives”).

The benefit of allocations to “non-traditional” asset classes over the past 12 months is clear—and this is a trend we expect to continue for quite some time. Over longer-term horizons, the historical benefits of an endowment-like approach are equally clear. (We’ve just forgotten them over the past 10 years of low interest rates and volatility.)

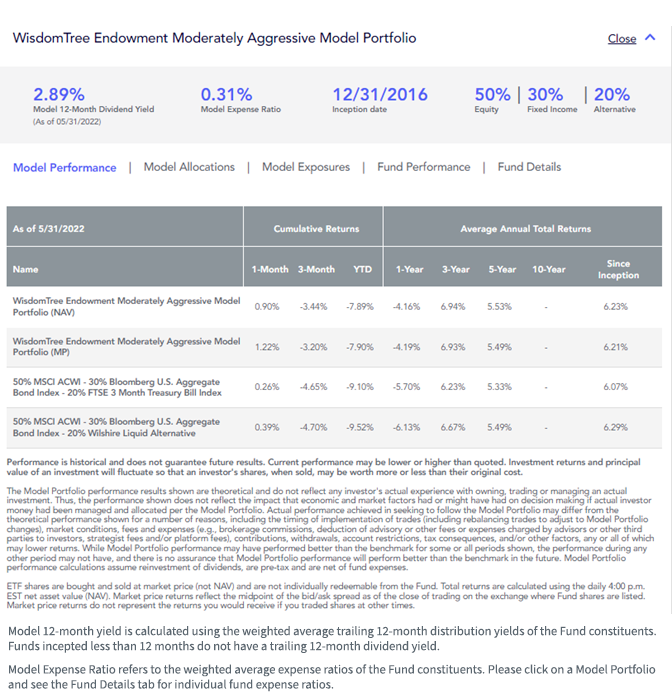

Since the inception date of our Endowment Models back in 2016, performance has been very much as expected—they generally will not and did not keep up with a raging bull equity market, but they provided risk mitigation and consistent performance throughout varying market regimes. (Note the outperformance over the past 12 months, which were marked by rising interest rates and market volatility.)

Please click HERE and see the Fund Performance tab for individual Fund standardized performance and the Fund Details tab for Fund-specific links for yield, most recent month-end performance and a prospectus.

As with all WisdomTree Model Portfolios, our Endowment Models share certain common characteristics:

- They are global in nature,

- They are ETF-centric, to optimize fees and taxes,

- They are “open architecture” and include both WisdomTree and third-party strategies, and

- They charge no strategist fee.

Conclusions

We’ve been believers in an endowment-like approach to long-term portfolio construction for many years and often had to defend ourselves against claims of “deworsification” during periods of low volatility, low interest rates and bullish equity markets. But we maintained our conviction that this approach has merit for long-term investors seeking a more consistent performance profile over full market cycles.

Most investment products and models have market environments where they have “the wind at their back” and perform best. Given the current market environment of economic uncertainty, high inflation, rising interest rates and increased volatility, we believe our Endowment Models are well positioned.

We hope you will take a closer look.