An Update on Fixed Income Market Outlook and Positioning within our Strategic Model Portfolios

This article is relevant to financial professionals considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Looking only at year-to-date returns across the U.S. fixed income market, particularly when compared to last year’s historical rout, you might conclude that 2023 is off to an uneventful start.

Fixed Income Sector Returns: 2023 YTD and 2022 Calendar Year

But fixed income markets have been anything but dull this year.

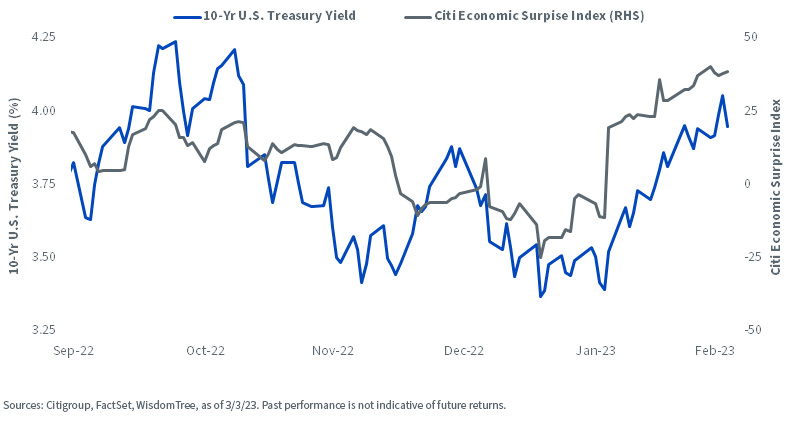

Throughout January, it seemed obvious to most market participants that the U.S. was entering a highly anticipated recession and inflation would cool accordingly. The yield on 10-Year U.S. Treasuries fell approximately 50 basis points in the first several weeks of the year before a string of hot economic and inflation data releases completely shifted the market narrative and pushed yields back up to 4%.

10-Yr U.S. Treasury Yield, Citi Economic Surprise Index: October 2022–Present

Where do we go from here?

While we did make modest adjustments to fixed income allocations throughout 2022, the strategic outlook of the WisdomTree Model Portfolio Investment Committee (MPIC) has remained intact in 2023.

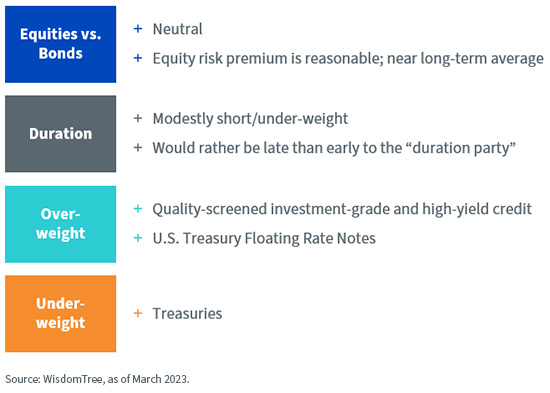

WisdomTree Model Portfolio Investment Committee—Fixed Income Market Outlook

At WisdomTree, we are focused on several key themes across fixed income markets that shape our outlook and drive the positioning within our Model Portfolios:

1. Equity risk premium is near long-term average

In the years following the global financial crisis, interest rates near 0% meant investors received a healthy risk premium (earnings yield minus risk-free yield) for moving out of bonds into stocks. As higher interest rates have increased this risk-free yield, this expected premium on equity investments has clearly been reduced.

However, we do not agree with the view that today’s equity risk premium is dangerously low.

Importantly, since corporate earnings and dividends have historically kept up with inflation, long-term inflation-indexed (TIPS) yields are the most relevant comparator for calculating the equity risk premium. Using this approach, today’s equity risk premium has come down, but only to a level that is in line with long-term historical averages.

2. There’s income back in fixed income

While today’s equity risk premium certainly looks reasonable, it is undeniable that fixed income is back. With yields at levels a whole generation of investors have never seen, it is worth revisiting the role of bonds within a portfolio. Beyond the potential for diversification and downside protection, fixed income can once again deliver meaningful returns and income.

This is true even in shorter-term maturities with little to no duration or credit risk. For example, U.S. Treasury floating rate notes have a one-week duration and are now one of the highest-yielding Treasury instruments available.

The WisdomTree Floating Rate Treasury Fund (USFR) provides our Model Portfolios with access to this market and can continue to play a valuable role in today’s market environment.

3. Selectivity is key within corporate credit

While we are constructive on both investment-grade and high-yield corporate bonds, recession concerns clearly remain paramount for credit investors. To help mitigate the risk of downgrades and defaults weighing on potential returns, we utilize strategies such as the WisdomTree U.S. High Yield Corporate Bond Fund (WFHY), which focus on fundamentally sound corporate issues.

By incorporating a cash flow-based quality screen and tilting toward issues with attractive fundamental and income characteristics, WFHY has been able to avoid a large majority of the defaults experienced by the broader high-yield market.

4. Interest rate volatility remains elevated

As 2023 has proven in just a couple months, the future is still very much uncertain for the U.S. economy, inflation and Fed policy.

As investors continue reacting to incoming economic data, we expect ongoing volatility in both short-term and longer-term interest rates.

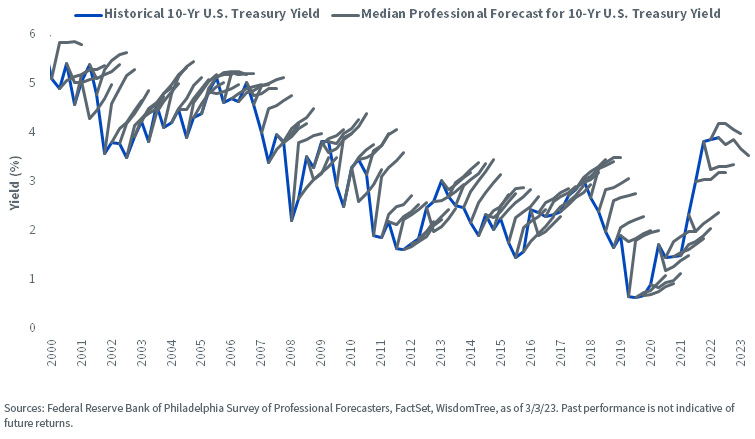

We maintained a short/under-weight duration position throughout 2022 and into the current year. Although it is still our “base case” scenario that interest rates remain higher for longer, a recession-induced cooling of price pressures remains a reasonable scenario.

Given this outlook and the inherent difficulty of predicting shorter-term movements in interest rates (see chart below), we modestly lengthened duration, reducing the size of this under-weight position, as part of our quarterly rebalance last September.

10-Yr U.S. Treasury Yield: Historical vs. Median Professional Forecast

WisdomTree Model Portfolio Investment Committee—Fixed Income Positioning

Based on the MPIC’s fixed income outlook, our positioning across strategic fixed income Model Portfolios is the following:

As we recently highlighted, positioning within our strategic fixed income strategy delivered positive relative performance in 2022.

While we have kept most of these key views intact into 2023, we are certainly not complacent. Our MPIC remains focused on both mitigating potential risks and capitalizing on attractive opportunities across today’s evolving fixed income market.

Financial advisors can learn more about the WisdomTree lineup of fixed income and multi-asset Model Portfolios by visiting our Model Adoption Center.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.