The WisdomTree Portfolio Review, Part One: Strategic Models

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

As we begin an already turbulent 2023, let’s take a moment to review how our Model Portfolios performed in 2022. This is the first of a three-part series, breaking each blog post into our categorizations of models: 1) Strategic, 2) Outcome-Focused and 3) Collaboration.

Let’s dive in.

Equity

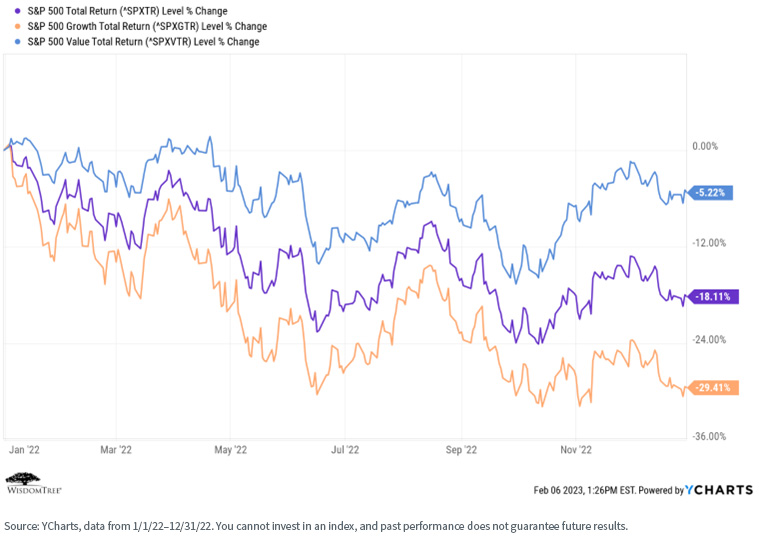

No one needs to be reminded what a terrible year 2022 was for both global stock and bond markets. No one completely avoided the tsunami, but there were certain risk factors that performed better than others.

First and foremost was value. We saw a massive rotation into value and out of the growth risk factor that dominated market performance for most of the previous 10 years (think mega-Tech stocks). The 24+% differential between value and growth performance in 2022 was the largest dispersion the market has witnessed in decades, perhaps ever.

For definitions of Indexes in the chart, please visit our glossary.

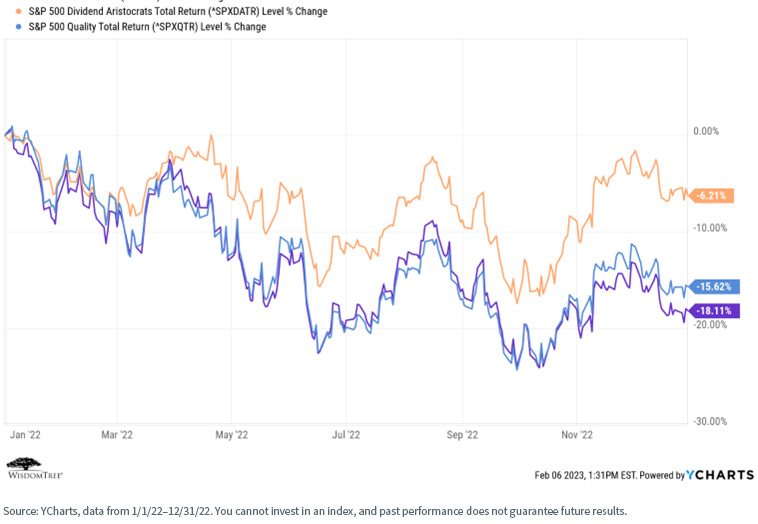

We saw similar outperformances, on smaller scales, by the dividend and quality factors (though dividends were close).

For definitions of Indexes in the chart, please visit our glossary.

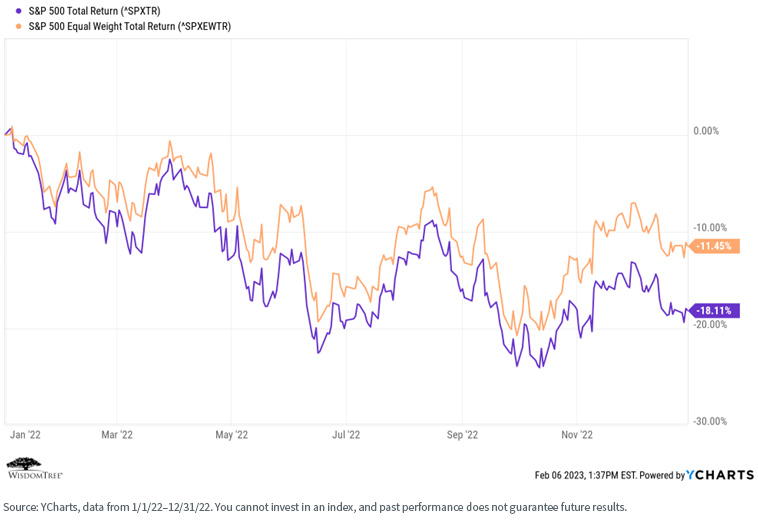

For definitions of Indexes in the chart, please visit our glossary.

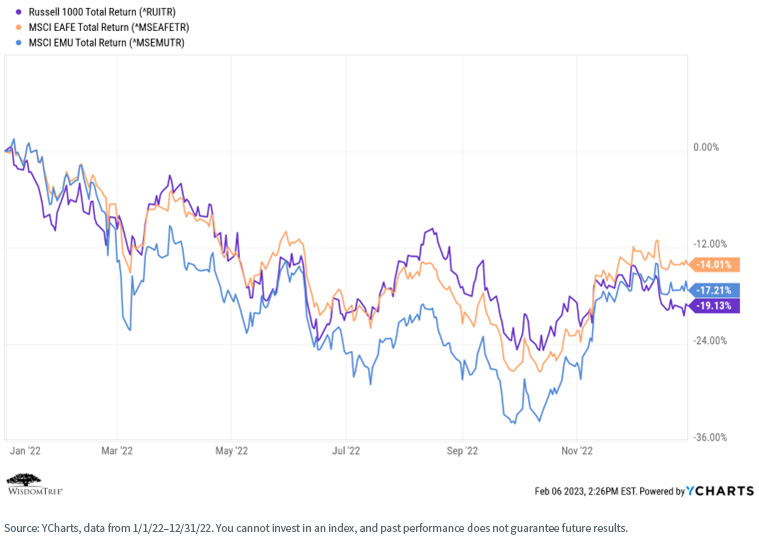

Furthermore, another inherent thesis in our equity models is a belief in global diversification. This, too, worked out well in 2022, as both developed international and emerging markets outperformed the U.S., despite an almost year-long rally in the U.S. dollar (which works to dampen the return realized by U.S. investors on their non-U.S. investments).

For definitions of Indexes in the chart, please visit our glossary.

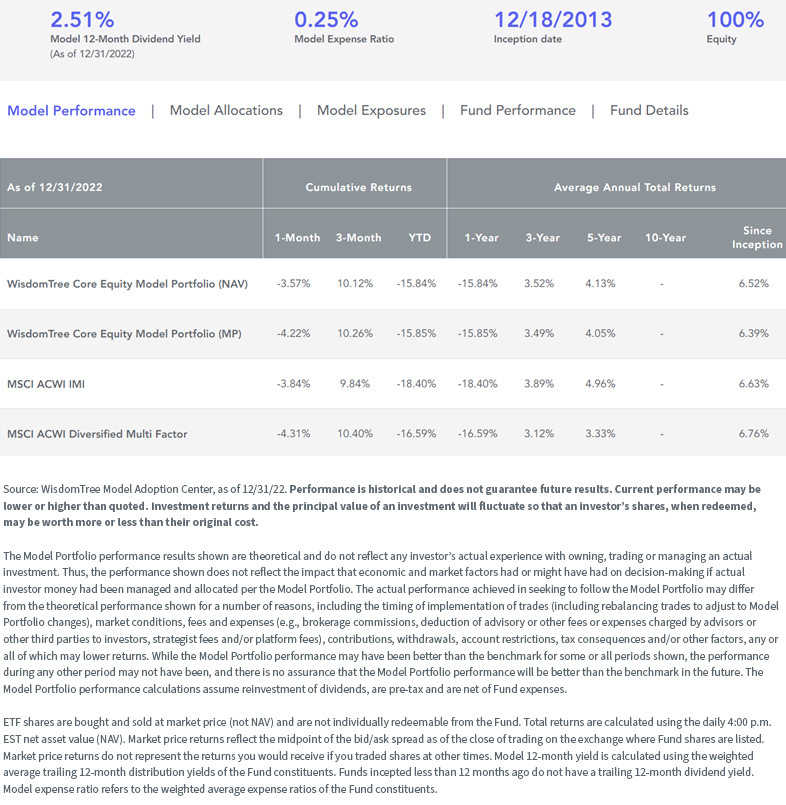

WisdomTree Core Equity Model Portfolio

For underlying Fund performance including standardized performance and 30-Day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs

The good news is that these factor rotations tend not to be one-year phenomena but rather multi-year cycles. So, these “factor tailwinds” may be with us for some time to come.

Fixed Income

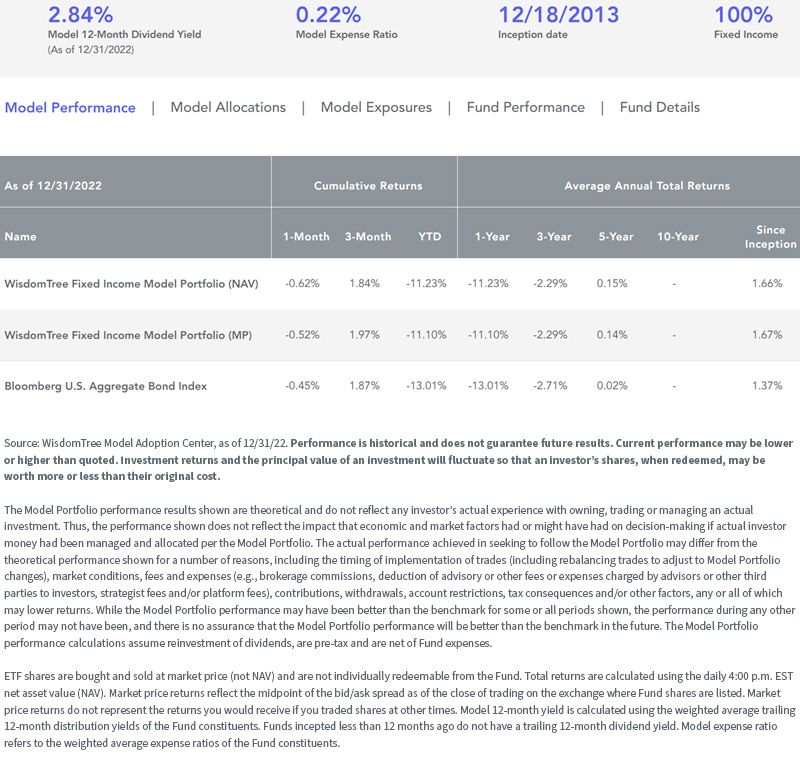

For all of 2022, the positioning within our fixed income model was to be under-weight in duration and over-weight in quality credit relative to the Bloomberg Aggregate Index.

These were the correct calls, and this portfolio outperformed its underlying benchmark as well in 2022 by almost 200 basis points.

WisdomTree Fixed Income Model Portfolio

For underlying Fund performance including standardized performance and 30-Day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs

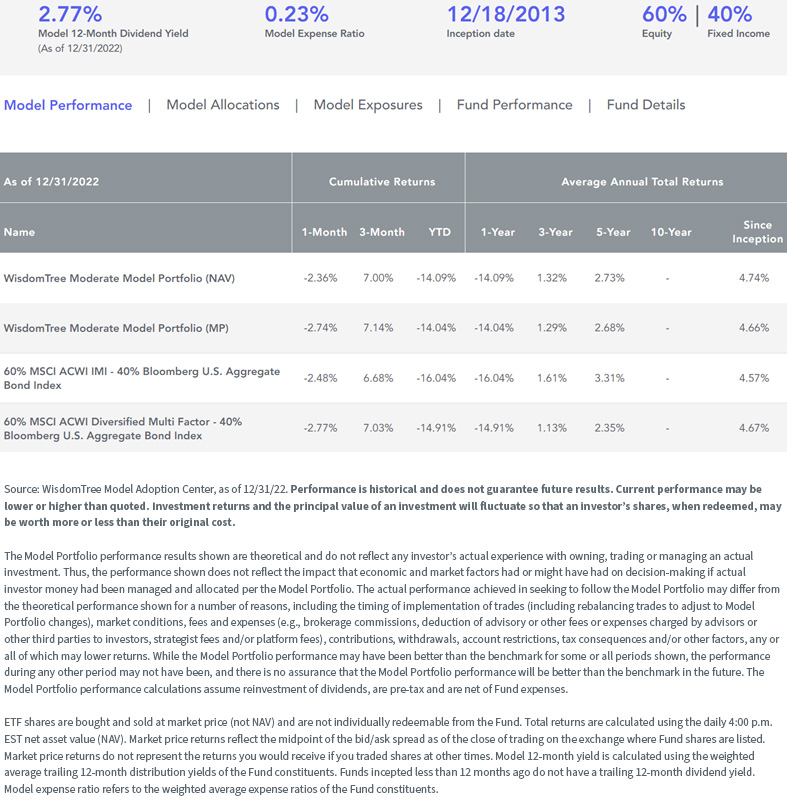

Well, if your core equity and fixed income models both outperformed, then your strategic allocation models, comprised of varying combinations of the equity and fixed income portfolios, should also have outperformed. Using the traditional “60/40” stock/bond portfolio as an example, this is exactly what happened.

WisdomTree Moderate Model Portfolio

For underlying Fund performance including standardized performance and 30-Day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs

Endowment Model

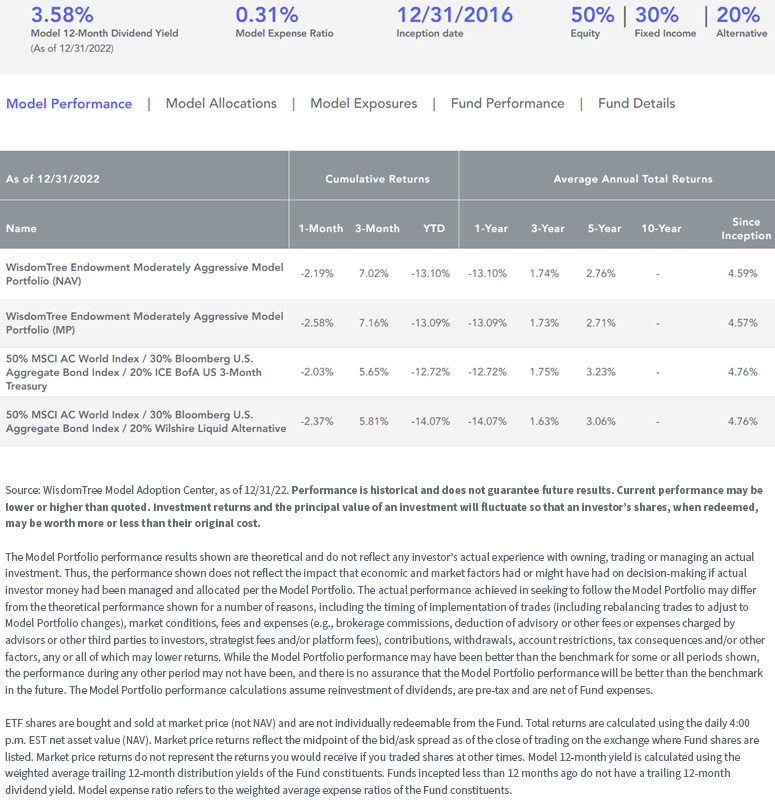

Finally, a word about our endowment models, which combine stocks and bonds with an allocation to lower-correlated strategies such as real assets and alternatives. The thesis behind these models is that by incorporating lower-correlated strategies, advisors can deliver a more diversified portfolio experience, with the potential of delivering more consistent portfolio performance regardless of the market regime.

The idea is to take advantage of the power of compounding—if you don’t lose as much in down markets, you don’t need to gain as much in up markets to still come out ahead in the long run.

This is what happened in 2022. Most advisors know if they included real assets (specifically commodities) and alternatives (equity long/short, managed futures, global macro, etc.) in 2022, they were pleased with the outcome.

Using our “moderately aggressive” endowment model as an example, as it is the closest allocation to our traditional 60/40 portfolio, we notice two things: (1) our portfolio (down 13.10%) generally tracked its underlying benchmarks, but (2) it outperformed our traditional 60/40 portfolio (down 14.09%). In other words, it did its job.

WisdomTree Endowment Moderately Aggressive Model Portfolio

For underlying Fund performance including standardized performance and 30-Day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs

Conclusion

No one is happy to see negative performances in their portfolios. But, given the annus horribilis that was 2022, our relative outperformances are something we can build from as we move into and through 2023.

In part two of this series, we will examine the performances of our Outcome-Focused models.

Financial advisors can learn more about these models and how to position them successfully with end clients at our Model Adoption Center.

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For definitions of terms/indexes in the charts above, please visit the glossary.