The WisdomTree ex-State-Owned China Index Rebalance: What’s Changed and What Remains?

We recently released the annual rebalance of the WisdomTree ex-State-Owned Enterprises China Index (CHXSOE) and WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE). China is about one-third of EMXSOE.

Here are some more details of the CHXSOE rebalance:

1. Tencent, Baidu and Weibo removed from the Index

CHXSOE uses ESG data from Sustainalytics, a Morningstar company, to assess companies' compliance with the United Nations (UN) Global Compact Principles.

Due to their involvement in severe violations of freedom of expression in China, these companies were downgraded from being on a watchlist to being non-compliant with UN principles.

Dropping them from our Index results in 28% turnover.

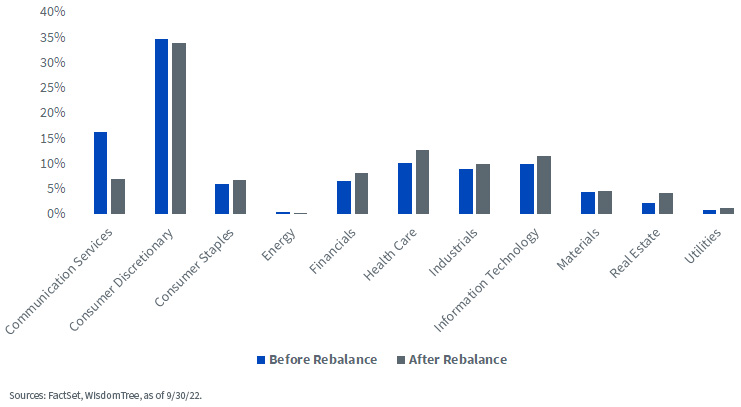

WisdomTree’s ex-stated-owned approach attempts to reduce government influence over corporate bottom lines. Sector exposures also change, resulting in smaller allocations to communication services.

WisdomTree ex-State-Owned Enterprises China Index Sector Weight

2. We continue moving into Hong Kong-listed shares and away from U.S. shares, with about a 94% weight in Hong Kong and China-mainland shares

Recently China’s SEC equivalent—CSRC—signed a confidential agreement, allowing the U.S. super auditor PCAOB to inspect the intermediate audit files of Chinese companies listed in the U.S.

The U.S. press release mentioning this agreement is nuanced. It touts unfettered access, while a Chinese press release emphasized pre-screening of audit papers. By December, there will be clarity on whether the process meets the U.S. standards of having unfettered access to Chinese auditors’ files.

We continue to prefer trading the Hong Kong-listed shares of companies when they reach sufficient liquidity, rather than the U.S.-listed shares. Under this guideline, we now have close to 94% weight of the Index in Hong Kong and mainland shares, protecting against a worst-case scenario. The Index still has 13 companies listed in the U.S., but they are a small weight as we evaluate how the U.S. and China work out the delisting issue.

3. We continue to maintain a 33% allocation to China A shares, higher than MSCI China index but lower than S&P China 500 index.

We’ve written before on a typical broad China equity index’s exposure to A shares. Just taking the largest 500 Chinese public companies, China A shares would account for about 50%. We assess the listing location landscape of Chinese companies annually to decide the weight of A shares. The final portfolio reflects broad China equity exposure.

China is holding its 20th Party Congress, which is analogous to US Presidential election. China’s political calendar runs every five years, and President Xi is expected to retain broad political power within foreseeable future.

Things move fast in the current unstable geopolitical environment and many political predictions about China 10 years back turned out to be quite off. We also caution clients to give healthy discounts on many current predictions of Chinese politics.

For those interested in more on this topic, please listen to this recent China of Tomorrow podcast episode.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.