Unpacking Your Portfolio's Exposure to China

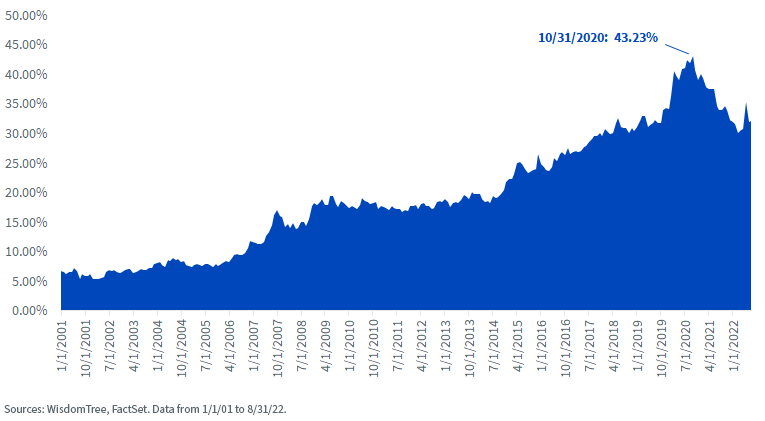

When the MSCI Emerging Markets Index (MSCI EM) launched in January 2001, the market cap weight of the Chinese equity market was just above 6%.

Fast-forward two decades, and its market cap weight is now equivalent to one-third of the emerging market (EM) equities.

MSCI EM Index - Exposure to China

As the Chinese market continues growing, investors with broad EM exposure have been left with a 33% position in a market that has an incredible amount of both headwinds and tailwinds, making it complicated to implement their specific asset allocation views.

WisdomTree is launching XC—the WisdomTree Emerging Markets ex-China Fund—allowing investors to unpack the Chinese exposure in their EM position. Investors will now be able to combine XC with other China-specific exposures like the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) to scale their exposure to their desired asset allocation.

Methodology

The WisdomTree Emerging Markets ex-China Fund will track the WisdomTree Emerging Markets ex-China Index (WTEMXC), which rebalances on an annual basis and provides investors with exposure to non-state-owned companies (non-SOEs) in emerging market countries excluding China.

The investment thesis behind excluding state-owned enterprises (SOEs) when investing in emerging markets is one that we’ve written about in the past. Companies in which the local government has a significant ownership interest (defined as greater than 20%) have exhibited conflicts of interest in their management and tend to have lower profitability than their non-SOE peers. Excluding SOEs also tilts a portfolio toward higher growth sectors like Consumer Discretionary, Health Care and Communication Services, which reflect the current makeup of EM economies.

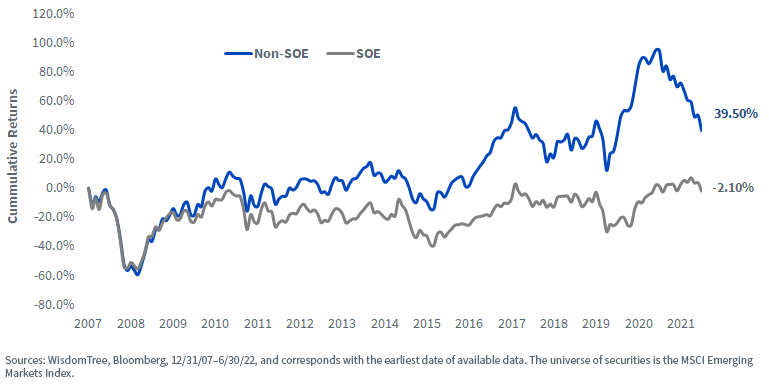

In the below chart, we can see how since the start of 2008, non-SOEs in the MSCI EM Index have outpaced SOEs by more than 2.5% annually.

Despite recent outperformance by SOEs, given the macroeconomic and commodity backdrop, we still believe that the risks associated with these types of companies are not justified or rewarded:

MSCI EM Universe

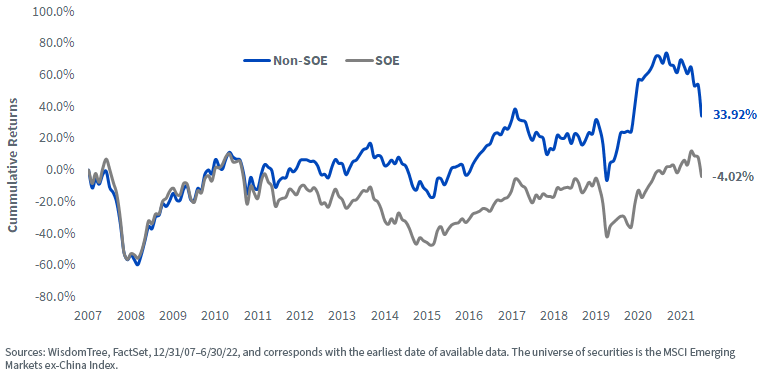

The results of applying the same investment strategy to the MSCI EM ex China Index universe are consistent, which shows how this is a persistent issue in most EM countries.

MSCI EM ex China Universe

Exposures

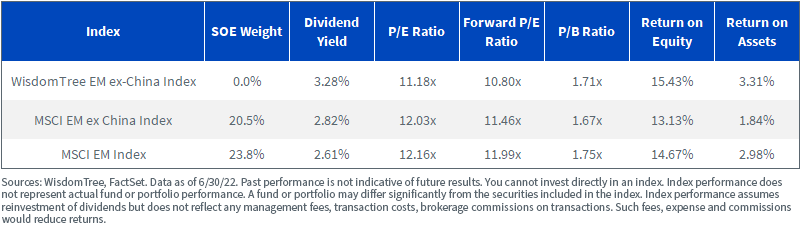

Excluding China from a broad EM universe has considerable consequences in terms of fundamentals, sector and country exposures.

Given their high valuations, excluding Chinese companies from a broad EM universe results in lower valuations, as seen in the table below for the MSCI EM ex China Index. An additional thing to highlight in the below table is how WTEMXC’s SOE screen helps achieve a lower valuation and improves aggregate profitability measures like ROE and ROA.

For definitions of terms in the chart above, please visit the glossary.

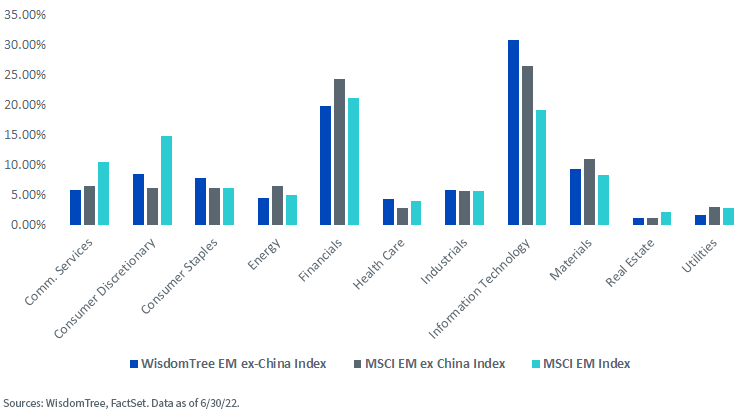

In the below chart, we can see how the MSCI EM ex China Index has a higher exposure to the Financials, Materials and Information Technology sectors and a lower exposure to the Consumer Discretionary, Health Care and Communication Services sectors compared to the MSCI EM Index. WTEMXC’s ex-SOE screen results in a portfolio with improved exposure toward higher growth sectors like Consumer Discretionary, Health Care and Info. Tech. and limits exposure to traditional EM sectors like Energy, Financials and Materials compared to the MSCI EM ex China Index.

Sector Exposure

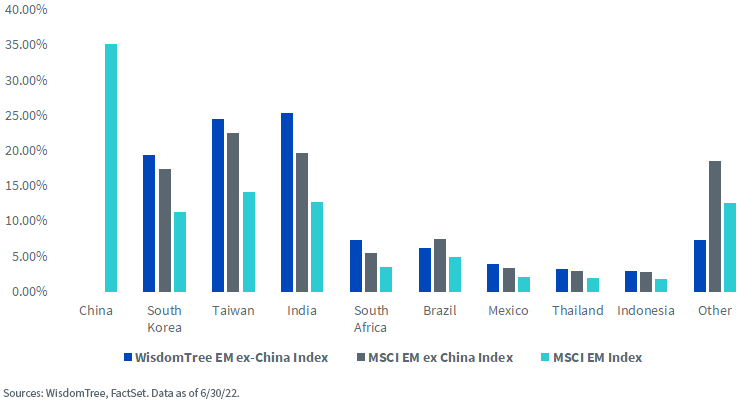

In terms of country exposures, excluding close to 33% of the weight results in increased exposure to EM countries such as South Korea, Taiwan and India.

Country Exposures

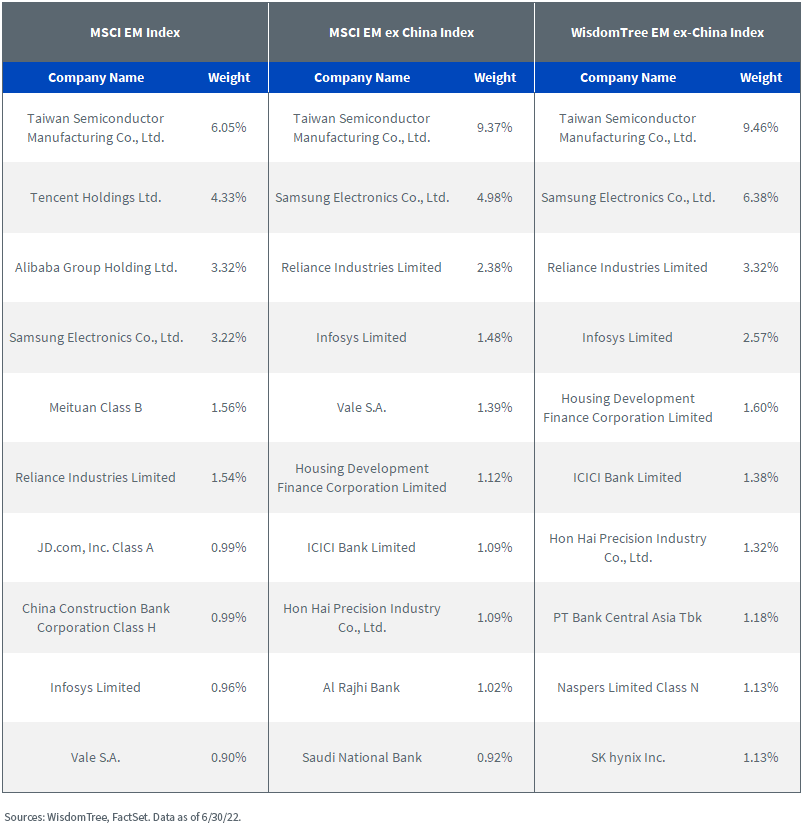

Comparing the top 10 holdings, we can get a better understanding of the impact of the China exclusion and the application of WTEMXC’s ex-SOE screen.

Conclusion

Given the significant number of headwinds and tailwinds associated with the Chinese market, along with its polarizing nature, we believe the launch of XC will allow investors to implement their views on China while maintaining a focused ex-state-owned approach.

Important Risks Related to this Article

The Fund is new and therefore does not have a performance history.

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks. The Fund’s investment strategy limits the types and number of investment opportunities available and, as a result, the Fund may underperform other funds. The Fund’s exposure to certain sectors, countries, or regions may increase its vulnerability to any single economic or regulatory development related to such sector, country, or region. The Fund is non-diversified, as a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.