Europe’s Energy Policy Unravels a Potential Advantage for U.S. Energy over Europe

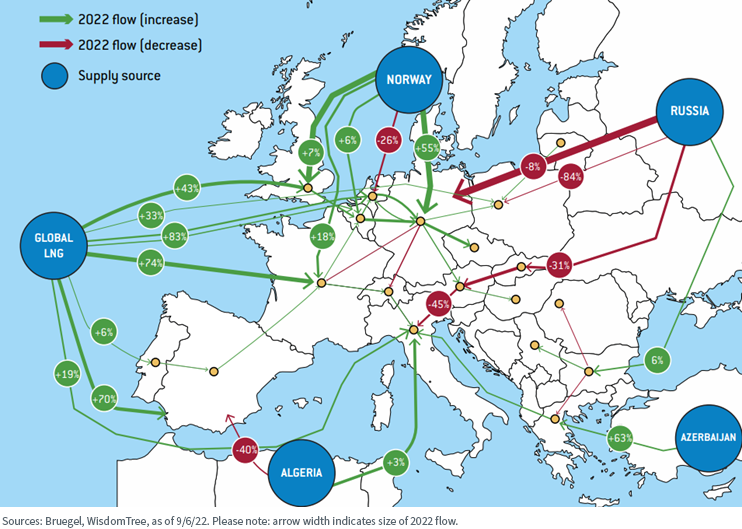

The clock is ticking for Europe to shield its economy in the current energy crisis. The cost of electricity across the European bloc is nearly 10 times the 10-year average following Russia’s cutting back natural gas supplies in retaliation to sanctions. There has been a substantial increase in the share of supply of liquefied natural gas (LNG) and alternative suppliers as a direct replacement of waning Russian gas supply.

Figure 1: Natural Gas Flows in the European Market, First-Half 2022 vs. First-Half 2021

European leaders are racing to come up with a plan on energy intervention in the power markets. One of the measures being touted is imposing an energy windfall tax on oil and gas profits to help households and businesses survive this upcoming winter season. The plan is to re-channel these unexpected profits from the energy sector to help domestic consumers and companies pay high bills. The windfall tax on the oil and gas companies should be treated as a “solidarity contribution,” according to EU Commission (EC) President Ursula von der Leyen.

Imposing a Windfall Tax on Those Profiting from the War

A windfall tax would impose a levy on the revenues generated by non-gas producing companies when market prices exceed €200 per megawatt hour (Mwh), and redistribute excess revenues to vulnerable companies and households. There has been greater consensus among EU countries on the windfall tax than on other parts of the EC’s five-point plan. This plan includes setting a price cap on Russian gas, a mandatory reduction in peak electricity demand, funding for ailing utility companies, a windfall tax on fossil fuel companies and changes to collateral requirements for electricity companies. The EC’s plan will need the bloc’s approval before being enforced. The most controversial issue remains the Russian price cap, which is aimed at penalizing Russia for weaponizing energy.

Coordinated Energy Policy Needed despite Different Energy Mix across EU Bloc

Imposing a one-energy policy on member states will be challenging given the major differences between them, based on whether they rely on coal, nuclear or renewable power. Austria, Hungary and Slovakia import large amounts of Russian gas and are against the Russian price cap. On the other hand, a number of EU countries, including France, Italy, and Poland, support a cap, but argue it should apply to all imported forms of the fuel, including LNG. Germany is undecided, but fears the price cap disagreements risk spoiling EU unity. Spain, a big generator of wind and solar power, was quick to draw criticism of the proposed €200/Mwh threshold, as it does not correspond to real costs and fails to support electrification and deployment of renewables.

In the U.S., various senators, including Senate Finance Chair Ron Wyden, have proposed legislation that would double the tax rate on excess profits of large oil and gas companies. However, given the current political climate, it seems increasingly unlikely that these proposals will gain any traction in Congress.

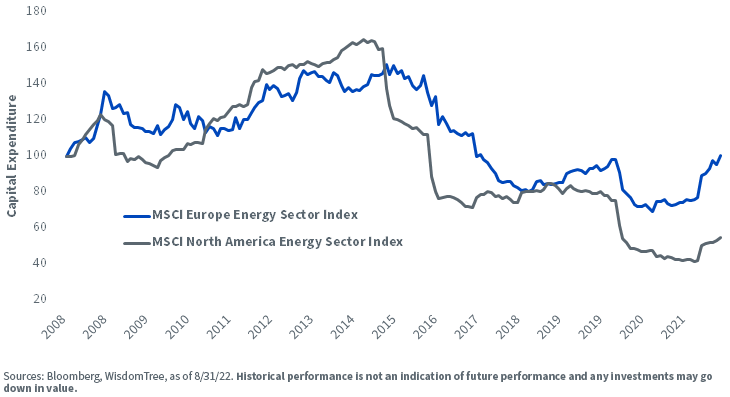

Europe’s Energy Policy Likely to Put a Strain on Capex in the Near Term

Since the oil price plunge of 2014–2016, alongside climate change awareness and environmental, social and governance (ESG) mandates, the energy sector saw a sharp decline in capital expenditure (capex). Since then, capex in the energy sector globally has failed to attain the levels last seen at its peak in 2014. Capex trends in Europe’s energy sector had begun to outpace that of the U.S., driven mainly by a rise in the share of spending on clean energy. However, we believe the impending energy crisis and energy policy, including the national windfall levies in Europe, are likely to disincentivize capex in Europe compared to the U.S. over the medium term. High prices are encouraging several countries to step up fossil fuel investment, as they seek to secure and diversify their sources of supply.

EU Windfall Tax Likely to Deter Further Capital Expenditure

Opportunity in Energy Stocks

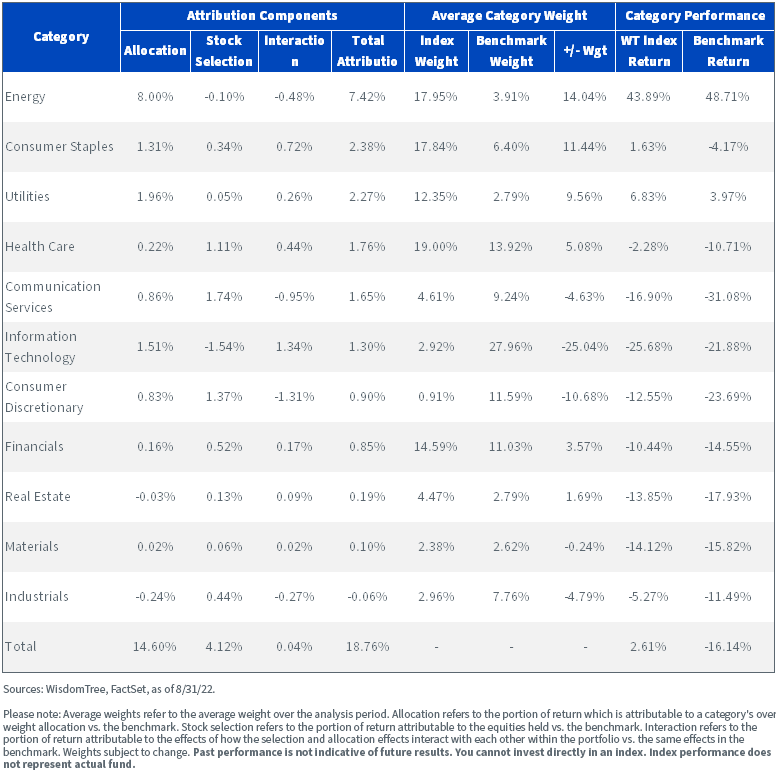

The divergent energy policies and prevalent supply situations in the U.S. and Europe open up a potential opportunity in the energy sector. The energy sector has been the unique bright spot in global equity markets in 2022, posting the strongest earnings results in H1 2022. Despite its strong price performance, the U.S. energy sector trades at a price-to-earnings (P/E) ratio of eight times and has a dividend yield of 3%.

In September 2008, the energy sector had a 12.5% weight in the S&P 500 Index and was thus the fourth-largest sector by market capitalization in the world’s largest economy and equity market. Today the energy sector accounts for only 4% of the S&P 500.

While the future trajectory is greener, the world realizes we will require oil and gas in the interim. Investment is increasing in all parts of the energy sector, but the main boost in recent years has come from the power sector—mainly in renewables and grids—and from increased spending on end-use efficiency. As Europe plans to reduce its reliance on Russian energy supply, it will become more reliant on U.S. LNG imports. This should fuel further investment in the U.S. energy sector in the interim.

As one example of a relevant U.S. equity income index, the WisdomTree U.S. High Dividend Index offers a much higher allocation to the energy sector at 17.95% compared to the S&P 500 Index as highlighted in the table below. This enabled its outperformance versus the benchmark S&P 500 Index.

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s parent company, WisdomTree Investments, Inc.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.