WisdomTree 101: We’re All Rates Traders Now

In most traditional portfolios, investors think about fixed income returns as the “safe” buy-and-hold bet. Unfortunately, in 2022, it seems we are all rates traders now. Why is that?

In this piece, we seek to distill key insights we publish in our Daily Market Snapshot.

Fixed Income Returns

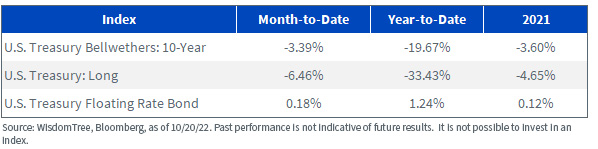

We try to cast a rather wide net to understand what’s going on in various types of fixed income. The two ways investors can add risk to a bond portfolio are by increasing interest rate risk or credit risk. Unfortunately, both bets are driving some of the worst performance for fixed income in 30 years. The lone positive? Floating rate notes. For a traditional fixed coupon bond, as interest rates increase, prices decrease, leading to negative total returns. In the case of floating rate notes, as interest rates rise, the amount of income on the bond increases. In an environment of rising rates, floating rate notes can add significant value. In fact, year-to-date, allocations to floating rate notes have resulted in a more than 20% performance differential compared to U.S. 10-Year notes.

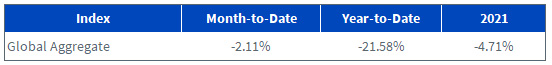

Bloomberg Fixed Income Indexes – as of 10/20/22

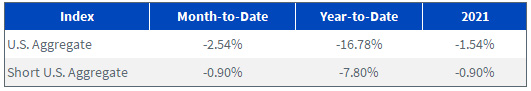

Turning our attention to the Barclays U.S. Aggregate Bond Index, or the Agg, which is commonly viewed as THE benchmark for most fixed income portfolio returns, negative performance can also be seen year-to-date. Rising rates, unfortunately, also explain why owning the same securities as the Agg but reducing the maturity profile (1–5 years) led to losses that were about 50% of the standard Index. In 2021, rates also rose, so owning a shorter-maturity version was yet another way to add value versus the benchmark.

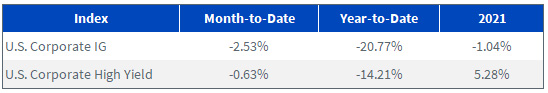

Moving on to corporate bonds, we can see that both investment-grade and high-yield are underperforming year-to-date. While the magnitude of returns is similar, what’s interesting is that the drivers of those returns are different. The investment-grade Index has more interest rate risk than the Agg, which is detracting from performance year-to-date.1 Also, since corporate bonds have credit risk (i.e., the risk that they may not be able to pay you back), they trade at an additional “spread” (i.e., an additional amount of income) versus U.S. government bonds. As concerns about the health of the economy have increased, the amount of additional compensation that investors require to lend money to corporations has also risen. When this happens, credit spreads are said to “widen.” This shows up in performance via numerically higher credit spreads and lower bond prices. In the case of high-yield bonds (aka junk bonds), they have much higher credit risk than the Agg or investment-grade but lower amounts of interest rate risk. It’s a bit of a coincidence so far that they have similar levels of return year-to-date, but high-yield is losing primarily because investors are worried about the risk of downgrades or defaults versus rising Treasury yields.

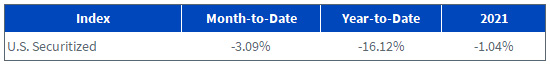

Similar to corporate bonds, securitized debt also has a credit component, but it’s not from corporations. This type of debt is primarily mortgage-backed or asset-backed. It gets its name from the “securitization market.” Instead of buying a single mortgage on a house, investors buy a bond whose payments depend on a portfolio of mortgages. Monthly mortgage payments are aggregated and then paid to the owners of securitized bonds. In the case of asset-backed securities, the same concept could be applied to credit card receivables or auto loans. Historically, these types of bonds have less interest rate risk than the Agg but do have a credit or prepayment risk component.

Turning our focus to international markets, we see that investing globally has generated far worse returns than owning U.S. fixed income. The Global Aggregate Bond Index is often used as the global proxy for investment-grade fixed income investing. Year-to-date, these slices of the market have performed similarly to the Agg.

Due to sharp increases in interest rates at the longer end of the yield curve in Germany, this market currently represents some of the worst returns globally.

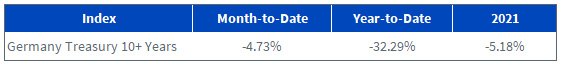

Finally, we turn our attention to changes in yields in the U.S. Treasury market. These are important for two reasons: first, they represent the lowest rate of borrowing along every point of the yield curve. Day over day, rates rose at the short end of the yield curve (2y), but rose by more at the long end. In this market, the yield curve is said to have flattened (the distance between long maturity and short maturity decreased). The second reason is that while day-over-day changes may not be meaningful, in the long run, the yield curve is a closely watched barometer by economists seeking to understand the health of the U.S. economy.

Treasury Yields

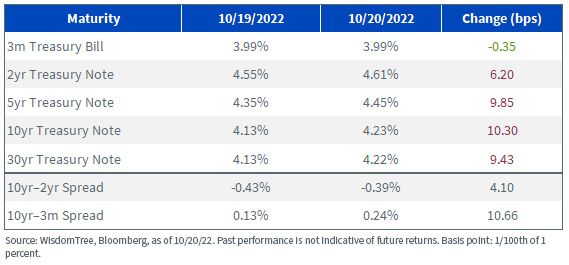

The flattening of the yield curve and a move toward inversion, where shorter-maturity Treasuries yield more than longer-maturity, has historically been a good predictor of a slowing economy and an impending recession. This is measured by the difference in yields between 2-Year and 10-Year notes. The spread between the two has further widened post the rate hike in September, as investors’ worry of an upcoming downturn increased.

The yield curve is usually upward-sloping, where lending money for longer periods has a higher rate of return than for shorter time frames.

Treasury Yield Curve

Conclusion

In sum, 2022 has been a challenging year for fixed income markets, with the exception of floating rate notes. In our view, investors will need to continue to remain vigilant in managing risk for the remainder of 2022. To help keep investors apprised of shifts in the market, we’ll continue to explore additional components of our daily market monitor in future blog posts.

For definitions of all terms in the figures above, please visit our glossary.

1 Corporate bonds generally have lower interest rate risk than a U.S. Treasury, but the duration of the corporate bond index is currently greater than the Agg