Does Diversification Matter Again?

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

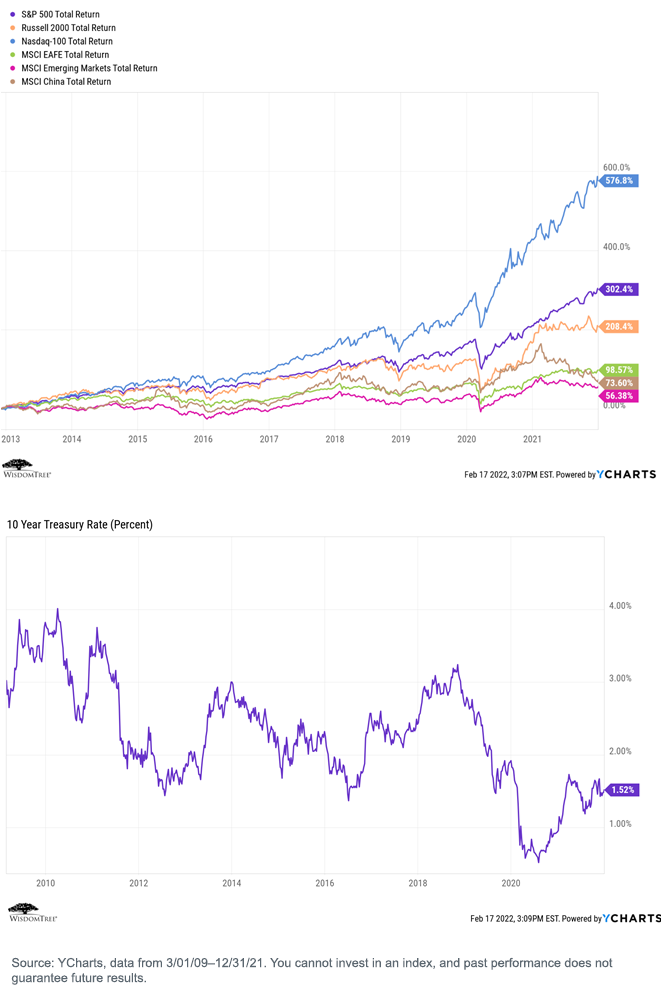

From the depths of the great financial crisis in March 2009 through the end of 2021, pretty much all you needed in your client’s Model Portfolios were allocations to the S&P 500 Index and the Bloomberg U.S. Aggregate Index, and you were just fine. The S&P 500 (purple line below) outperformed all other major stock indexes except the tech-heavy NASDAQ-100 Index, and interest rates generally fell, providing positive returns in both allocations.

The phrase “deworsification” became popular over this period—if you had anything but U.S. stocks and bonds in your portfolio, say for diversification purposes, your performance “worsened.”

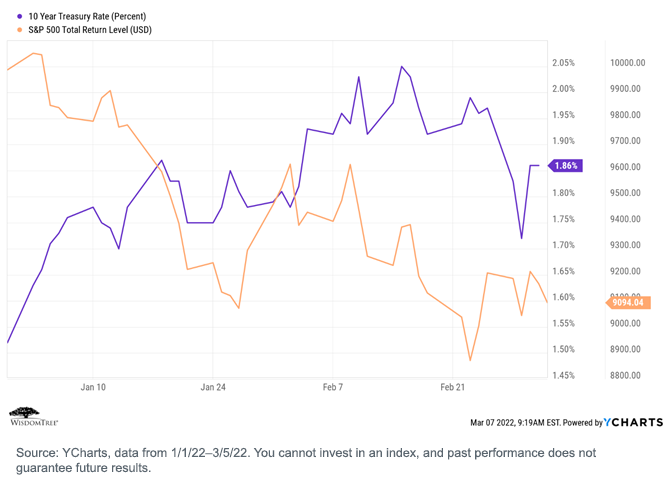

We are less than three months into 2022, but already we see a very different picture. Interest rates are up and expected to continue to rise (hurting bond performance), and the S&P 500 Index is falling.

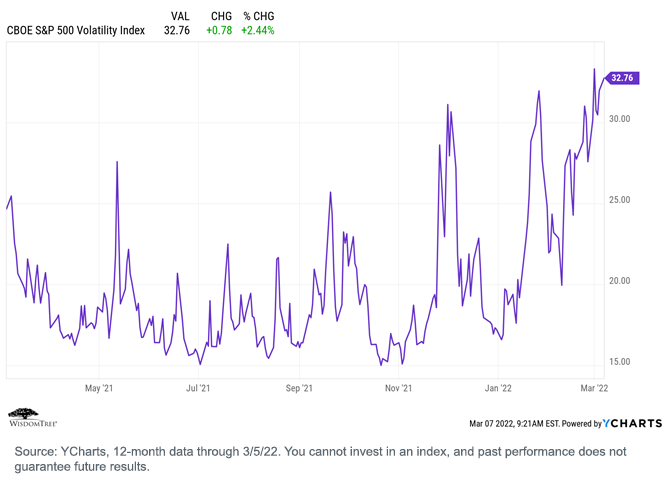

In addition, after more than 10 years of relative “quiescence,” we are beginning to see more volatility in the market (as measured by the VIX, a commonly referenced measure of the volatility of the S&P 500 Index).

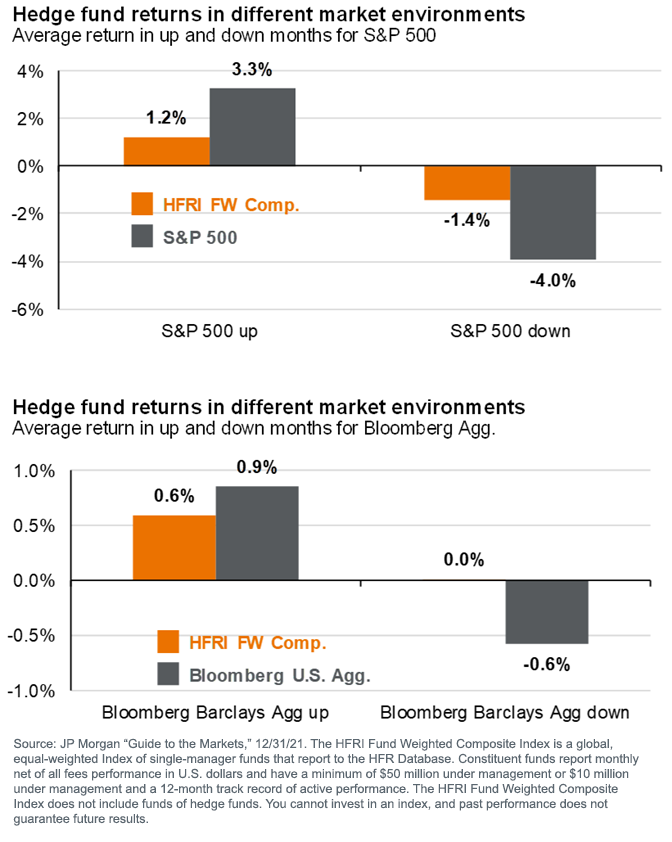

So, rising rates and increased volatility—historically, this has been the market regime in which alternative investments have performed best (or, said differently, the past 10 years of falling rates and low volatility helps to explain why alternative investments have not performed very well). The point is that the inclusion of alternatives may help to improve both the diversification of the portfolio and the consistency of performance.

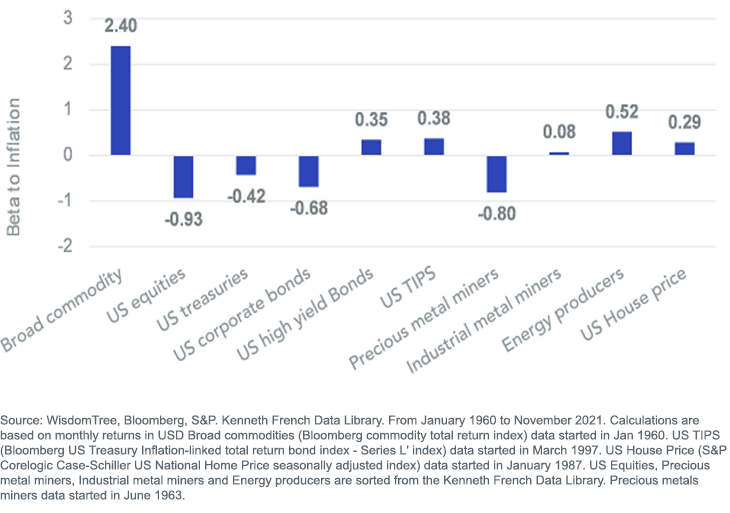

Another aspect of the current market environment is rising inflation, with recent CPI reports in excess of 6%–7%. Considering this environment, it is helpful to see how different asset classes historically have responded to inflation.

Beta to Expected Inflation of Main Asset Class

The way to interpret this graph is that, historically, (a) the two best hedges to inflation were U.S. equities and precious metals/miners (highest negative beta to inflation) and (b) broad commodities represented the best way to take advantage of inflation (highest positive beta).

The point of the story is that we believe today’s market environment is ripe for the inclusion of both real assets and alternatives in diversified portfolios, which is exactly what the WisdomTree Endowment Model Portfolios do.

I have been writing about, advocating for and defending the “Endowment Model Portfolio” for more than 10 years.1 And, periodically, I have had to accept being accused of “deworsification” for doing so. But I still believe it has a place for many investors and advisors— especially now in this period of rising volatility, rising interest rates and uncertain equity market performance.

First, let me define terms. In the actual endowment world, there are no taxes, and time horizons are infinite. Therefore, illiquidity is not an issue. This translates into an Endowment Model Portfolio that holds very few bonds, only enough public equity to make a difference and lots of private and alternative investments, plus real assets.

Of course, in the world of tax-paying, high-net-worth and affluent retail investors who do not have an infinite time horizon, things are different. Does that mean the “Endowment Model Portfolio” doesn’t translate? I don’t believe that is true. Adjusting for the realities of human behavior and taxes, I believe that an appropriate Endowment Model Portfolio for individuals means the following:

- Broad and global diversification

- Intelligent use of active vs. passive investment strategies (i.e., a cost/benefit optimization of active management fees or, in WisdomTree’s phrase, Modern Alpha®

- A prudent use of nontraditional or less correlated investments in an attempt to improve overall portfolio diversification (i.e., real assets and alternatives)

- A long-term time horizon

- Investment discipline through full market cycles

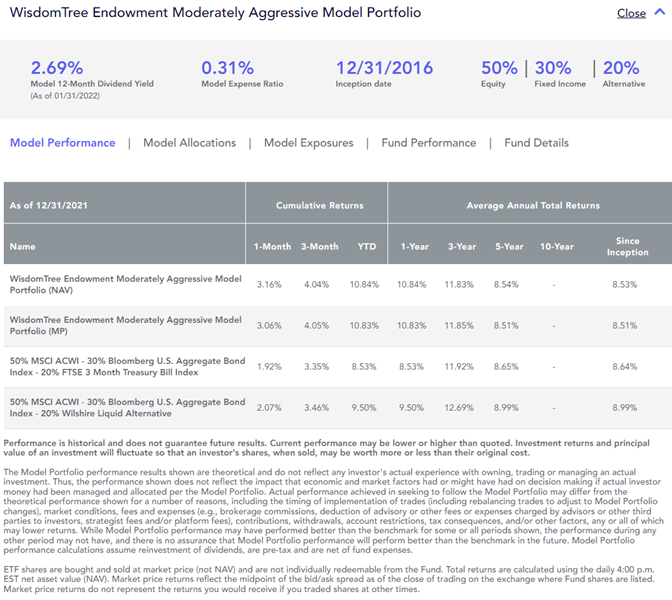

We manage five Endowment Model Portfolios (at different risk levels from conservative to aggressive) in exactly this way, and we believe they deserve more attention as long-term solutions for many advisors and end clients. Our most widely used model is the “Moderate Aggressive,” which allocates 50% to global equities, 30% to fixed income and 20% to a combination of alternative and real asset strategies.

Financial advisors who are registered on the WisdomTree website can learn more about them in our Model Adoption Center.

All these Model Portfolios are multi-asset, with allocations to global equities, fixed income, real assets and alternative investments. Somewhat unique, we believe, is our ability to fund the less-traditional asset class positions because we allocate to NTSX, the U.S. version of our “Efficient Core” strategy that takes a leveraged 90/60 position in large-cap U.S. equities and U.S. Treasuries. This provides us with a “core” allocation to stocks and bonds while leaving capital to allocate to other strategies.

On the real asset side, we have allocations to energy master limited partnerships (MLPs), a hybrid real estate/infrastructure strategy, and, via our own GCC, a dynamically managed broad basket of commodities.

On the alternative investment side, we have allocations to a short-biased strategy, a managed futures strategy (via our own WTMF and a hedged equity strategy in the form of our own put-writing strategy, PUTW.

The explicit purpose of these Model Portfolios is to seek to deliver consistent, absolute return performance, regardless of underlying market conditions. To date, they have performed as expected. They will not keep up with a raging bull equity market, but they are designed to not lose as much in down or disruptive markets. And, historically, that’s what they’ve delivered (using the Moderately Aggressive model as an example).2

For standardized performance of the underlying Funds, please click here.

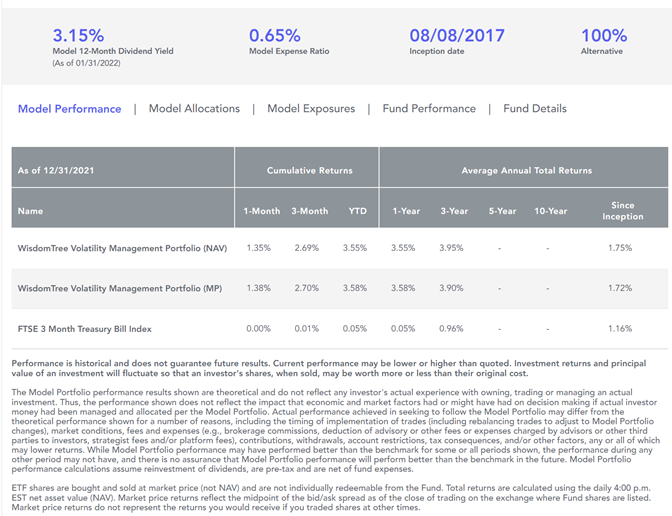

In addition to our Endowment Model Portfolios, we also offer a Volatility Management Model Portfolio. This is one of our “outcome-focused” Model Portfolios designed with explicit investment objectives in mind. In this case, to be used as a complement to existing more-traditional Model Portfolios when the advisor and/or end client wants a more “endowment-like” portfolio experience.

In addition to the short-biased, hedged equity and managed futures strategies that are embedded in our Endowment Model Portfolios, the “Vol Man” Model Portfolio also has explicit allocations to diversified arbitrage3 and a different form of hedged equity.4

Similar to the Endowment Model Portfolios, our Vol Man Model Portfolio has performed as it was designed to do.5

WisdomTree Volatility Management Model Portfolio

For standardized performance of the underlying Funds, please click here.

As with all WisdomTree Model Portfolios, our Endowment and Volatility Management Model Portfolios share certain common characteristics:

- They are global in nature

- They are ETF-centric to optimize fees and taxes

- They are “open architecture” and include both WisdomTree and third-party strategies

- They charge no strategist fee

Conclusions

With market conditions where they are, we definitely are receiving more questions from advisors about less-traditional and/or more-diversifying Model Portfolio solutions.

We think the Endowment Model Portfolios and the Volatility Management Model Portfolio can be appropriate solutions to those questions.

We hope you will take a look.

1Scott Welch, “In Defense of the Endowment Model,”, IMCA Investments & Wealth Monitor, May-June 2010, pgs. 32-–2636. (https://investmentsandwealth.org/getattachment/75a77ec3-2a97-44f7-bae8-196e6c52b895/IWM10MayJun-EndowmentModel.pdf).

2Past performance is no guarantee of future results.

3A “diversified arbitrage” strategy is one that employs multiple types of investment strategies that seek to profit from corporate capital- raising events such as new debt, equity, and convertible issues and corporate control events such as mergers or bankruptcies.

4“Hedged Equity” refers to an investment strategy that maintains both long and short equity securities positions, in an attempt to capture up market movement via the long strategies while mitigating down market movements via the short positions.

5Past performance is no guarantee of future results.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

NTSX: There are risks associated with investing, including the possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

GCC: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include the use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and, historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relates directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WTMF: There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include the use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and, historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise (or short-only indexes decline). The Fund’s investment objective is based on historical price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed; thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

PUTW: There are risks associated with investing, including the possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s NAV. Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the number of option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.