In Defense of the Endowment Model (Yet Again)

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

I have been writing about, advocating for and defending “the endowment model” for more than 10 years.1 And periodically I have to accept being smacked around for doing so. But I tend to be a long-term, strategic investor. With the recent and sad passing of endowment model proponent David F. Swensen of Yale University, let me try again.

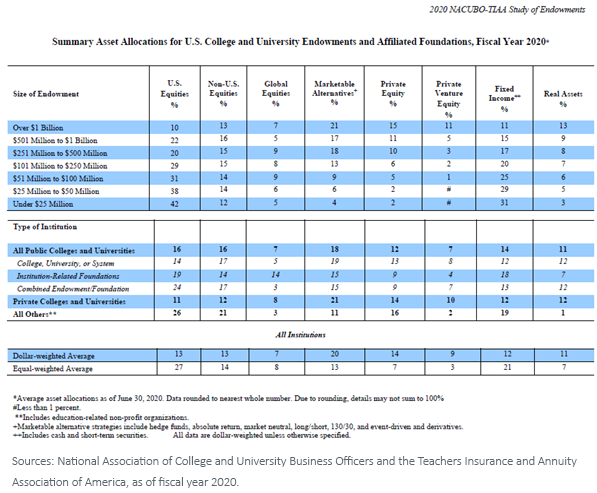

First, let me define terms. In the endowment world that Swenson worked in, there are no taxes and time horizons are infinite; therefore, illiquidity is not an issue. This results in an endowment model that holds very little bonds, only enough public equity to make a difference and lots and lots of private and alternative investments, plus real assets.

Of course, in the world of tax-paying high net worth and affluent retail investors, who do not have infinite time horizons, things are different. Does that mean the endowment model doesn’t translate? I don’t think that is true. Adjusting for the realities of human behavior and taxes, I believe that an appropriate endowment model for individuals means the following:

- Broad and global diversification

- Intelligent use of active vs. passive investment strategies (e.g., a cost/benefit optimization of active management fees or, to use WisdomTree’s phrase, Modern Alpha®)

- A prudent use of non-traditional or lower correlation investments in an attempt to improved overall portfolio diversification (e.g., real assets and alternatives)

- A long-term time horizon

- Investment discipline through full market cycles

We manage our different risk-banded Endowment Models in exactly this way, and we believe they deserve more attention as long-term solutions for many advisors and end clients. Financial advisors who are registered on the WisdomTree website can learn more about them in our recently launched Model Adoption Center.

All these Models are multi-asset, with allocations to global equities, fixed income, real assets and alternative investments. Somewhat uniquely, we believe, we are able to fund the less-traditional asset class positions because we allocate to NTSX, the U.S. version of our Efficient Core strategies, which takes a leveraged 90/60 position in large-cap U.S. equities and U.S. Treasuries. This provides us with a “core” allocation to stocks and bonds while leaving capital to allocate to other strategies.

On the real asset side, we have allocations to energy MLPs, infrastructure and, via our own GCC, a dynamically managed broad basket of commodities.

On the alternative investment side, we have allocations to a short-biased strategy and two variations of hedged equity strategies, including our own put-writing strategy, PUTW.

Going forward, we will consider additional diversifying strategies, including managed futures, long/short equity, global macro and diversified arbitrage.

The explicit purpose of these Models seeks to to deliver consistent, absolute return performance, regardless of underlying market conditions. And, to date, they have performed as expected. They will not keep up with a raging bull equity market, but they are designed to not lose as much in down or disruptive markets. And, historically, that’s what they’ve delivered.2

In addition to our Endowment Model, we also offer an explicit Volatility Management Model Portfolio. This is one of our “outcome-focused” strategies, designed with explicit investment objectives in mind. In this case, to be used as a complement to existing, more traditional portfolios when the advisor and/or end client wants a more “endowment-like” portfolio experience.

In addition to the short-biased and hedged equity strategies that are embedded in our Endowment Model, the “Vol Man” Model also has explicit allocations to diversified arbitrage and interest rate volatility/inflation hedge strategies.

As with all WisdomTree Model Portfolios, our Endowment and Volatility Management portfolios share certain common characteristics:

- They are global in nature

- They are ETF-centric, seeking to optimize fees and taxes

- They are “open architecture” and include both WisdomTree and third-party strategies

- They charge no strategist fee3

Conclusions

It is incorrect to say, as some people have, that the “endowment model is dead.” It is more accurate to say, given the years-long bull run in traditional U.S. stocks and bonds, that it has been “sleeping” for a while (just like the cicadas that now cover my backyard).

But, with interest rates and credit spreads where they are, and with equity market valuations stretched to all-time highs, we definitely are receiving more questions from advisors about less-traditional and/or more-diversifying portfolio solutions.

We think both the Endowment Model and the Volatility Management Model can be appropriate solutions to those questions.

We hope you will take a look.

1Scott Welch, “In Defense of the Endowment Model,” IMCA Investments & Wealth Monitor, May–June 2010, 32-26. https://investmentsandwealth.org/getattachment/75a77ec3-2a97-44f7-bae8-196e6c52b895/IWM10MayJun-EndowmentModel.pdf

2Past performance is no guarantee of future results.

3Other fees and expenses may apply

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

No level of diversification or non-correlation can ensure profits or guarantee against losses.