Q4 2023 Earnings: Quality Growth Takes Center Stage

Key Takeaways

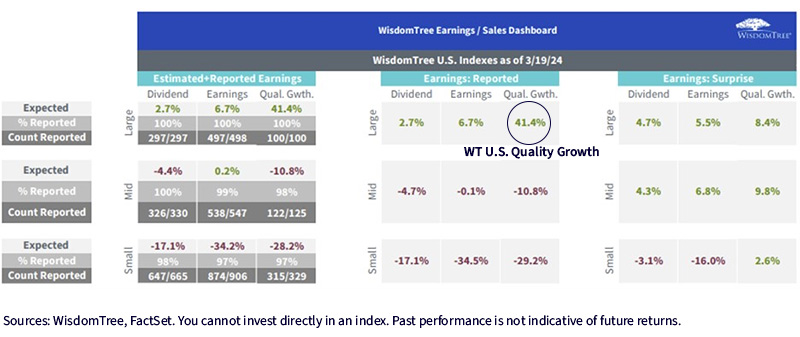

- Most companies surpassed earnings expectations in the last quarter of 2023, with growth stocks, particularly in the S&P 500 Growth Index, showing significant earnings growth over value stocks.

- The WisdomTree U.S. Quality Growth Index outperformed other indexes, reporting earnings growth of 41.4%, nearly double that of the S&P 500 Growth Index, despite being under-weight in the largest S&P 500 stocks.

Earnings season for the last quarter of 2023 has wrapped up. Despite recession fears early in the year, most reporting companies made it across the finish line with better corporate profits than analysts had expected.

We think it’s a great time to revisit the Daily Earnings Snapshot, available in the Earnings Path tool in our Portfolio Analysis Tools Hub (PATH).

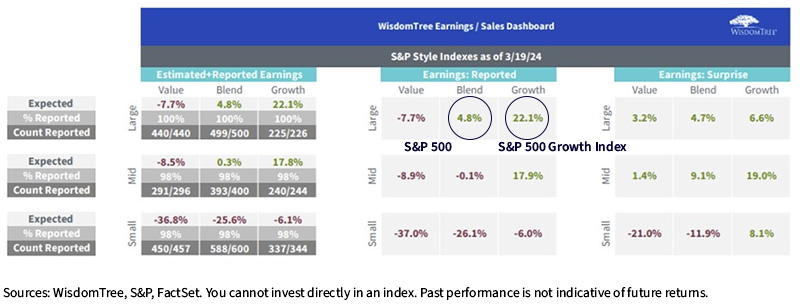

Among the S&P SmallCap 600, S&P MidCap 400 and S&P 500 indexes and their respective style (value and growth) baskets, all but the SmallCap 600 and its value variant beat earnings expectations. Growth again took center stage this quarter, with the S&P 500 Growth reporting 22.1% earnings growth—well ahead of the broader S&P 500’s 4.7% growth.

The theme of growth stocks over value stocks persisted last quarter, with growth names significantly outpacing value names in terms of earnings growth. Small caps reported negative earnings growth across the board, with only the S&P SmallCap 600 Growth Index reporting a positive earnings surprise.

Earnings Snapshot, S&P Indexes

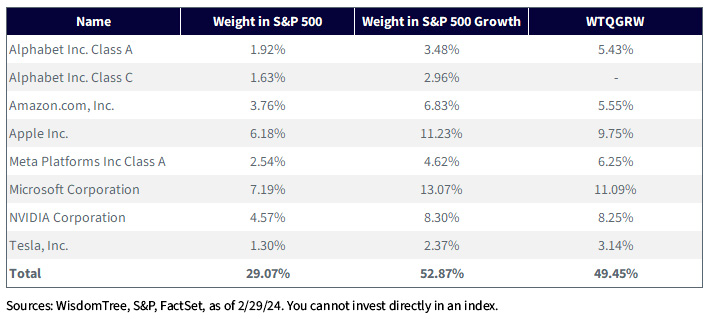

There was one basket whose earnings growth blew these benchmark indexes out of the water: quality growth. Despite being narrowly under-weight in the the Magnificent Seven—the seven largest stocks in the S&P 500 that drove much of the index’s returns throughout 2023—relative to the S&P 500 Growth, the WisdomTree U.S. Quality Growth Index (WTQGRW) was able to capture a significantly larger degree of EPS growth than either the S&P 500 or its growth counterpart.

Magnificent Seven Weights, Select S&P Indexes vs. WisdomTree U.S. Quality Growth Index

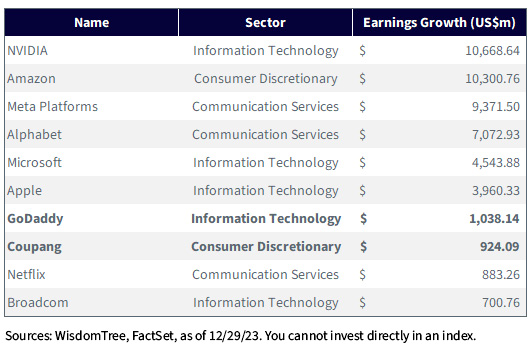

Looking at the largest earnings growers in the WisdomTree U.S. Quality Growth Index, the top 10 companies that had the largest dollar amounts of earnings growth were all unsurprisingly in the Information Technology, Communication Services and Consumer Discretionary sectors. The Index was also able to capture significant earnings growth from companies not held in the S&P 500 Growth index, such as GoDaddy Inc. and Coupang Inc.

Top 10 Earnings Growers in the WisdomTree U.S. Quality Growth Index

The WisdomTree U.S. Quality Growth Index, which invests in growth stocks with strong quality metrics, had a reported earnings growth rate of 41.4%, almost double the 22.1% of the S&P 500 Growth Index.

Earnings Snapshot, Select WisdomTree Indexes

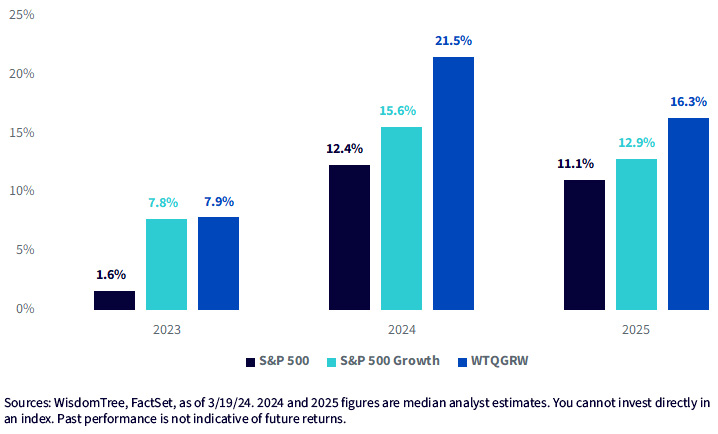

Over the 2023 calendar year, the WisdomTree U.S. Quality Growth Index reported similar operating earnings growth to the S&P 500 Growth, and far ahead of the broader S&P 500. Analyst forecasts for 2024 and 2025 call for greater relative growth.

Reported Operating Earnings and Forecasts

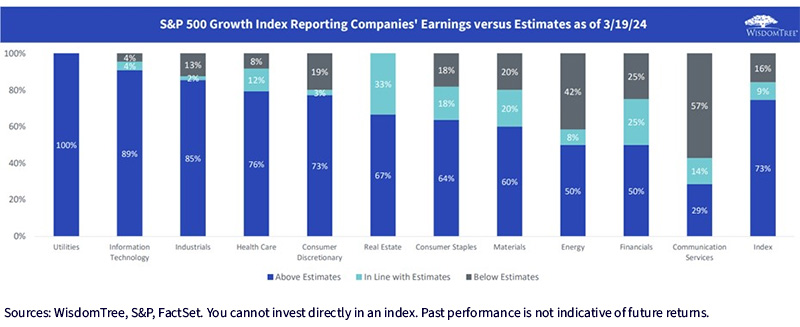

Across all sectors in the S&P 500 Growth Index, most companies showed positive earnings surprises, with over 73% of companies in the index beating analyst earnings estimates. Aside from the Utilities sector (which has only one company in the Index), the information technology sector had the greatest earnings surprise among the sectors, with 40 out of 45 reporting companies beating estimates. On the other hand, four out of seven reporting Communications Services companies reported earnings below analyst estimates.

Earnings Snapshot, S&P 500 Growth Earnings Surprise Sector Breakdown

Closing Thoughts

The Daily Earnings Snapshot is a useful asset for investors to get a broad understanding of what earnings look like across indexes and sectors and compare WisdomTree Indexes and ETFs to benchmarks. As the first quarter of 2024 wraps up and the first earnings season of the year begins, we hope investors can leverage the Snapshot as well as the growing suite of tools in our PATH hub to make informed decisions.