Japan’s MTICCC Takes Center Stage

Key Takeaways

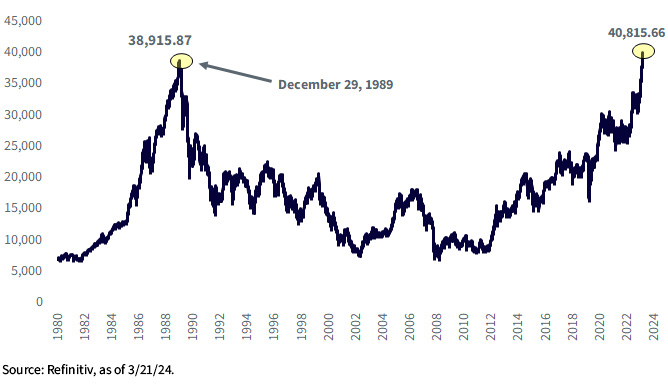

- “Management That Is Conscious of Cost of Capital” (MTICCC) is a significant driver of the recent bullish trend in the Japanese stock market, with the Nikkei surpassing its 1989 high and the 40,000 level.

- Japan is trying to shift from a cash-hoarding culture to an investment culture, with reforms like the Doubling Asset-Based Income Plan and changes to NISA accounts to encourage equity investments.

- The Japan Exchange Group is encouraging companies that adhere to MTICCC principles, and there’s a broader push for asset management industry reform and accountability to shareholders.

Who would have thought that such a benign phrase as “Management That Is Conscious of Cost of Capital” (MTICCC from here on) could be a driver of bullish spirits in a stock market?

Though the artificial intelligence (AI) frenzy deserves a hat tip for the Japanese stock market’s recent vertical run, MTICCC is probably a bigger driver. The Nikkei has taken out both the long-standing 1989 high and also the psychologically critical 40,000 level.

Figure 1: Nikkei 225

For months, the catch-all MTICCC has been used time and again by the Tokyo Stock Exchange (TSE) in its profitability push. Every time the TSE put out a memo, MTICCC has been there in spades. The message is essentially, “Start investing in projects that make economic sense, buy back stock, listen to activists, maybe replace the board of directors. If you don’t, your company’s name is going on our ‘Name and Shame’ List.”

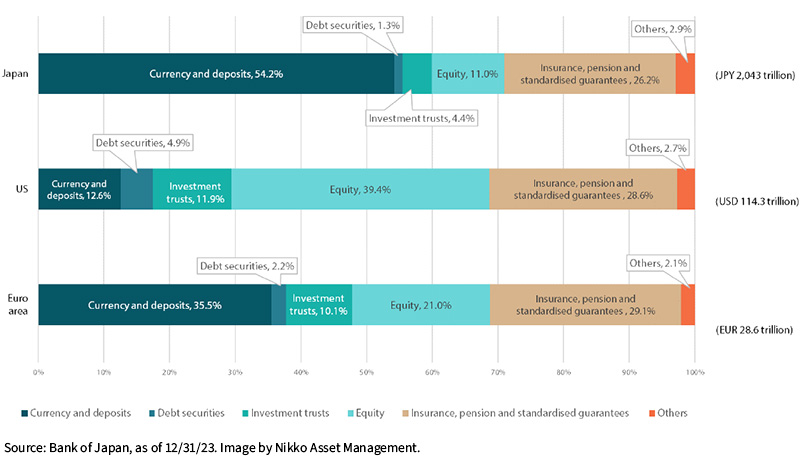

Beyond MTICCC, there is also a push to change Japan’s cash-hoarding culture. Prime Minister Fumio Kishida has made it his mission. The typical Japanese household keeps 54% of its assets in currency and deposits. For context, the figure in the U.S. is 12.6%.

Figure 2: Household Asset Proportions

Enter Prime Minister Fumio Kishida’s “Doubling Asset-Based Income Plan,” one of a handful of forces that are driving bullishness for the Japanese market. His goal is to increase the number of Nippon Individual Savings Accounts, or NISAs, which I think of as Japan’s “Traditional IRA.” Because the equity society isn’t accomplished if people open NISAs but put everything in cash, there is a big push for allocations to go into Tokyo-listed corporations.

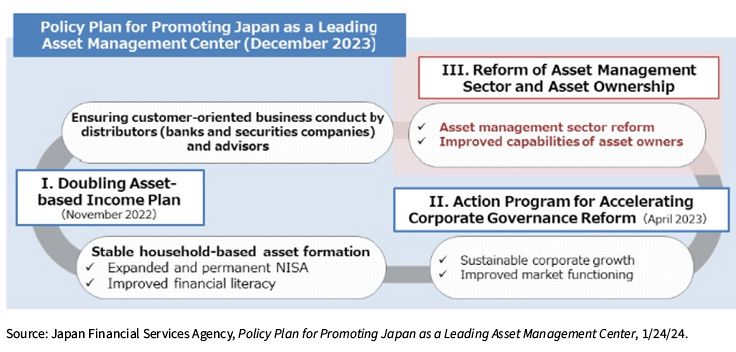

Figure 3 shows the general outline from Japan’s Financial Services Agency (FSA). The only part that is new to me is in the lower left: “improved financial literacy.” I am not sure what the FSA is referring to, because I hadn’t seen anything along those lines until coming across this exhibit.

Figure 3: The Plan

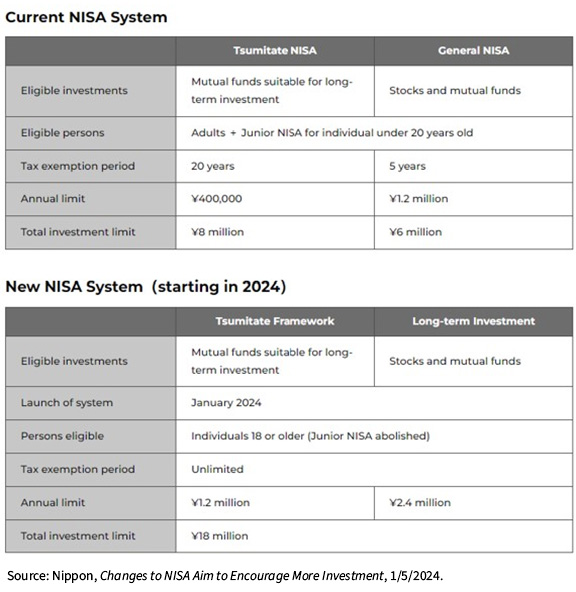

Until December 31, there were three kinds of NISA accounts:

1. The Tsumitate NISA, for savings

2. The General NISA (like a Traditional IRA)

3. The Junior NISA, for minors

Effective January 1, 2024, they simplified the program, made it more tax-friendly and allowed bigger contributions.

The one for savings, the Tsumitate NISA, now has an annual contribution limit of ¥1.2 million ($8,000), a tripling from last year’s ¥400,000 ($2,666).

The General NISA is now called the Long-Term Investment NISA. The contribution limit doubled from ¥1.2 million ($8,000) to ¥2.4 million ($16,000). Junior NISAs were eliminated.

Figure 4: NISA System

Importantly, until a few weeks ago, the tax exemption timeframe was either 5 or 20 years, depending on the account type. Now the tax exemption period is indefinite, though account size caps apply.

As that money gets invested, the hope is that it will be invested in companies that took to heart the push for MTICCC. Figure 5 is the opening slide of the Japan Exchange Group’s January memo.

Figure 5: There’s That Phrase

The Japan Exchange Group, which runs the TSE, also created an index that owns a bunch of companies that exemplify the ideal MTICCC corporation. A futures market on the JPX Prime 150 Index commenced March 18; an ETF launched in Tokyo that same day. This is from the JPX’s home page (figure 6).

Figure 6: JPX Prime 150 Futures and Funds Are Coming

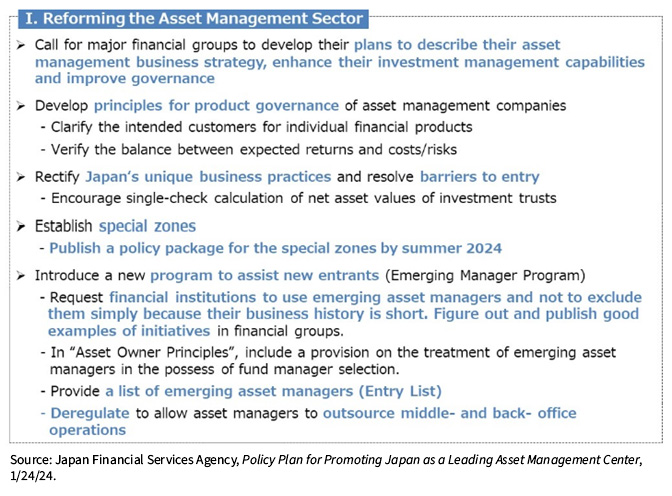

Finally, Japan is pushing asset management industry reform. Money managers were told to submit a plan that shows how they are committed to bettering their Japanese operations. There are also other plans such as “special zones” for nurturing venture capital expertise (figure 7).

Figure 7: A Portion of the FSA’s Policy Plan

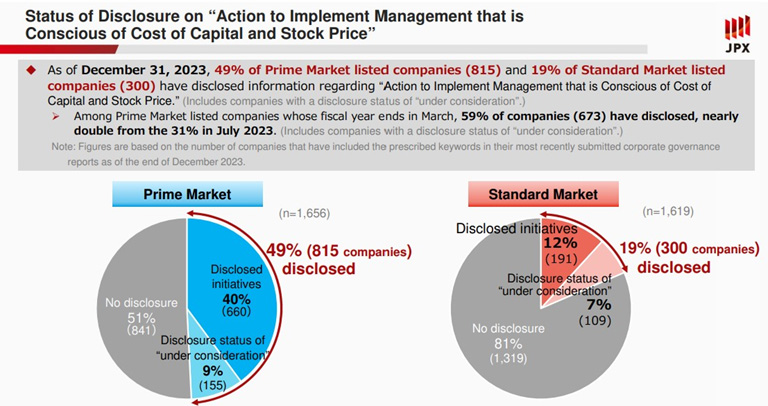

Finally, investors are encouraged that the Name and Shame initiative is forcing companies to do right by shareholders. As of December 31, about half of Prime Market companies (the big ones) and 19% of Standard Market (small) companies have disclosed their “Action to Implement MTICCC.” The theory goes that the passage of time will witness more companies fall in line, ostensibly boosting valuations.

Figure 8: Rising Consciousness

We have three Japan Funds:

• DXJ: WisdomTree Japan Hedged Equity Fund

• DXJS: WisdomTree Japan Hedged SmallCap Equity Fund

• DFJ: WisdomTree Japan SmallCap Dividend Fund

I also went through our broad Developed Market Funds. The ones that are heaviest in Japan are DLS and DDLS, each with 28% in the country:

• DLS: WisdomTree International SmallCap Dividend Fund

• DDLS: WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund

Related Products

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

DXJ: The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations and derivative investments, which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DXJS: Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations and derivative investments, which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DFJ: Funds focusing their investments on smaller companies or certain sectors increase their vulnerability to any single economic or regulatory development. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DDLS: The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.