Japanese Stocks Are Red Hot

Key Takeaways

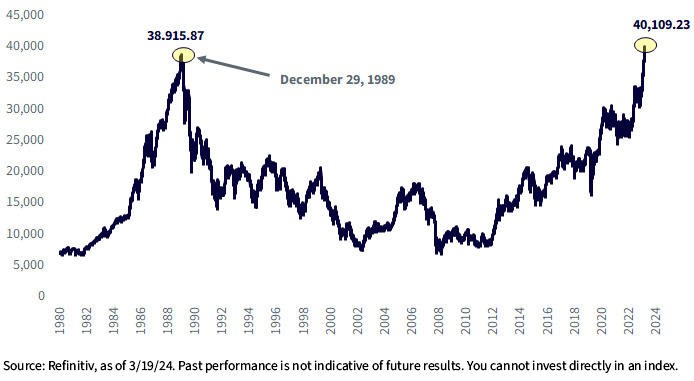

- The Nikkei 225 index reaching new all-time highs, surpassing the previous record set in 1989, is a significant psychological achievement for Japan.

- Despite Japan’s current recession, the long-term effects of Abenomics, particularly corporate governance reform, are influencing market sentiment and investment in Japanese stocks.

- The recent surge in Japanese equities may be partially attributed to a shift away from Chinese investments, though this trend is not solely responsible for the market’s performance.

It’s a little surreal, having looked at long-term charts of the Japanese stock market for my entire career, but here we are, seeing new all-time highs on the Nikkei 225. The previous record had held since 1989, when many of us mid-career types were children. Granted, the Nikkei is price-weighted like the Dow Industrials, so it’s a little blasphemous to cite such a poorly constructed index. Cut us some slack. Everyone is talking about the Nikkei and it is the index they cite on CNBC. It’s a big psychological win for Japan’s benchmark to surpass 40,000 for the first time.

Figure 1: Nikkei 225

Abenomics, the reform program implemented by former Prime Minister Shinzo Abe, is now over a decade old. The first two planks of Abenomics’ “Three Arrows” were monetary easing and fiscal stimulus. Considering the country is barely out of recession right now, it is hard to argue Abenomics spurred some economic miracle.

Then again, even with the Bank of Japan’s barely positive policy rate, the attendant collapse in the yen to ¥151 from ¥103 as recently as three years ago could be a set-up for a competitiveness thesis. Still, it is not economic vibrancy that has the market interested in allocating to Japanese stocks.

Abenomics’ third arrow, corporate governance reform, is driving sentiment. Progress had been coming in fits and starts. But now Japan has the infamous “Name and Shame” list, which still has the ink drying on it. Named are all the corporations who ignored the Tokyo Stock Exchange’s (TSE) demand, namely that listed companies plot out explicit business plans for boosting their profitability and stock prices.

We were pumped about Name and Shame because the TSE has been specifically hammering companies that trade for less than book value, which are the types of stocks that tend to find their way into dividend funds.

We spent all these years trying, sometimes with success, sometimes in futility, to poach business from unhedged Japan ETFs. Fortunately, the MSCI Japan Index has an aggregate price-to-book ratio of 1.55, while the WisdomTree Japan Hedged Equity Fund (DXJ) trades for 1.29 times book.1 We think we have an alpha generation case because we own more sub-1.0 price-to-book companies.

Last year, we felt like few investors were paying attention to the TSE’s obscure memos, which were aggressive in their demands for corporate reform. I would often discuss with our Global CIO, Jeremy Schwartz, why it sometimes seemed like investors were not paying attention to the steady stream of reforms.

But now we have the Nikkei drawing attention to a market that has been ignored by many…with the exception of the M&A crowd (figure 2).

Figure 2: Japan Represents About One-Third of All Asian M&A Activity

Part of It (But Not All of It) Is “No China, Please”

Make no mistake: last year we saw a ton of ETF creations on DXJ and the WisdomTree India Earnings Fund (EPI) because investors were selling China first and asking questions later.

That was great news for our Japan and India strategies, but the risk was that the bull run in those countries was based on portfolio clean-outs, not because our investor base was truly enamored with them.

That brings me to figure 3, which is heartening because China rallied hard in recent weeks. By the logic of “they’re selling China and switching to Japan and India,” we should have seen material weakness, maybe losses in DXJ and EPI. That has not been the case. Maybe we overestimated how much of it was “no China, please.”

Figure 3: Performance since 1/31/24

For the most recent month-end and standardized performances and to download the Fund prospectus, please click the respective ticker: CXSE, EPI, DXJ.

The Nikkei’s move to new all-time highs comes at an unusual time; Japan just released a GDP report that skirted recession. It’s a bizarre situation in the country too, because exports were up 7.8% in the year to February, while imports were largely flat, rising just 0.5%. That comes back to the ¥151 exchange rate, which has helped DXJ because of its cheap yen-reliant exporter screen.

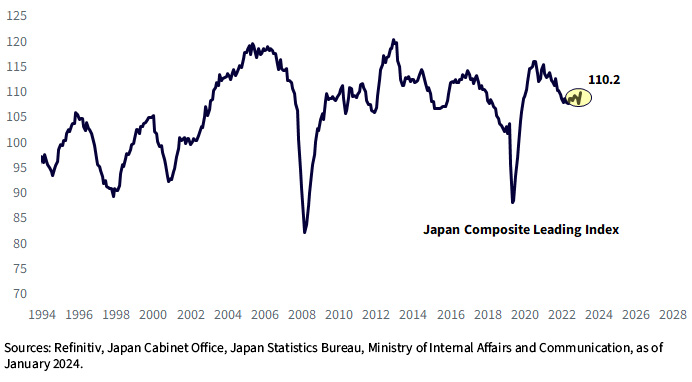

Promisingly, Japan’s recession-mired economy may also have green shoots, if leading indicators are to be believed. The Composite Leading Index is trying to get some footing (figure 4).

Figure 4: Composite Leading Indicators Are Trying to Head Higher

We have three Japan-oriented strategies:

- DFJ: WisdomTree Japan SmallCap Dividend Fund, which does not have the currency hedge

I didn’t get into it here, but Japan is also reforming retirement savings accounts. I think this is an underappreciated bull catalyst. I’m working on a blog post for that specific subject. Stay tuned.

1 Price-to-book ratios are as of January 2024.

Related Products

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

DXJ: The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations and derivative investments, which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DXJS: Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DFJ: Funds focusing their investments on smaller companies or certain sectors increase their vulnerability to any single economic or regulatory development. The Fund focuses its investments in Japan, thereby increasing the impact of 0065vents and developments in Japan that can adversely affect performance. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

EPI: This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

CXSE: The Fund focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increase its vulnerability to any single economic or regulatory development related to such sector. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.