Revisiting Our Earnings Path

After a tumultuous 1Q earnings season amid numerous bank collapses, investors are continuing to closely monitor second-quarter earnings as the latest numbers pour in.

Blended Sales and Earnings Growth

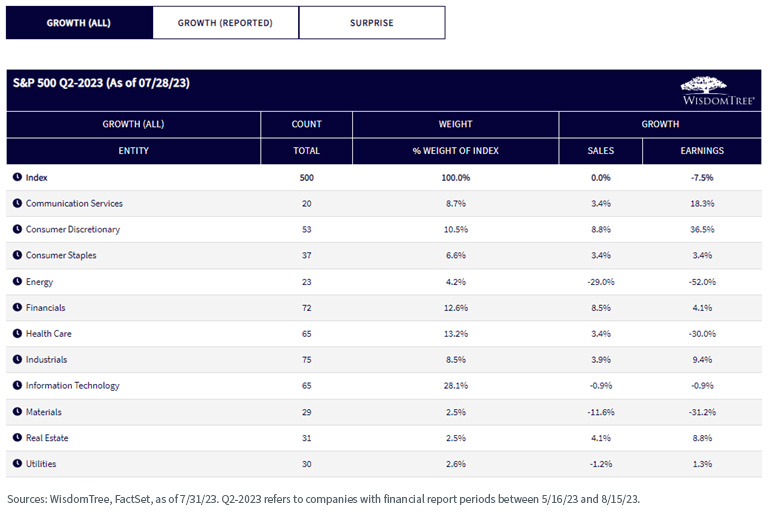

With earnings season fully underway, the screenshot below was taken from the Growth (All) tab of the Earnings Path on July 31, when 255 out of 500 companies in the S&P 500 had reported their 2Q earnings. The sales and earnings growth figures represent a combination of actual reported sales and earnings growth and analyst estimates.

Analysts expected the heavily weighted Information Technology sector to have a negative earnings growth of -3.5% against broader index-level estimates of -9.1%, partially driven by positive sentiment around artificial intelligence.

The Energy sector is expected to have a dramatically negative earnings growth of -52%—a stark difference in outlook compared to 1Q earnings of 14.4% as oil demand weakened.

Reported Figures

The below screenshot was taken from the Growth (Reported) tab of the tool, which shows actual sales and earnings growth figures from reporting companies. As of July 28, 2023, 56 out of 72 companies in the Financials sector had reported 2Q figures, while only 9 out of 30 Utilities companies had reported sales and earnings.

Surprises

The Surprise tab shows the difference between actual reported sales and earnings versus median analyst estimates. So far, 27 of the 65 companies in the Information Technology sector have reported Q2 earnings, with an earnings surprise of 9.2% and a sales surprise of 1.6%. As of July 28, all 11 sectors of the S&P 500 Index show positive earnings surprises, while 8 out of 11 sectors show positive sales surprises.

New Feature Highlight: Daily Earnings Snapshot

A new feature of the Earnings Path lets users download a PDF version of our Daily Earnings Snapshot by clicking on the “Download Daily Earnings Snapshot PDF” button, shown in the below screenshot.

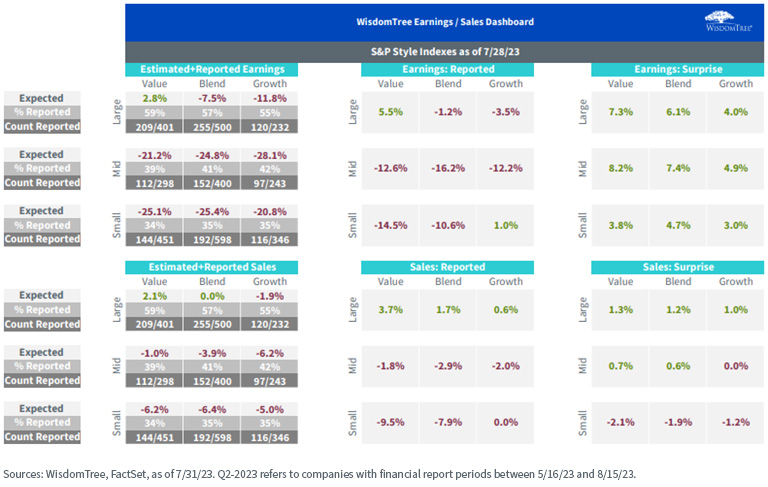

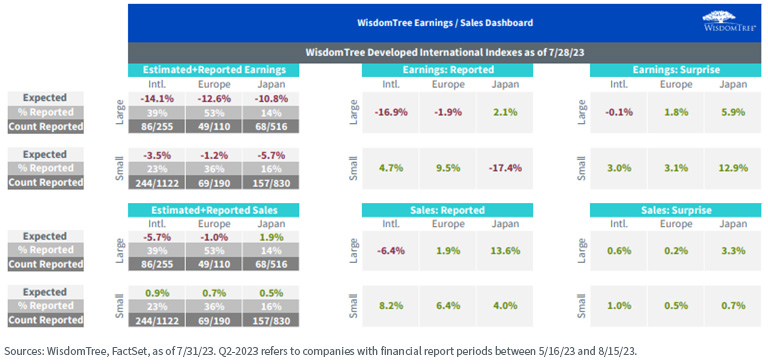

The Snapshot displays information from the Earnings Path tool in a concise format for benchmark indexes, including the S&P 500 and the Russell 1000, as well as their mid-cap and small-cap counterparts and style indexes (e.g., the S&P 400 Value Index).

The same information is also available for U.S., developed international and emerging markets indexes within the Snapshot.

The Earnings Snapshot also shows other useful information, including but not limited to valuation information for benchmarks and WisdomTree Indexes.

Conclusion

We hope the Earnings Path tool continues to help investors keep a close eye on earnings and that the Daily Earnings Snapshot will be another useful tool to track earnings trends in a concise, easily digestible format. Bookmark this link for easy access to daily data updates.