Wealth Management Is Now a “Design” Industry, Part Two

In part one of this series, we focused on broad industry trends and shared our thoughts on how to deliver a successful wealth management “Platform.” In this second part, we focus on delivering and developing the other two “Ps”—Process and People. Let’s get to it.

Process

The second leg of delivering a successful wealth management solution is creating an appropriate process for delivering the platform. The traditional model of a salesperson handing off to a portfolio manager is exactly the wrong model to deliver the platform described in Part One.

To its credit, the wealth management industry is moving in the right direction on this front. Increasingly, practices are focusing on building teams with different areas of specialization to service a common client base, and compensation structures are changing to reward professionals who deliver the entire practice to the client and not just their area of expertise.

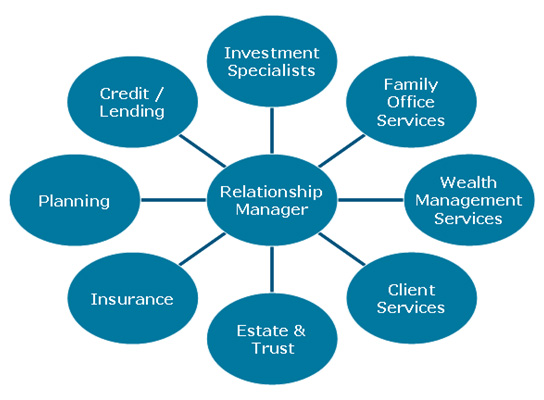

This model is illustrated below. Some firms have made great strides in this direction; others have a way to go.

Putting the right process in place requires, of course, more than just changing the organization chart and compensation structure. Many firms and practices today place a heavy emphasis on client attraction (i.e., bringing new clients in the door) but have little to no formal process in place to retain the clients already in the house.

From a profitability perspective, the “dirty little secret” of wealth management is that it generates lower operating margins than other types of firms in the broader financial services industry. It historically was not as scalable (though that is changing due to technology advances and firm consolidation), it requires more qualified and higher-priced professionals to deliver successfully, and the cost of dealing with external managers and service providers can be more expensive than in-house solutions.

To be successful, then, wealth managers need to make heavy investments in technology and place an increasing emphasis on operating efficiency and bottom-line growth—not just top-line revenue or growth in assets under management.

This point also highlights an ongoing difficulty for publicly held banks and financial service providers in providing an appropriate wealth management solution. It is more profitable (both absolutely and on a recurring revenue basis) for firms to sell a captive product. So, while some practices may recognize that offering an “open architecture” solution (that is, offering both internal and third-party solutions) is more appealing to clients, it may be the wrong solution for shareholders. This is known as the “agent/fiduciary conflict,” and it is not an easy conflict to resolve.

A final aspect of “Process” is the cultural one.

No amount of change to the product mix or delivery system of a wealth management offering will succeed if the firm does not focus intensely on creating a corporate culture and mindset that aligns business practices and behaviors with the overall business strategy.

People

The final aspect of delivering a successful wealth management solution, and perhaps this should have been listed first, is people—and there are several aspects to making sure the right people are in place.

The BDO/CRM Conundrum

Industry and psychological research suggest that roughly 10% of wealth management applicants possess the appropriate personality and psychological profile to be successful business development officers (BDOs).1

“Making it rain” is a rare and valuable skill.

At the same time, roughly 50% of candidates have the appropriate makeup to be successful client relationship managers (CRMs). Statistically, then, only (0.1 x 0.5) percent—one applicant in twenty—has the goods to excel at both client acquisition and client servicing.1

The implication is clear—wealth management firms must hire and retain both types.

Today, successful CRMs must be able to not only deliver the firm’s solution in a seamless and professional manner, but they must also be able to harvest internal leads that come their way from other specialists within the organization and develop strong relationships with center of influence referral sources.

On the flip side, the stereotype of the successful BDO is an extrovert with strong empathy, well-developed knowledge/understanding of the firm’s offering and value proposition, high “EQ” (emotional quotient), discipline/persistence and highly developed interpersonal skills, combined with a high tolerance for failure.

Those traits may still be necessary, but given the increased relationship management responsibility implicit in delivering an integrated wealth management solution, they are no longer sufficient.

“Credentialization”

One manifestation of the increasingly complex solution demanded by HNW clients is that it becomes increasingly difficult to be a generalist—wealth management is an industry well down the path of specialization and niche players. Even a CRM whose primary responsibility is to marshal specialists to meet client issues needs more than a “casual chatter” level of expertise.

The result? The industry has seen an explosion in “credentialization” as wealth advisors pursue advanced degrees and industry certifications to remain competitive.

Consider the following partial list of programs and certifications now available:

- The Certified Investment Management Analyst (CIMA), Certified Professional Wealth Advisor (CPWA) and Retirement Management Advisor (RMA) certifications offered by the Investments & Wealth Institute (IWI)2

- The Chartered Financial Analyst (CFA) certification offered by the CFA Institute

- The Certified Financial Planner (CFP) certification offered by the Certified Financial Planning Board (CFP Board)

- The Personal Financial Specialist (PFS) certification offered by the American Institute of CPAs (AICPA)

- The Certified Trust and Financial Advisor (CTFA) designation offered by the American Bankers Association (ABA)

This list does not even consider internal “university” and certification programs offered by individual wirehouse and banking firms. Many of the larger wirehouse firms, for example, have instituted rigorous internal certification programs that financial advisors must complete before they are allowed to work with HNW clients.

This is not a fad—the emphasis on advanced education and specialized training will only increase and will soon become an industry-wide requirement for advancement. Conversely, firms that do not offer appropriate certification and education opportunities for their advisors will find it difficult to retain top talent who have embraced the “new paradigm” and demand training as part of their employment package.

In the third and final part of this series, we share our perspectives on “framing the wealth management experience” and the role of outsourcing and conclude with our summary thoughts on delivering a successful wealth management solution. Hope to see you there.

1 Allan Starkie, Ph.D., Anthony R. Riotto and Kenton Thompson, “Will That “Star” Producer Stay a Star?” Knightsbridge Advisors. https://knightsbridgesearch.com/will-that-star-producer-stay-a-star/

2 Disclosure: As we write this, Scott Welch currently sits on the board of directors at IWI.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.