Wealth Management Is Now a “Design” Industry, Part One

Wealth management is “in.”

Banks, wirehouses and RIAs are pouring resources into developing competitive wealth management offerings, hoping to capture a larger share of this rapidly growing marketplace. And we believe many of these firms are going about it all wrong.

How?

By focusing too much on products and not enough on the client experience.

In this three-part blog series, we focus on the evolution taking place in the wealth management industry and present our thoughts on how to succeed in the face of this evolution. In this first part, we focus on broader industry trends and then begin the discussion of how to differentiate an advisor’s practice. Let’s dive in.

There are reasons people shell out premium prices for a cup of coffee at Starbucks, rooms at The Ritz-Carlton, Apple products and trips to Disney World. Yes, the products offered by these firms are excellent, and yes, they all deliver good service, but the reason these firms are so successful is that they understand their customers do not keep coming back to buy a product—they are paying for an experience.

Wealth management is evolving in the same direction.

The value proposition decreasingly focuses on products or services, which are assumed or taken for granted. Increasingly, the emphasis is on the quality of the advice, the level of expertise delivered, the ease with which information and service can be accessed—the wealth management experience enjoyed by the client.

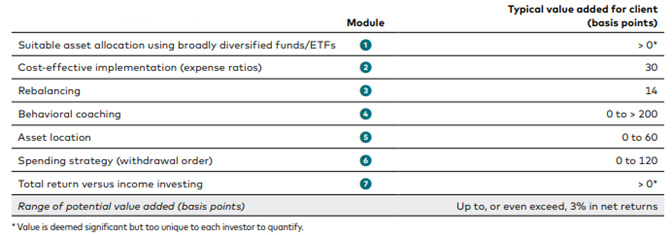

According to research conducted in 2022 by Vanguard,1 here is a summary of how high-net-worth (HNW) investors and families value their wealth management solution:

For definitions of terms in the figure above, please visit the glossary.

This paper summarizes several of the trends driving the high-net-worth marketplace today, with a particular focus on commoditization and true differentiation in the high-net-worth space. It also suggests what a successful wealth management solution needs to offer and why more firms find that outsourcing provides them with the best opportunity to remain competitive and deliver an appropriate wealth management experience.

To deliver a successful wealth management solution in today’s competitive marketplace, a good place to start is with the idea of the “3 Ps” (Platform, Process, People) model, an adaptation of the “People, Process, Technology” framework applied across many industries:2

Platform

A competitive solution begins with the wealth management platform offered to clients. An appropriate framework here is the solution offered by many of the leading wealth advisory firms. These firms rarely compete based on product or price—they compete based on the quality of the advice they provide and the level of service they deliver.

The advice these firms deliver can be segmented into main categories—investment consulting services and a broadly defined suite of wealth management services tailored to the needs of the client base.

Investment consulting has its historical roots in the institutional world, where pension funds, endowments and foundations have long sought objective advice on how to structure and implement an appropriate investment portfolio.

In the high-net-worth space, the “deliverables” of investment consulting can be summarized broadly as follows:

- Integrated wealth planning

- Investment policy statements

- Asset allocation and “asset location” planning (tax efficiency)

- Customized portfolio construction

- Manager search and selection (both traditional and alternative investments)

- Consolidated performance reporting

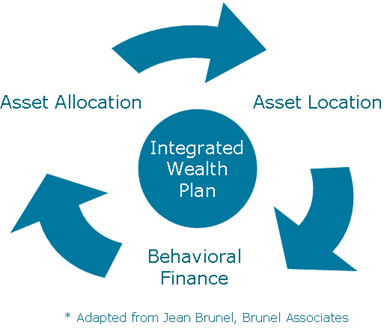

Most of these terms are self-explanatory, but the phrase “integrated wealth planning,” made popular by industry thought leader Jean Brunel,3 deserves further discussion.

The term refers to the fact that the institutional consulting model, with its heavy focus on unemotional asset allocation in a world where the time horizon theoretically is infinite and taxes don’t exist, is flawed when applied to tax-paying humans.

Brunel suggests that when dealing with individual investors, the concept of an “optimized” portfolio does not exist; instead, investors and their advisors are on a perpetual “path to optimization.”

Think of integrated wealth planning as a three-legged stool. One leg is the traditional concept of asset allocation—diversifying investments across multiple asset classes in such a way as to minimize the risk of the portfolio for an expected or desired level of return. Many advisors today still “sell” asset allocation as the be-all and end-all of investment planning. But traditional asset allocation ignores two inconvenient aspects of dealing with individual investors—they pay taxes, and they frequently behave irrationally with respect to their wealth.

To factor these components in on the “path to optimization,” wealth managers need to incorporate the following:

- Asset Location: This refers to the integration of appropriate estate planning vehicles to minimize the taxes paid on the overall investment portfolio. Estate planning is often pigeonholed to minimize wealth transfer taxes as money moves through generations. But the proper use of estate planning and other tax-deferred or tax-minimization vehicles (IRAs, 401(k)s, LLCs, FLPs, trusts, etc.) can also reduce income taxes paid along the way. By placing different types of investments within different tax-deferred and estate planning entities, investors can increase the inherent power of compounding within the portfolio.4 Many wealth advisors tend to focus on creating the “perfect” investment portfolio—but the truth is that, in the long run, good tax and estate planning will trump good investment planning every time.

- Behavioral Finance: The field of behavioral finance, which is essentially the study of why perfectly rational investors frequently make wildly irrational decisions with respect to their money, has been around for 20–30 years, but it is only in the past several years that the wealth management industry has attempted to turn the theory into practical applications. Today it represents one of the most talked-about and written-about concepts in the industry. With respect to the “path to optimization” for individual investors, it can be thought of as developing a better understanding of the investor’s emotional makeup and frame of reference concerning their wealth and using that understanding to create investment portfolios that not only “work” quantitatively, but are comfortable for the investor from an emotional perspective. Most wealth advisors have experienced the frustration of creating an investment plan for a client that is never implemented or is abandoned at the first unexpected event. Many times, this is because the investor simply could not “buy in” to the plan from an emotional perspective.

Successfully integrating asset allocation and asset location into an overall wealth plan that fits the emotional frame of reference of a specific client is clearly not a commodity—it is a critical step in delivering a differentiating wealth management experience.

- According to annual wealth management surveys from Capgemini and PwC,5 in addition to investment consulting, the successful wealth management platform must also deliver a broad array of services tailored to the needs of the affluent marketplace, such as:

- Access to alternative and private investments

- Access to digital assets and digitized technology

- Access to ESG and Impact strategies

- Access to “OCIO” (Outsource Chief Investment Officer) services

- Access to attractive loan rates and credit services

- Negotiated access and price for managers and custodians

- Access to top-quality estate and insurance planning

- In-house or external access to high-quality trust services

- Internal or external access to bill paying, recordkeeping and tax preparation

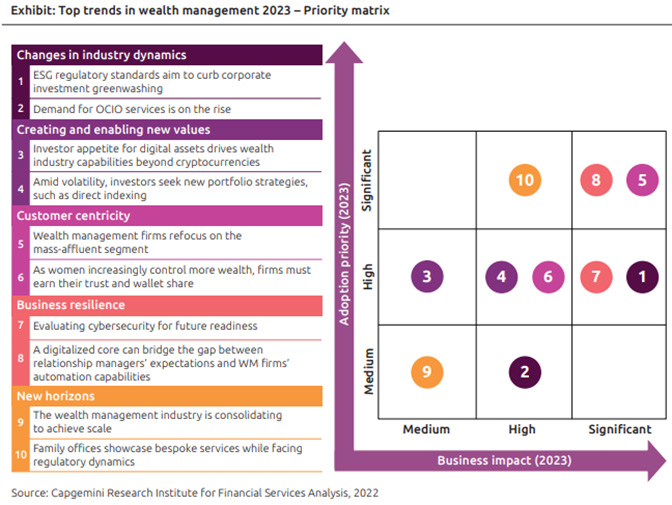

Here is how Capgemini sums up wealth management trends as we move through 2023 and beyond:

The key word in all these services is “access.” It is not required—and often not desirable—for a given firm or practice to deliver these services through internal or captive channels. As wealth management becomes more complex and customized, many firms are developing expertise in specialized and niche-oriented services.

The comprehensive platform described above is necessary but not sufficient for success. These services are not automatic differentiators in today’s marketplace, but not offering them is, or soon will be, a negative differentiator.

In part two, we will focus on the other two “Ps”—Process and People. See you there.

1 See: https://advisors.vanguard.com/iwe/pdf/IARCQAA.pdf

2 See, for example: https://www.smartsheet.com/content/people-process-technology

3 Jean Brunel, “Integrated Wealth Management: The New Direction for Portfolio Managers,” Euromoney Publishing, 2002. See: https://www.amazon.com/Integrated-Wealth-Management-Direction-Portfolio/dp/1855649233

4 See, for example, Doug Rogers and Scott Welch, “Tax-Aware Investing – An Interview with Douglas S. Rogers,” Investments & Wealth Monitor, January/February 2015, pp. 5–10.

5 See the Capgemini Wealth Management “Top Trends” Report 2023: https://prod.ucwe.capgemini.com/wp-content/uploads/2022/12/Top-Trends-Wealth-Management-2023-1.pdf, and the PWC “Next in Asset and Wealth Management 2023” report: https://www.pwc.com/us/en/industries/financial-services/library/asset-wealth-management-trends.html.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.