Finding Fixed Income Opportunities in the New Rate Regime

Calendar year 2024 presents fixed income investors with a new rate regime in terms of absolute yield levels, and from a monetary policy perspective.

Unlike 2022 and 2023, when rate hikes dominated the landscape, this year is expected to bring a change in scenery from the Federal Reserve, where rate cuts are soon to be the primary theme.

However, given the outcome of the January FOMC meeting and attendant Powell presser, the timing and magnitude for an easing in policy is still uncertain.

In addition, economic data, such as the most recent jobs report, has also challenged the money and bond markets’ most optimistic expectations, creating an environment for continued elevated volatility.

While the potential for ongoing bond market volatility certainly presents challenges, we are also finding many interesting opportunities for fixed income investors.

For advisors seeking the flexibility to capitalize on bond market opportunities and adjust exposures as conditions change, Model Portfolios can provide cost-effective access to the expertise of our asset allocation and fixed income teams.

Our WisdomTree Fixed Income Model Portfolio recently passed its 10-year anniversary since inception. To mark the occasion, we wanted to provide an update on our current outlook and positioning, and look back on performance since inception.

Positioning within our Fixed Income Model Portfolios

Below we summarize the current positioning and some of the recent changes within our WisdomTree Fixed Income Model Portfolio, which is dynamically managed based on the top-down and sector-specific views of our Model Portfolio Investment Committee.

WisdomTree Model Portfolio Investment Committee—Fixed Income Positioning

Given the inverted nature of the yield curve, we remain allocated to short-duration bonds, including Treasury floating rate notes.

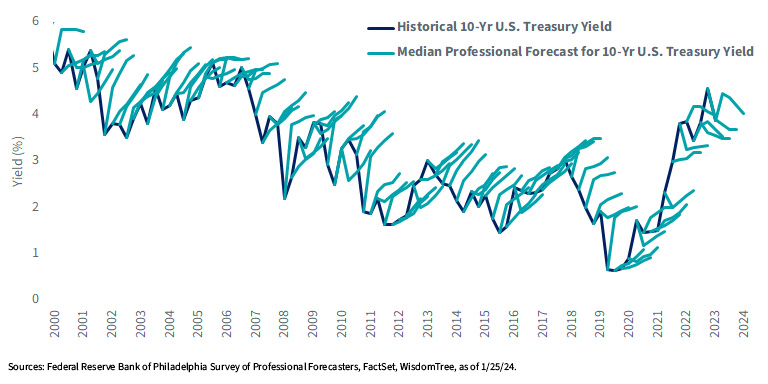

However, using a barbell approach, we continued to add duration in a deliberate manner in 2023. After spending much of the past few years shorter in duration than our benchmarks, we are now closer to a “neutral” stance, which we feel is prudent given the level of ongoing interest rate volatility and the inherent difficulty in predicting shorter-term movements in interest rates (see below).

10-Year U.S. Treasury Yield: Historical vs. Median Professional Forecast

Another opportunity we see in fixed income markets is securitized assets, specifically agency mortgage-backed securities (MBS). While investment-grade and high-yield corporate credit spreads tightened well inside of their historical averages last year, we believe yields on agency MBS relative to Treasuries offer attractive value. Therefore, we rotated from high-yield corporates into MBS, while maintaining a modest over-weight allocation to quality high-yield credit.

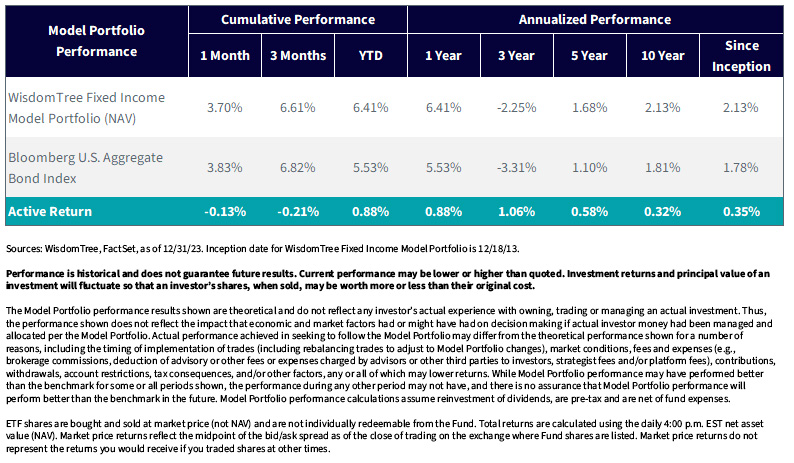

A 10-Year Track Record of Performance

Since its launch in December 2013, the WisdomTree Fixed Income Model Portfolio has delivered on its objective, outperforming the Bloomberg U.S. Aggregate Bond Index since inception and over the past 1-year, 3-year, 5-year and 10-year periods.

Financial advisors can learn more about the WisdomTree lineup of fixed income and multi-asset Model Portfolios by visiting our Model Adoption Center.

WisdomTree Fixed Income Model Portfolio Performance

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.