An Attractive Entry Point for Agency Mortgage-Backed Securities (MBS)?

“Higher for longer ” has certainly been the dominant theme in fixed income markets this year, with rising interest rates weighing on the price of U.S. Treasuries.

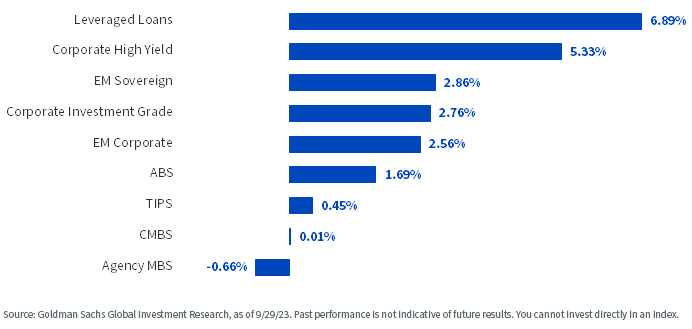

However, bond sectors outside of government debt have been resilient, with tighter credit spreads driving positive excess returns across high yield, leveraged loans, emerging markets and investment-grade corporates.

Excess Returns Year-to-Date across Fixed Income Asset Classes

An area of the high-quality fixed income market that hasn’t enjoyed a smooth ride this year is agency mortgage-backed securities (agency MBS).

Agency MBS: A Large, Liquid, High-Quality Fixed Income Asset Class

One of the largest asset classes in the U.S. bond market, the principal and interest of agency mortgage-backed securities are guaranteed by government-sponsored entities (GSEs) such as Fannie Mae, Freddie Mac and Ginnie Mae, which benefit from their relationship with the U.S. government.

Even with this implicit backing, an MBS typically provides a yield premium compared to Treasuries as compensation for investors assuming the prepayment risk embedded in the underlying mortgages. Therefore, investors in an agency MBS are compensated for the uncertainty of when they receive the bond’s principal, but not if.

A Potentially Improving Supply / Demand Environment

Outside of higher interest rates and elevated volatility, the agency MBS market has also faced supply concerns related to the Federal Reserve’s quantitative tightening program and the FDIC’s liquidation of failed banks’ MBS portfolios.

While the demand void left by the Fed and commercial banks remains, at least some supply headwinds could be easing. The FDIC has already liquidated approximately 95% of its agency MBS portfolio, and many market participants see additional sales from the Fed as unlikely given the level of anticipated runoff compared to mandated redemption caps.1

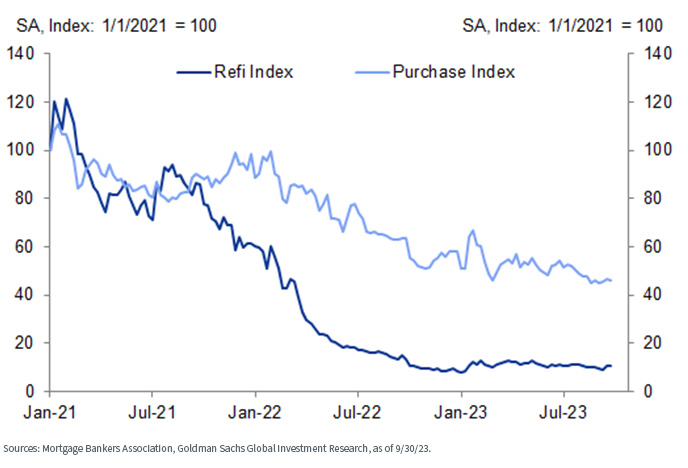

Furthermore, new issuance of agency MBS has been muted this year, and the lack of housing activity and incentive for homeowners to refinance should translate into greater cash-flow stability going forward.

Mortgage Loan Application Indexes for Refinance and Purchase

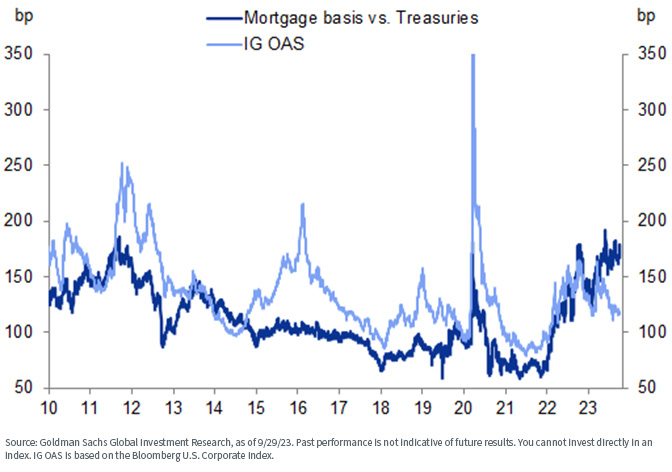

The current yield premium offered by agency MBS compared to Treasuries suggests that the bad news from this year may be priced in. Indeed, this mortgage basis spread is now at the higher end of the historical ranges, and it even looks attractive compared to credit spreads on investment-grade corporates.

Mortgage Basis (Current Coupon Mortgage Rate — 5/10-Year Treasury Rate) and IG Option-Adjusted Spread (OAS)

Diving a little into the details of the asset class, perhaps the more significant story this year has been the relative performance of the most discounted corners of the market.

Low-coupon MBS have generally outperformed higher coupons because of a lack of supply and persistent fund inflows (demand), primarily in passive index products. This situation has led to a decisive difference in comparative value across the coupon stack but with very few willing to go against it.

As a result, we continue to see good value in production-coupon MBS, with spreads near 50 basis points and nominal spreads over 160 basis points offering attractive yields compared to other high-quality fixed income sectors.

Capitalizing on the Opportunity

Based on the sector’s high credit quality, modest correlations to other credit sectors and attractive level of yield premium, our Model Portfolio Investment Committee recently decided to add exposure to agency MBS across our Strategic Model Portfolios.

For investors also considering a dedicated exposure to mortgage-backed and other securitized debt instruments, the WisdomTree Mortgage Plus Bond Fund (MTGP) may be worth considering.

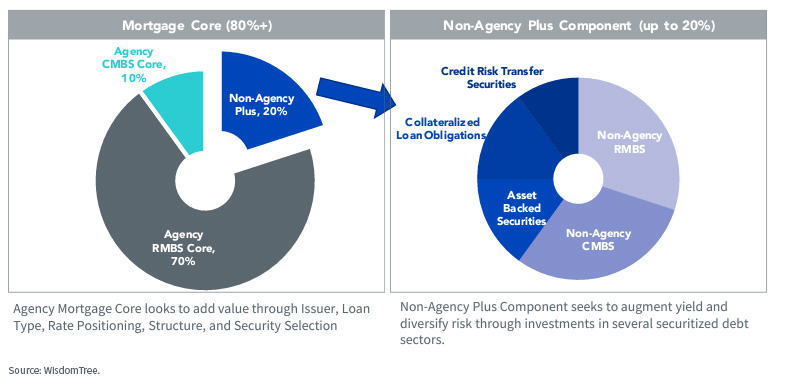

The strategy is an actively managed ETF that balances a strategic core exposure to agency MBS augmented by diversifying and tactical exposures to other securitized sectors.

WisdomTree Mortgage Plus Bond Fund — Strategy Construct

MTGP seeks to deliver superior risk-adjusted returns to the Bloomberg U.S. Securitized Index through an investment process combining macro and fundamental research.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of an investment will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that investment to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising-interest-rate environment and/or with respect to particular types of securities, such as securitized credit securities. Non-agency and other securitized debt are subject to heightened risks compared to agency-backed securities.

High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. Unlike typical exchange-traded funds, the Fund is actively managed using proprietary investment strategies and processes, and there can be no guarantee that these strategies and processes will be successful or that the Fund will achieve its investment objective. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.