A Volatile Week in Oil as Security-Driven Supply Concerns Counter Demand Concerns

While the International Energy Agency (IEA) and Energy Information Administration (EIA) have been revising their oil demand forecasts downward for a number of months, the Organization of the Petroleum Exporting Countries (OPEC) has kept its forecasts at a rather optimistic level for some time (see Table 1).

Table 1: Oil Demand Growth Forecasts (million barrels per day)

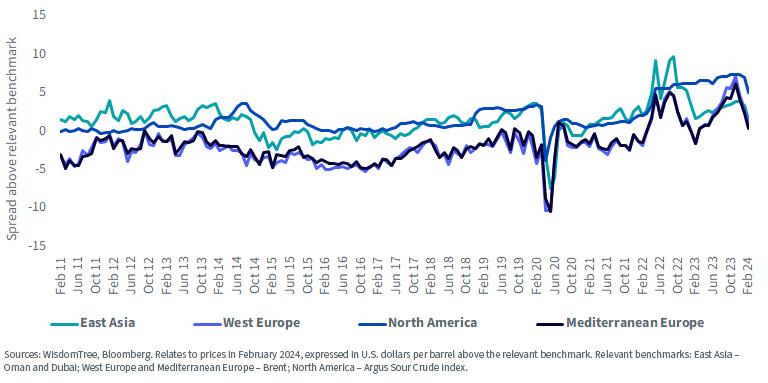

Reduction in Saudi OSPs

However, last Sunday (January 7, 2024), Saudi Arabia, the largest and most influential OPEC member, cut its selling prices across most regions. The official selling price (OSP, as a spread above the Oman and Dubai benchmarks) of the flagship Arab Light crude to East Asia, for example, fell to the lowest level since November 2021. Markets interpreted this as Saudi conceding that oil demand is indeed soft, and the price of Brent crude oil fell 4.5% between the open and late afternoon on Monday, January 8.

Official Selling Price (OSP) for Arab Light Crude

Middle East Export Disruption in Focus

The price weakness in Brent was not sustained for long and by Wednesday, January 10, most of the losses were recovered. The chief driver has been market concern about oil export supply disruptions in the Middle East. Attacks on ships passing through the Red Sea by Houthi rebels had gathered pace in December 2023 and escalated in January 2024. On January 10, a British warship, in an operation with U.S. forces, shot down seven drones launched by Houthis in the Red Sea, to repel the largest drone and missile attack to date. Further U.S. air strikes against Houthis on January 12 lifted oil prices, erasing all losses from earlier in the week.

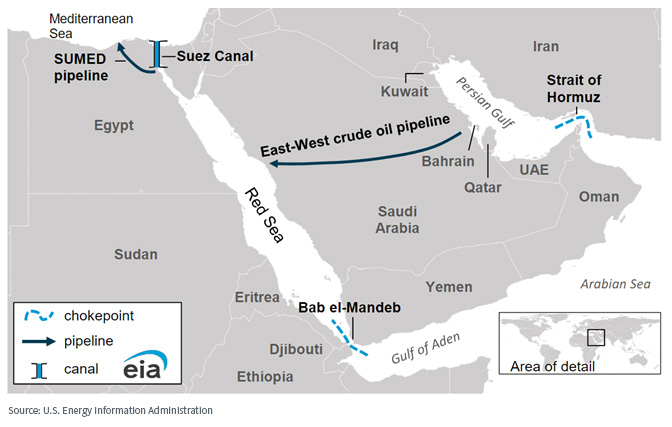

Arabian Peninsula Marine Choke Points

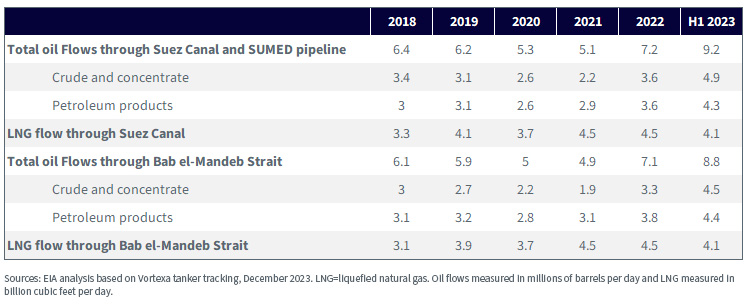

The Suez Canal and Bab el-Mandeb Strait are choke points around the Red Sea. According to EIA analysis, in the first half of 2023, 9.2 million barrels per day of oil and petroleum products passed through the Suez Canal and SUMED pipeline, and 8.8 million barrels per day of oil and petroleum products passed through the Bab el-Mandeb Strait.

Table 2: Suez Canal, SUMED Pipeline and Bab el-Mandeb Strait Choke Points

The region is critical for global oil transportation. Oil and fuel tanker traffic through the Red Sea has not fallen significantly yet, unlike Asia–Europe container ships, which have chosen to divert around the Cape of Good Hope in South Africa (adding an extra 14 days to shipments, according to S&P Global). However, the few that have paused their Red Sea shipments could become more numerous the longer the security concern in the area remains.

Could the Strait of Hormuz Be Next?

On Thursday, January 11, security concerns in the Middle East escalated further when Iranian state media reported that Iran’s elite Revolutionary Guards seized a tanker with Iraqi crude destined for Turkey. The seizure was in retaliation for the confiscation last year of the same vessel and its oil by the U.S. Last year the U.S. stopped the vessel as part of its enforcement of Iranian sanctions. Markets are becoming fearful that Iran and it proxies could disrupt oil moving out of the Strait of Hormuz, which is the world’s most important oil choke point. The Strait lies to the north of the point where the tanker was taken. More than 20 million barrels of oil per day move through the Strait of Hormuz, which could be more than a third of all seaborn oil, eclipsing both the Bab el-Mandeb Strait and the Suez Canal.

Will OPEC Adjust its Forecasts?

At the end of a volatile week, it appears security-related supply concerns overwhelmed demand concerns to drive oil prices higher. However, should supply issues be resolved, market focus could return to the demand side of the equation. Crude oil is an unusual market in that OPEC and partners control more than 50% of production. Their supply decisions can drive market balance and ultimately price. OPEC will publish its next monthly report on January 17. OPEC and its partner countries are restraining production with voluntary cuts of 2.2 million barrels per day until March 2024. Should demand forecasts be revised lower in the January report, that could build the groundwork for a deeper cut.

WisdomTree Investment Considerations

To hedge against further oil price rises stemming from the geopolitical and security-related supply concerns, investors could look to WisdomTree Enhanced Commodity Strategy Fund (GCC), which is an actively managed exchange-traded Fund that includes Brent and WTI oil futures exposures. Disruptions to shipping routes could push up the input prices for commodities more broadly and that could be reflected in this broad commodity offering as well.

Conversely, investors who want to incorporate commodities but with the ability to be more tactical on exposure, based on signals like momentum and trend, could look to the WisdomTree Managed Futures Strategy Fund (ticker WTMF). With rising correlations between stocks and bonds, WisdomTree thinks diversifiers like managed futures are becoming important to portfolios and this Fund has the ability to profit from both long and short positions in commodities.

Important Risks Related to this Article

GCC: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the price of futures contracts further from expiration may be higher (a condition known as “contango”) or lower (a condition known as “backwardation”) and the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WTMF: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise (or short-only indexes decline). The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or "whipsaw," the Fund may suffer significant losses. The Fund is actively managed thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.