Looking Back at Equity Factors in Q4 2023 with WisdomTree

Equities finished the year with a very strong fourth quarter. Global equities gained 11.4% over the last three months to close the year with a 23.8% positive performance. The lowering of the “higher for longer” rates’ fears and the awakening of small-cap stocks after three quarters of lackluster performance helped stocks edge higher. Overall, markets finished the year focusing on upcoming rate cuts; combined with decreasing inflation, this led to a reversal of the negative mood observed in Q3.

This installment of the WisdomTree Quarterly Equity Factor Review aims to shed some light on how equity factors behaved during this reversal and how this may have impacted investors’ portfolios.

- Overall quality and growth continued to dominate, but small cap joined the party this quarter. In the U.S. and Europe, small caps even posted the strongest outperformance.

- High dividend, value and min volatility posted the largest underperformance, suffering from the markets’ pivot to optimism.

- In emerging markets, the picture remained a bit different from the rest of the world, with most factors outperforming. Only momentum and min vol posted underperformance. Quality posted the strongest returns.

Looking to 2024, the equity outlook remains positive but quite uncertain. It appears rate cuts are coming, but a notable deterioration in economic data and continued disinflation may be required to validate expectations for significant policy easing in 2024 and to support equity markets. With non-dividend payers having benefited from an exceptional run over the last decade compared to high-dividend payers, 2024 may see a net expansion of the breadth of the market, leading to some mean reversion in favor of dividend payers. This could play a very important role in the performance of quality in the year ahead, pushing high-quality dividend-growing stocks to outperform high-quality tech stocks.

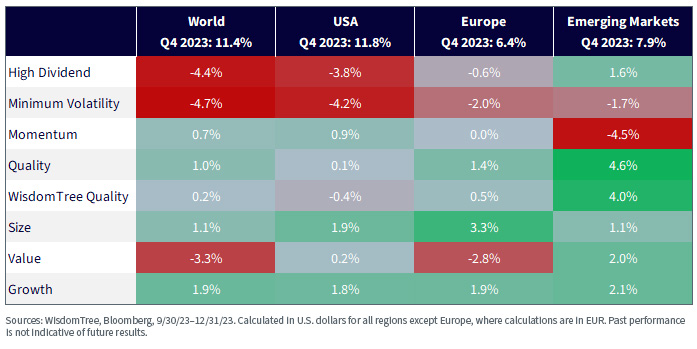

Performance in Focus: A Surprising Bull Run for Q4

In Q4, MSCI World (+11.4%) and MSCI USA (+11.8%) performed very strongly. European and emerging markets equities were weaker but still returned high single-digit performance. Overall, Tech megacaps continued to lead, but the market’s breadth increased, with small caps in the U.S. and Europe performing quite strongly.

Overall, Q4 ended up quite positive to factor investing:

- In global developed markets, growth and quality posted the strongest returns, in line with the rest of the year. Small cap finished third in a late revival after three quarters of lackluster performance.

- In the U.S. and Europe, small caps posted the strongest outperformance, followed by growth. Quality performed well in Europe, finishing third, but in the U.S., momentum grabbed the third place.

- Overall, in developed markets, high dividend, min volatility and, to a smaller extent, value suffered the bulk of the underperformance.

- In emerging markets, quality and momentum dominated, but like in previous quarters, most factors were able to produce outperformance over the quarter. Momentum was the standout loser in the region.

Figure 1: Equity Factor Outperformance in Q3 2023 across Regions

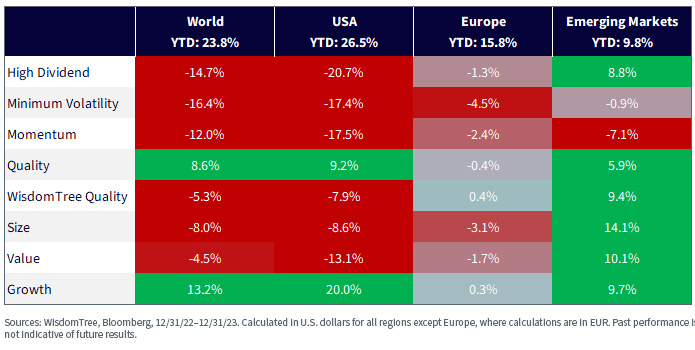

2023 in Review

Looking back at the full year, growth remained the clear winner in developed and U.S. equities with double-digit outperformance versus the market. In both regions, only quality managed to follow its lead, outperforming by almost 10% in both markets. All the other factors underperformed, with high dividend, min vol and momentum posting large underperformance.

In Europe, quality and growth also dominated the other factors but posted only minor outperformance. Minimum volatility and small caps were the standout losers in that region.

In emerging markets, all factors but momentum and min volatility did quite well in 2023. Small cap posted the strongest returns, followed by value and quality.

Figure 2: Equity Factor Outperformance in 2023 across Region

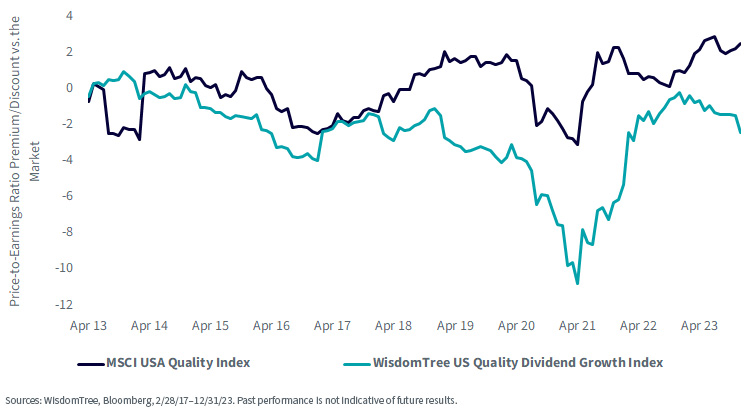

Is It Time for the Revenge of the Dividend Payers?

Research has shown that across markets, over the long term, big-dividend payers tend to outperform low-dividend payers or companies that don’t pay dividends at all. However, after the strong outperformance of Tech megacaps, including many non-dividend payers in 2023 and over the last decade in general, data from Dartmouth’s Ken French shows that over the last 20 years, the companies that paid no dividend outperformed the quintile that paid the highest dividends by the largest amount on record. Assuming some mean reversion, this could point to some resurgence of dividend payers.

This is of particular interest when looking at the quality factor. Quality continued to do well over the year, but over the last two years, we have observed a strong divergence in behavior between high-quality companies that pay dividends and those that don’t. In 2022, the quality dividend payers dominated, while the quality non-dividend payers did better in 2023.

To look at the impact of that divergence on “investable” portfolios, we consider:

- the MSCI USA Quality Index, which currently allocates a large proportion of the portfolio to Tech and high-quality, non-dividend-paying companies

- the WisdomTree U.S. Quality Dividend Growth Index, which focuses on high-quality, dividend-growing companies and, therefore, invests only in dividend-paying companies, leading to smaller allocations to Tech and the Magnificent Seven.

In figure 3, we observe that MSCI USA Quality, following the strong rally of Tech and the Magnificent Seven in 2023, is historically expensive compared to the market. On the contrary, with a discount of -2, the WisdomTree U.S. Quality Dividend Growth is currently quite cheap and getting cheaper.

Figure 3: Historical Price-to-Earning Ratio Premium/Discount vs. the MSCI USA Index

For definitions of terms in the chart above, please visit the glossary.

Taken together, this could indicate that high quality with a dividend tilt could be poised to take the lead in 2024.

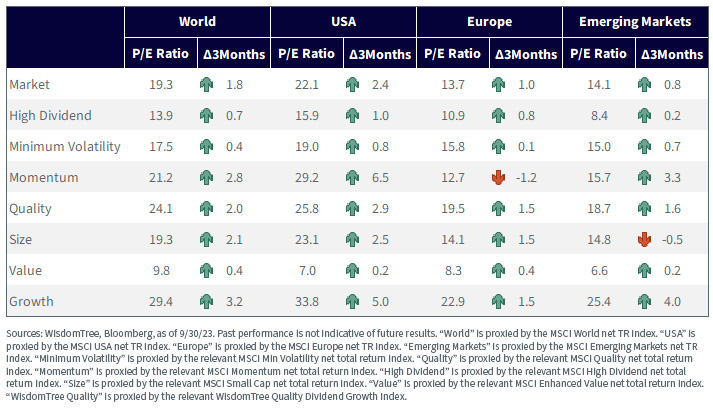

Valuations Increased in Q4

In Q4 2023, developed markets got more expensive following the sharp rally. All factors saw the price-to-earnings ratio increase over the quarter except for momentum in Europe. Growth saw the biggest increase across regions on average. Small caps and momentum follow just behind. In emerging markets, valuations increased across most factors bar small caps.

Figure 4: Historical Evolution of Price-to-Earnings Ratios of Equity Factors

Looking Forward to 2024

The equity outlook remains positive but quite uncertain. It appears rate cuts are coming, but a notable deterioration in economic data and continued disinflation may be required to validate expectations for significant policy easing in 2024 and to support equity markets. With non-dividend payers having benefited from an exceptional run over the last decade compared to high-dividend payers, 2024 may see a net expansion of the breadth of the market, leading to some mean reversion in favor of dividend payers. This could play a very important role in the performance of quality in the year ahead, pushing high-quality dividend-growing stocks to outperform high-quality tech stocks.

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree, Inc.