Quality Street

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

I have heard of playing around with numbers

But one is all I need

She can’t be beat; she makes me complete

On Quality Street

(From “Quality Street” by Van Morrison, 1991)

We last focused on the “quality” factor back in May with “Quality Is Job One.” Given the current market environment, it feels like it is time to revisit it.

At first thought, some might wonder what we mean by “current market environment.” The economy is proving to be more resilient than many expected, inflation is coming down, the Fed appears to be at or near the end of its rate hike cycle and, at least in the initial stages, Q3 earnings are in line with expectations. So, in the immortal words of Alfred E. Neuman, the perpetual “cover boy” for MAD magazine, “What, me worry?”

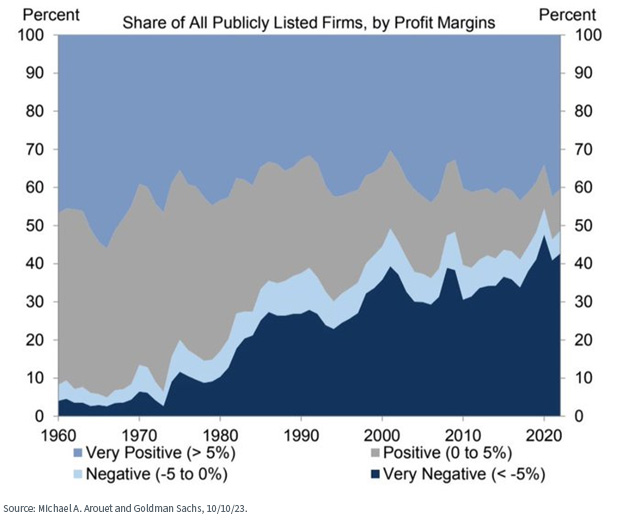

But let’s dig a little deeper. First, this chart shows the declining profit margins of almost half of all publicly listed U.S. companies.

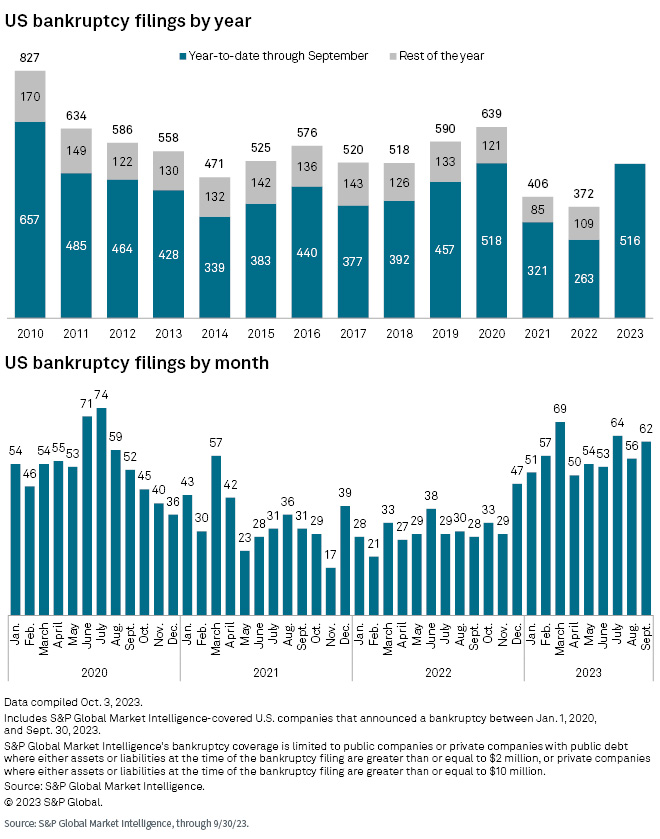

Second, we see a steady increase in bankruptcies so far in 2023—the highest level since the COVID-19 pandemic of 2020.

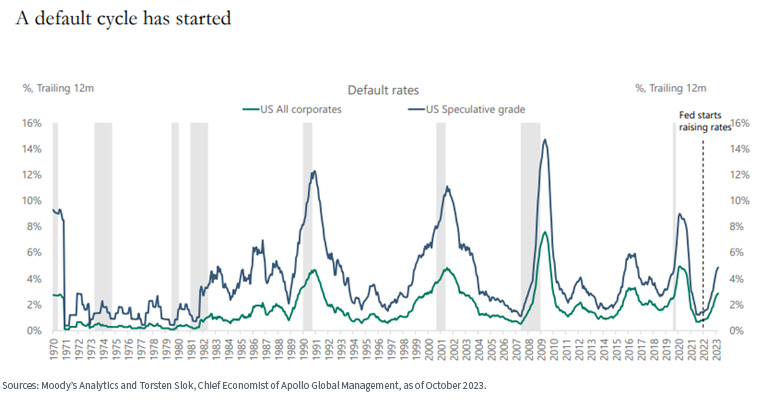

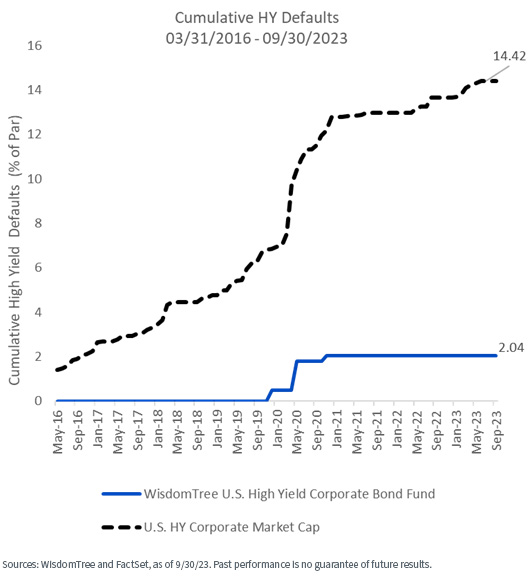

We could go on but will share just a few more charts, this time from the bond market, which is showing a steady increase in default rates.

Also, while many companies did a respectable job of terming out their debt when rates were exceptionally low, both investment-grade and high-yield bonds face sizable “maturity walls” over the next 12–36 months (meaning they will need to refinance in a much higher interest rate environment).

Let’s be clear. We are not taking on the character of “Chicken Little” and proclaiming “the sky is falling.” We simply want to illustrate that, much like a duck on a pond, everything may look smooth and serene on the surface, but underneath the water, there is more action going on than meets the eye. Said differently, we see more fragility in the market environment than the headline numbers may suggest.

Which brings us back to the quality factor.

Let’s define terms. “Quality” has its roots in the well-known DuPont Analysis, which defines quality as firms with better relative margins, earnings, cash flow and balance sheets (ROE, ROA and leverage, respectively). At WisdomTree, we extend that line of thought to include companies with better dividend sustainability and pricing power (i.e., the ability to withstand margin pressures in times of economic distress).

We measure this through our proprietary “composite risk score,” which seeks to find the highest-quality securities in many of the Indexes we manage.

Remember, WisdomTree is a “self-indexing” firm—we do not license most of our Indexes from third parties but create and manage them ourselves and then wrap ETFs around them, thereby giving us control over the screening filters and which securities go into those ETFs.

Why Does Quality Matter?

Let’s examine DGRW, our Morningstar five-star* large-cap quality dividend growth strategy. First, let’s look at its quality metrics relative to the S&P 500 Index.

*Overall rating. Large Blend (1,286 funds) as of 9/30/2023. Based on risk-adjusted returns.

For definitions of terms in the table above, please visit the glossary.

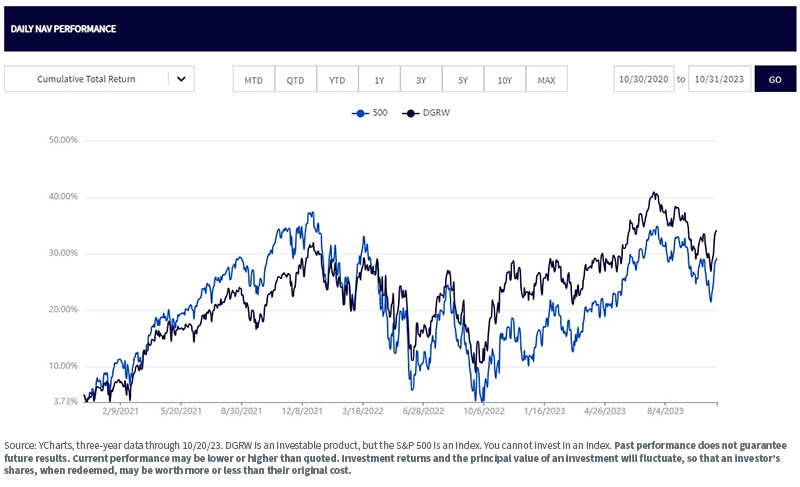

We see that over the past three years (including the awful 2022), DGRW added value versus the broader market index.

For the most recent month-end and standardized performance, click here.

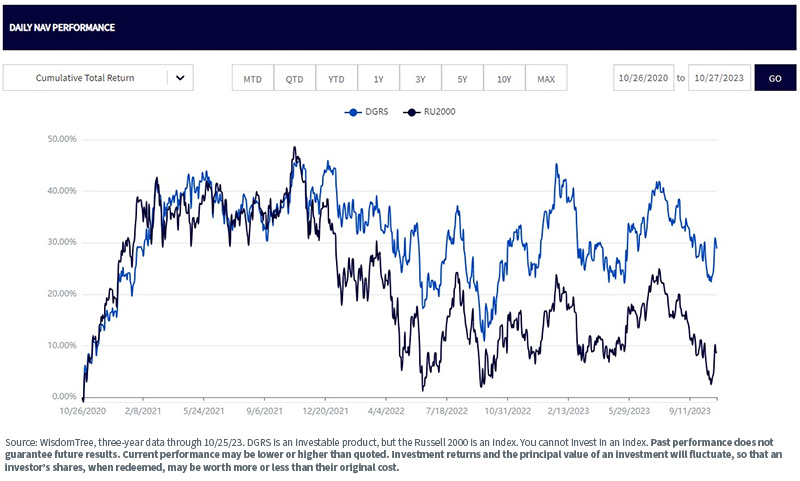

We see a similar story in small-cap stocks.

Using DGRS, our small-cap quality dividend growth strategy, as a comparison, we see quality metrics versus the Russell 2000 Index…

…as well as attractive performance.

For the most recent month-end and standardized performance, click here.

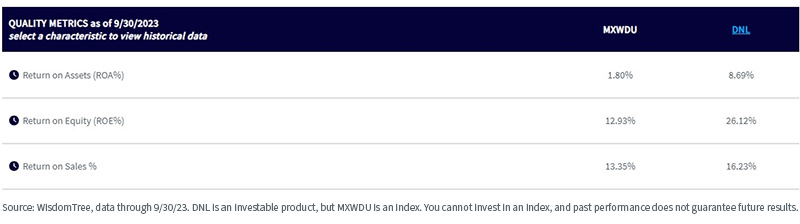

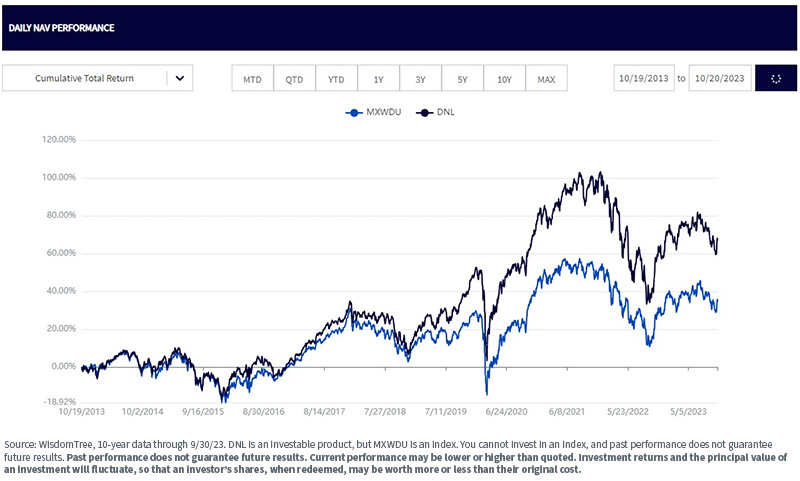

Finally, we see that quality has outperformed outside the U.S. as well. Here we compare the quality characteristics of DNL, our global ex-U.S. quality dividend growth strategy, versus its benchmark, the MSCI ACWI ex USA Index (MXWDU), using the primary DuPont Analysis metrics.

And now, we compare performance over the past 10 years.

For the most recent month-end and standardized performance, click here.

What about Fixed Income?

The more than 100-basis-point increase in the 10-Year Treasury rate over the past three months is well documented and widely discussed. What is less discussed is the widening of credit spreads (especially in high yield) over that same period.

In a market environment marked by rising interest rates and widening spreads, quality can be equally as important in fixed income as it is in equities. Focusing on our high-yield strategy, WFHY, it accesses the broad U.S. high-yield market with an important caveat—it screens out issuers with negative cash flow. The result is a far lower default rate in comparison to the broader high-yield market.

Default rates in the age of low interest rates were low, perhaps leading some investors to wonder why quality screens matter

A fair question, but one that may have a different answer going forward. We saw above that default rates are climbing, and many high-yield issuers face an impending “maturity wall.” We believe quality will be as important for fixed income going forward as it is for equities.

Conclusion

Here at WisdomTree, we will never apologize for anchoring many of our products and Model Portfolios to the quality risk factor. Historical performance suggests that doing so provides the potential for much more consistent performance over full market cycles.

Given what we believe will be volatile and uncertain markets over the remaining course of 2023 and beyond, we have an even higher conviction in tilting toward the quality factor.

We are more than happy to continue to walk along “quality street”.

Contact Us

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal.

DGRW/DGRS: Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

DNL: Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

WFHY: Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments.

Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance.

The top 10% of products in each product category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- and five-year Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns.

Overall ratings shown for funds with four or five stars only.

HISTORY:

3-Year | 4 out of 5 stars - Large Blend (1,286 funds)

5-Year | 4 out of 5 stars - Large Blend (1,184 funds)

10-Year | 5 out of 5 stars - Large Blend (877 funds)

Morningstar ratings are based on risk-adjusted return. Past performance is not indicative of future results.