Quality Is Job One

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“Quality Is Job One”

(Iconic advertising slogan for the Ford Motor Company for most of the 1980–90s)

In this blog post, we focus on the quality risk factor. Why? Two reasons: (1) it permeates and forms the anchor of many WisdomTree products and Model Portfolios; and (2) we believe it will become increasingly important as we sail through the uncertain seas of the remainder of 2023 and beyond.

First, let’s define terms. “Quality” has its roots in the well-known DuPont analysis, which defines quality firms as those with better relative earnings, cash flow and balance sheets (ROE, ROA and leverage, respectively). At WisdomTree, we extend that line of thought to include companies with better dividend sustainability and pricing power (i.e., the ability to withstand margin pressures in times of economic distress).

We measure this through our proprietary Composite Risk Score, which seeks to find the highest quality securities in many of the Indexes we manage. (Remember, we are a “self-indexing” firm—we do not license most of our Indexes from third parties, but create and manage them ourselves, and then wrap ETFs around them, thereby giving us control over which securities go into those ETFs.)

Why Does Quality Matter?

Historical analysis suggests that quality is the most consistent performer of the various equity risk factors. It is rarely the best or worst performing factor, but is the most consistent, which is why it anchors many of our products and most of our Model Portfolios.

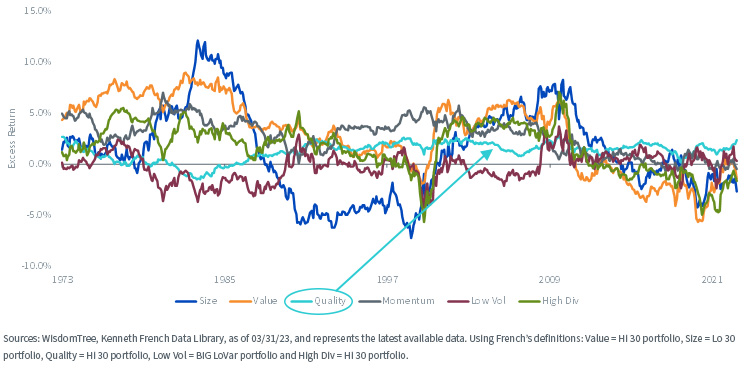

The following chart is busy, but focus on the teal line, which represents the historical performance of the quality factor.

Rolling 10-Year Excess Return vs. Market

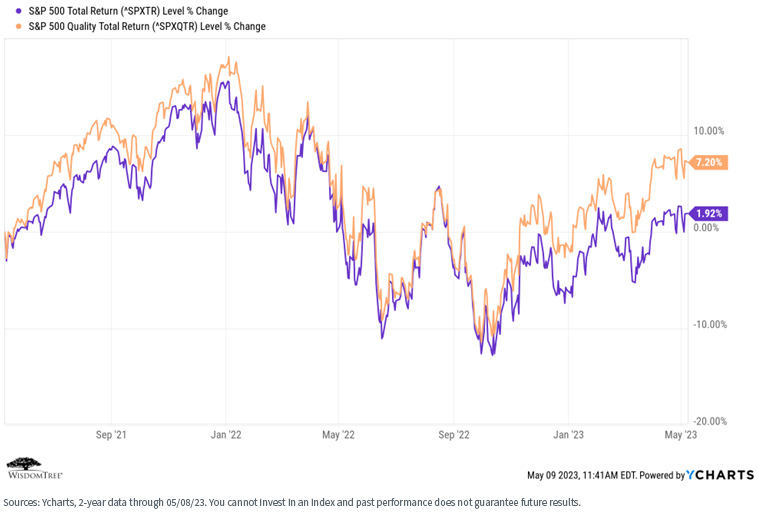

We see that over the past two years (inclusive of the awful 2022), quality added significant value in large-cap stocks…

…and in small- and mid-cap stocks (using the S&P 600 and Russell 2000 indexes as proxies. The S&P 600 is considered a higher quality index because it excludes a higher percentage of negative earners).

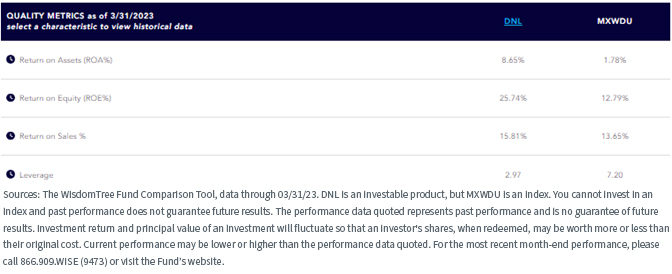

Longer term, we see that quality has outperformed outside the U.S. as well. Here we first compare the quality characteristics of our own DNL ETF, which is our Global ex-U.S. Quality Dividend Growth product and which filters its security selection through our composite risk score, versus its benchmark MSCI AC World ex-US Index, using the primary DuPont analysis metrics.

And now we compare performance over the past 10 years.

What about Fixed Income?

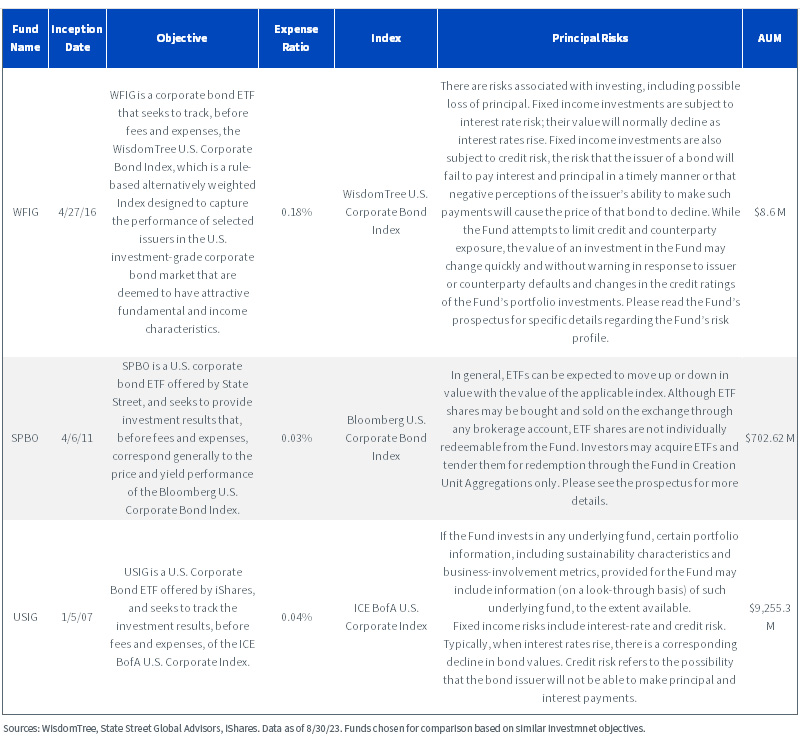

In a market environment marked by a slowing economy and rising interest rates, quality can be as important in fixed income as it is in equities. We apply quality filters to our security selection for both our U.S. Corporate Bond Fund (WFIG) and our U.S. High Yield Corporate Bond Fund (WFHY).

The quality screens for WFIG include free cash flow over debt service, leverage ratio, and return on invested capital (ROIC). We then eliminate the lowest scoring 20% of issuers based on those metrics, by sector.

Despite these quality screens, investors have sacrificed little total return over a common performance period versus broad market U.S. corporate bond ETFs.

For the most recent month-end and standardized performance, current yield, and to download the fund prospectus, click the respective ticker: WFIG, SPBO, USIG.

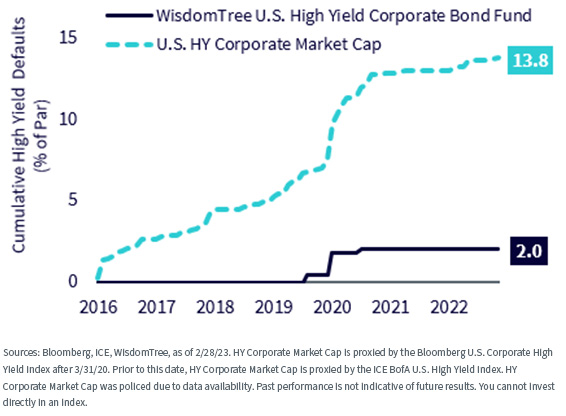

Our WFHY product accesses the broad U.S. high-yield market, but with an important caveat—it screens out issuers with negative cash flow. The result is a far lower default rate in comparison to the broader high-yield market.

Cumulative HY Defaults (Mar '16–Feb '23)

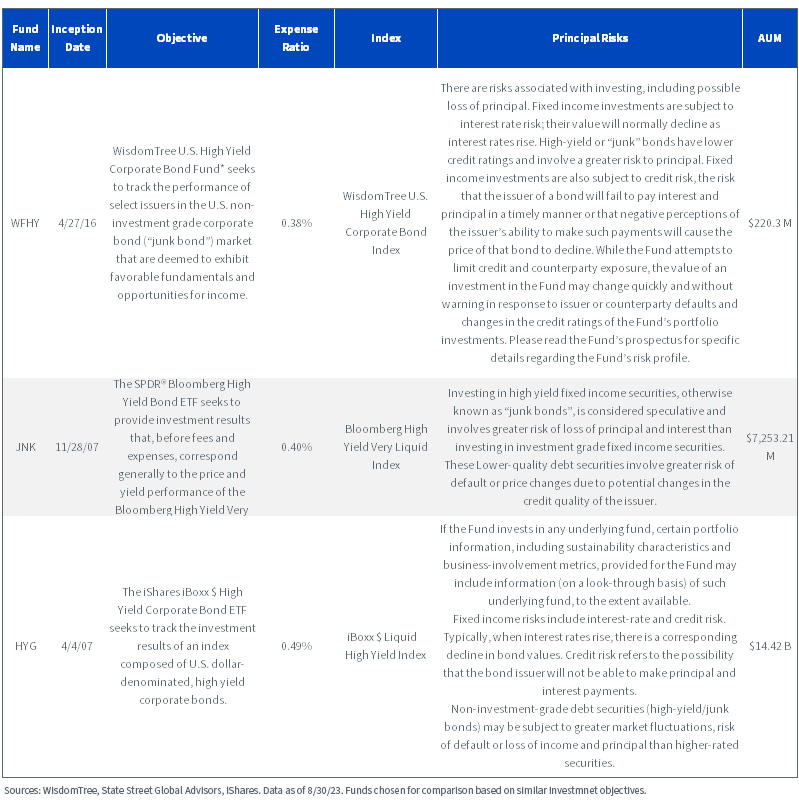

Over a common performance period, however, WFHY has not sacrificed total return relative to broader market competitors.

For the most recent month-end and standardized performance, current yield, and to download the fund prospectus, click the respective ticker: WFHY, JNK, HYG.

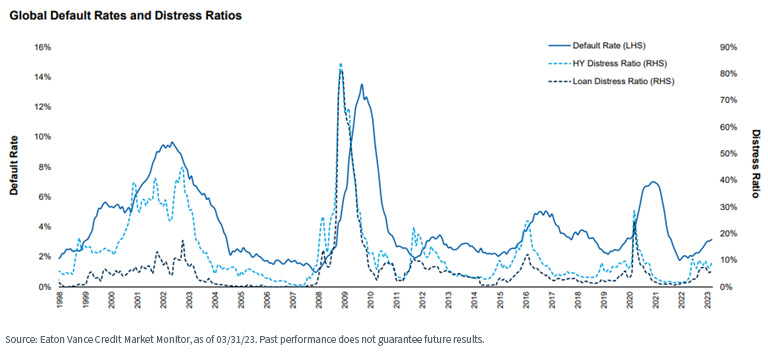

An important consideration is as follows. Default rates in the age of low interest rates were low, perhaps leading some investors to wonder why quality screens matter.

A fair question, but one that may have a different answer going forward. Consider the trend lines of default rates for both corporate and high yield bonds—still low but trending in the wrong direction.

Default Rates Remain Low, But Signs of Distress Are Increasing

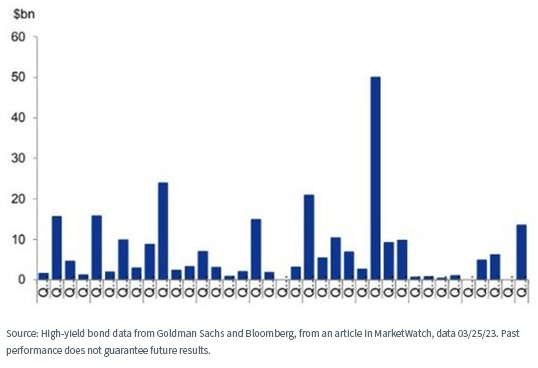

Q1 Defaults have Already Surpassed the Full Year Totals of 2021 and 2022 Combined (Quarterly Volumes of Defaulted USD Corporate Debt)

Conclusions

Here at WisdomTree, we will never apologize for anchoring many of our products and Model Portfolios to the quality risk factor. Historical performance suggests that doing so provides the potential for much more consistent performance over full market cycles.

Given what we believe will be volatile and uncertain markets over the remaining course of 2023 and beyond, we have even higher conviction in tilting toward the quality factor.

As the ad slogan said, at WisdomTree, “Quality Is Job One.”

Contact Us

Important Risks Related to this Article

DNL: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

WFIG & WFHY: There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Funds attempt to limit credit and counterparty exposure, the value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Funds’ portfolio investments.

Please read the Funds’ prospectus for specific details regarding the Funds’ risk profiles.