2023 Market Update: Buyer Beware

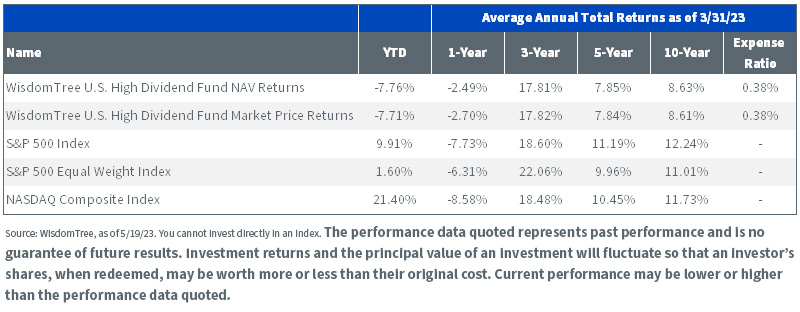

While many investors bemoaned market returns in 2022, a bright spot in the U.S. market was the WisdomTree U.S. High Dividend strategy (DHS). Although the high-growth Nasdaq Composite Index declined 19.21% and the S&P 500 Index declined 18.11%, DHS was up 7.88%, providing one of the few bright spots of 2022.

Despite near-term headwinds, our team believes there could be a multi-year cycle for value investing, and DHS represents one of the lowest-priced segments of the market.

For the most recent month-end and standardized performance as well as Fund holdings, click here.

What’s Driving Returns

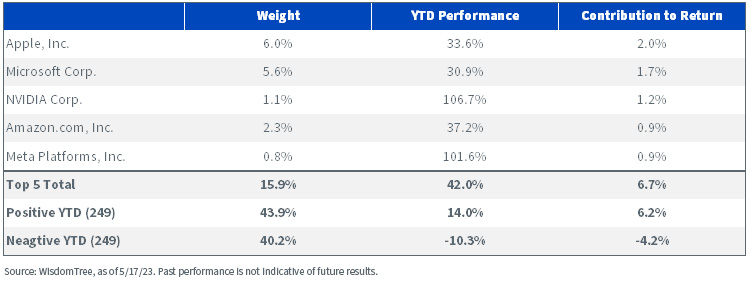

The challenge investors currently face putting fresh dollars to work in the S&P 500 centers around narrow market leadership and concentration risk. The S&P 500’s return year-to-date was driven almost entirely by five stocks that either comprise a large percentage weight or have returns that may be difficult to sustain going forward.

Given the current macro uncertainty, we still believe in anchoring portfolios to high-quality dividend payers with attractive levels of income.

YTD: S&P 500 Contribution to Total Return

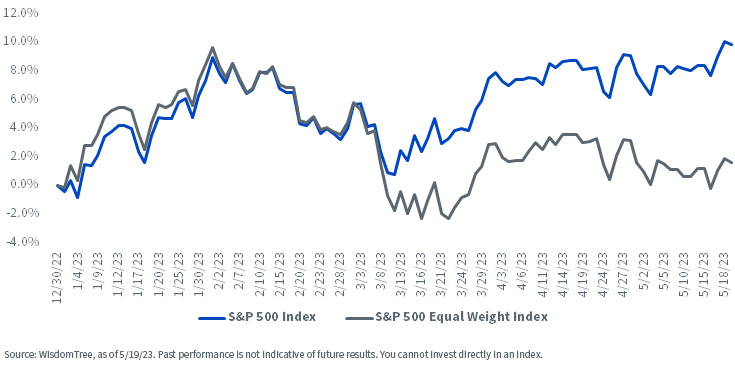

Seen another way, the dispersion between the S&P 500 Equal Weight Index and the S&P 500 Index is at some of the most stretched levels of the last five years. In short, the market would be modestly positive YTD but for the concentration in a few select names.

Year-To-Date Returns

Looking under the Hood

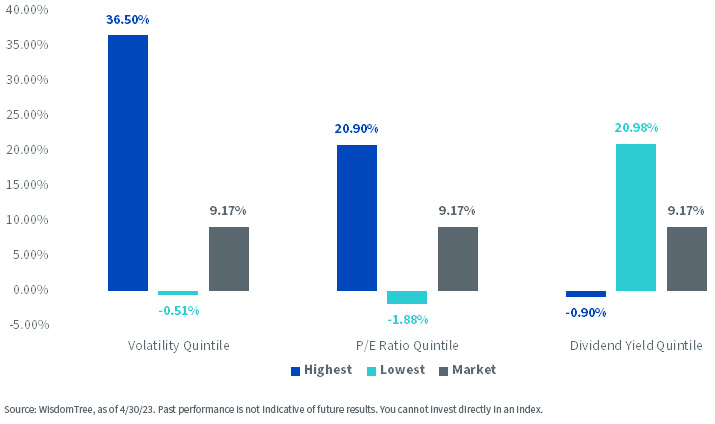

Additionally, performance so far this year appears to be the exact opposite of 2022. When ranking stocks into quintiles, we see that high-volatility, high-P/E and low-dividend-yielding stocks are outperforming the market by double digits.

YTD S&P 500 Index Total Returns

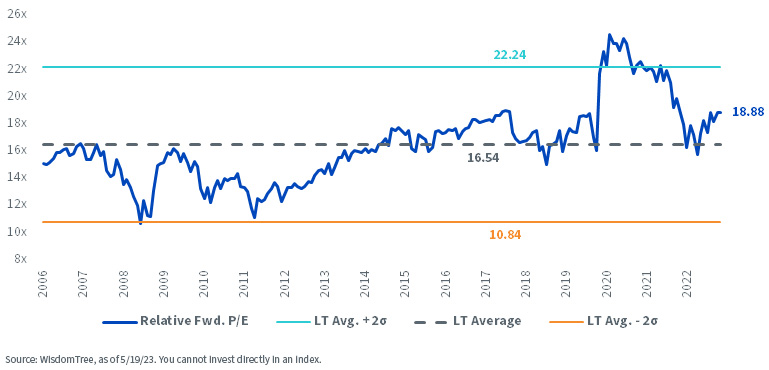

Turning to valuations, the market is not cheap. Our daily market dashboard shows the S&P 500 currently trading at 18.9x forward earnings or a 5.3% earnings yield. While not quite at the extremes we saw in 2021, the challenge will be maintaining these levels of earnings given that we are near peak margins for S&P 500 companies. Should the economy continue to soften in the face of Fed rate hikes, the market may be disappointed.

S&P 500 Index Forward P/E Ratio

Tilting Away from Concentration Risk

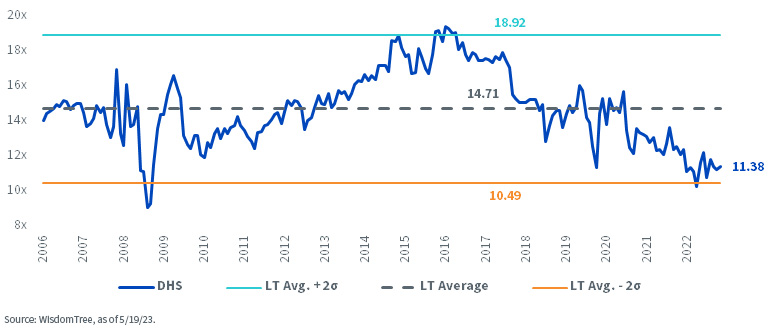

So, after looking at a rather challenging market for returns, what is an investor to do? We think anchoring to companies with strong fundamentals, attractive levels of income and cheap valuations may be a solid option over the next 12–18 months. With comparable quality metrics versus the market (return on equity of 17.7% vs. 18.4%), a dividend yield of 4.75% and 11x forward earnings, DHS could make a lot of sense for investors. While performance has lagged year-to-date on account of the high-vol, low-dividend and high-P/E stock rally, we think valuations are compelling.

Dividend yield as of 5/9/23. The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please click here.

DHS Forward P/E Ratio

While cheap valuations aren’t a catalyst on their face, they do help solve many of the challenges we’ve highlighted for market returns going forward. With the Fed committed to bringing inflation lower, we believe a high-dividend strategy like DHS may provide investors with an additional margin of safety should the narrative of a less aggressive Fed not materialize.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.