What’s Driving Returns in Emerging Markets?

If you were to distill WisdomTree’s views on asset allocation right now, we like high-quality stocks with low valuations that pay high levels of dividends. The region where we’re seeing these views shine the most is in emerging markets. Despite the uncertain outlook for China, we think these three factors can continue to shine in the coming months.

Persistent Outperformance

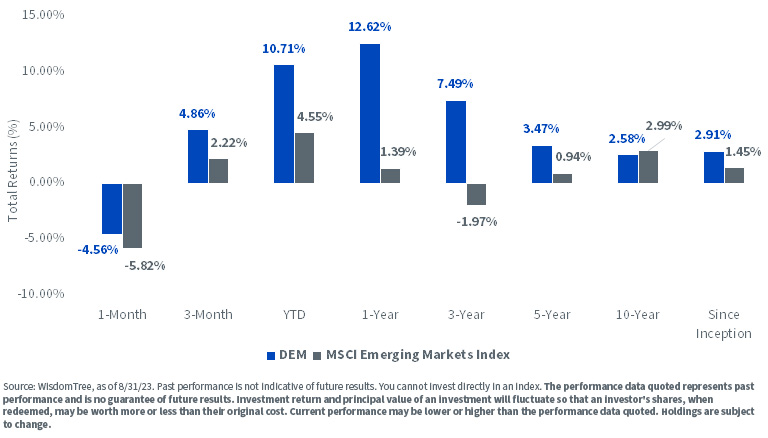

We first launched the WisdomTree Emerging Markets High Dividend Fund (DEM) back in 2007. While the narrative around emerging markets has changed significantly since that time, we are continuing to see our approach to EM add value compared to market cap-weighted approaches. As we show below, DEM is outperforming on a one-month, three-month, year-to-date, one-year, three-year, five-year and since-inception basis.

DEM vs. MSCI Emerging Markets Index

For the most recent month-end performance and SEC Standardized performance, click here.

What’s Driving Returns?

Drilling deeper into the numbers, we examine the three factors that we think are most responsible for generating outperformance over market cycles.

Dividends for the Long Run

In a recent piece, we showed that dividends accounted for nearly 30% of total returns for the S&P 500 Index going back to 1957. This is rather remarkable given that dividend yields for the U.S. have been below 2% as companies focused on share buybacks rather than dividends as a way of returning capital to shareholders. In emerging markets, nearly 86% of the investable universe pays dividends versus only 73% in the U.S.1 are north of 4%. For this reason, we believe focusing on dividend payers is one way to increase income potential, but also deliver attractive long-term performance.

In the table below, by breaking the market into five separate groups based on dividend yield, we show that since inception, the highest-yielding quintile of the MSCI Emerging Markets Index delivered the highest total returns. While not always the case, the most direct way to add value over this time period would be by shifting weight into the highest-yielding segments of the market as we do in the WisdomTree Emerging Market High Dividend Index.

Dividends Driving Returns: 5/31/07–8/31/23 Attribution of WTEMHY vs. MSCI EM Index

Valuations

Over the medium term, we believe valuations matter. While emerging markets tend to trade at discounted valuations relative to developed markets on account of structural factors and risk, allocating to cheaper segments within emerging markets has also been a strong differentiator for returns.

Over the last three years, high flying stocks, predominantly from China, have struggled to deliver on elevated expectations from the market. By contrast, anchoring a portfolio to low P/E stocks has been a solid way to deliver double-digit returns on an annualized basis. While some investors may feel concerned that they “missed the trade,” DEM has consistently traded at a less than 10 times P/E ratio over this period. This contrasts to the broader market that has ranged from 11 times to 22 times.

Valuations Matter: 8/31/20–8/31/23 Attribution of WTEMHY vs. MSCI EM Index

Quality

Quality is perhaps the most important factor globally at the moment. Investors are continuing to reward companies that are able to generate attractive levels of return in capital-efficient businesses. Over the past year, companies generating the highest return on equity (ROE) delivered double-digit returns whereas companies at the bottom of the quality spectrum struggled. In our view, the combination of high-quality companies with attractive dividend yields remains one of our preferred ways of owing emerging markets for the long run.

Quality Rewarded in EM: 8/31/22–8/31/23 Attribution of WTEMHY vs. MSCI EM Index

While investing in emerging markets continues to carry risks not generally associated with more developed markets, we believe focusing on fundamentals can add value over market cycles. By focusing on high-quality companies that pay attractive dividends, our valuation-sensitive approach to EM has delivered consistent returns that have generated excess returns versus the market.

1 Source: WisdomTree, as of 8/31/23.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.