Thinking International: Sector Exposures Complement (and Complete) the Economic Cycle

This blog is the first installment of a four-part series that examines the tactical and strategic case for investing internationally despite a multi-year period of U.S. equity outperformance.

Over the past several months, we’ve fielded a series of questions from advisors about why they should EVER allocate outside of the U.S. For the last decade, U.S. equities have handily outperformed, meaning that any allocations apart from U.S. large-cap exposure have probably cost investors returns. However, we feel this comparatively short-sighted period of performance-chasing misses a key consideration of prudent investing.

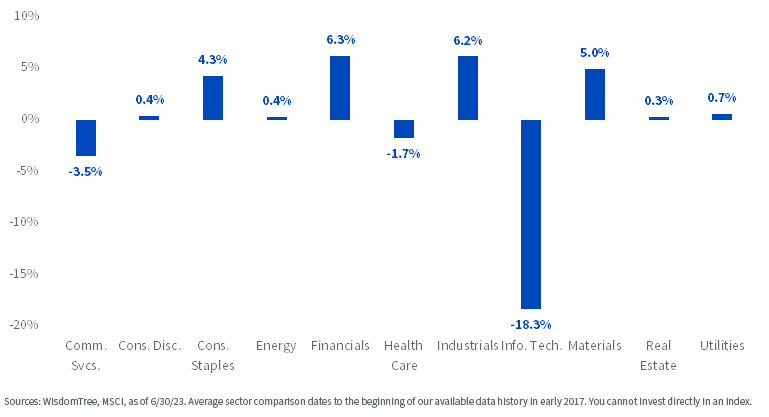

A major part of international equities’ appeal is that they provide sector exposures dissimilar to what U.S. investors are familiar with. In style investing parlance, we often categorize developed equity markets as value-focused (and cyclical, from an economic standpoint) while the U.S. is growth-centric.

These tendencies materialize through notable industry tilts between the U.S. and developed market equity universes. Over the past several years, international equities maintained over-weight exposures to the Financials, Industrials and Materials sectors, all of which are cyclical economic bellwethers. These exposures almost entirely come at the expense of Information Technology and (to a lesser extent) Communication Services, two sectors that have come to define U.S. equity investing due to mega-cap heavyweights like Apple, Amazon, Microsoft, Alphabet and more.

Avg. Sector Over-/Under-Weights: MSCI EAFE vs. MSCI USA

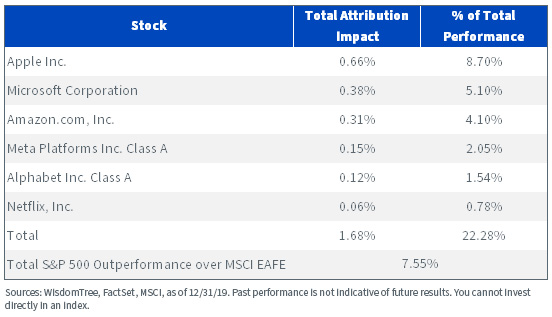

Though U.S. equities have led international stocks for more than 20 years now, their outperformance has not been broad-based. It’s important to decompose the outsized impact some of these companies have had on a domestic portfolio.

During the 2010–2020 decade, the S&P 500 outperformed the MSCI EAFE Index by 7.5% per year, annualized in U.S. dollar terms.1 The MANAMA cohort (Meta, Apple, Netflix, Amazon, Microsoft and Alphabet) alone contributed 1.68% toward that advantage, or roughly a quarter of overall annual outperformance.

S%P 500 MANAMA Attribution vs. MSCI EAFE (2010–2020)

Broader sector effects were similar. Information Technology, the largest over-weight exposure in the U.S. relative to developed international, contributed 2.3% of the 7.5% annualized outperformance per year, or about 30% of the advantage.

Through this lens, the extent of the U.S.’s success seems like an anomaly more than a foregone conclusion. The absence of a similar Information Technology and Communication Services footprint overseas, therefore, is advantageous for U.S. investors because it helps provides exposure to the complete economic cycle while avoiding overconcentration. A global portfolio can potentially generate higher returns from anchor positions in U.S. growth, while participating in market rotations to value stocks and other cyclical beneficiaries.

Digging Deeper

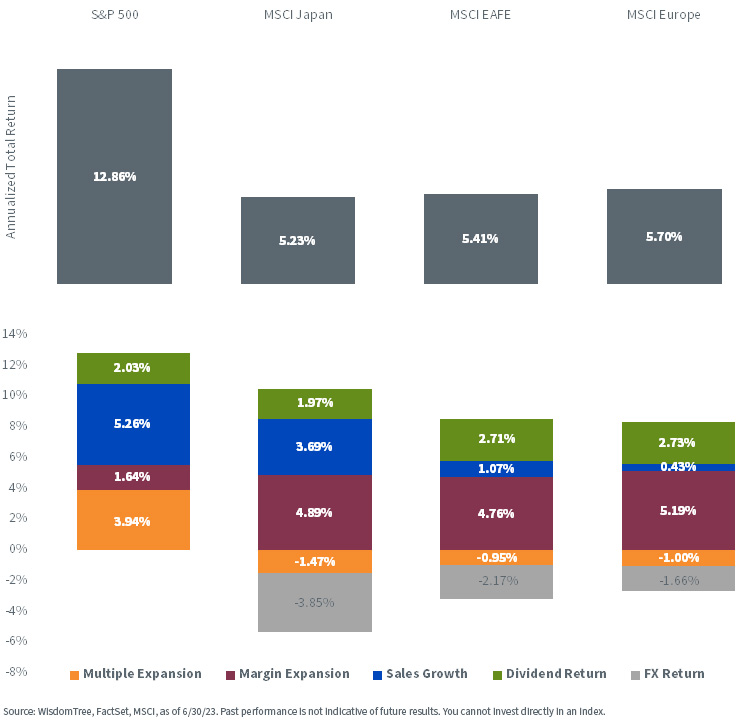

Over the past 10 years, U.S. outperformance has been predicated on steady support from valuation changes, fundamental drivers and positive currency effects. If previous market cycles are any indication, it appears unlikely that every driver of returns will continue to favor the U.S. versus the rest of the developed world.

Return Attribution (Trailing 10-Year)

Roughly half of the S&P 500’s 12.9% annualized return from June 2013 through June 2023 is attributable to business successes at the top and bottom lines. Over 5% came from sales growth, while operational efforts to grow earnings relative to costs added another 2% through margin expansion. Dividends delivered another 2%, while dollar strength relative to other currencies weighed on returns overseas.

But the U.S. also received a boost from a speculative component absent in the EAFE (Europe, Australasia and the Far East), European and Japanese equity markets: multiple expansion. U.S. investors happily paid more per dollar of company earnings over the past decade, propelling many S&P 500 constituents higher and adding 4% to the index’s annualized return in the process.

Abroad, however, an interesting phenomenon occurred.

Unlike the U.S., the EAFE, European and Japanese markets instead whittled down the prices they were willing to pay per unit of earnings, resulting in multiple contraction which weighed on returns.

Meanwhile, however, the equity fundamentals of each region surprisingly improved. The combination of margin expansion and strong sales growth contributed over 5% to total returns in EAFE and Europe and nearly 9% in Japan. Dividends between the two regions added 2.7% apiece (and 2% in Japan), resulting in return contributions due to fundamental factors ranging from 8% to 11% across all three regions.

Despite improving fundamentals, overseas multiples contracted, creating an attractive valuation opportunity and potential entry point for developed international equities.

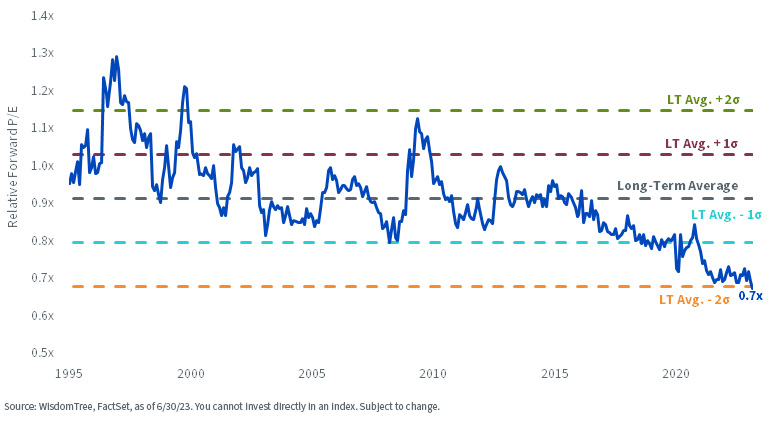

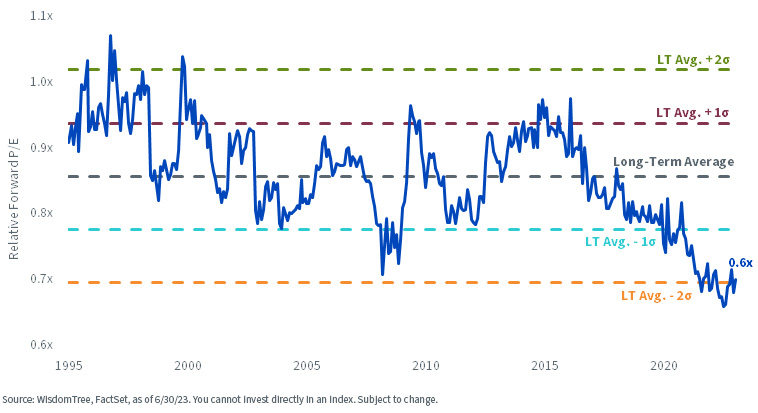

Relative to the U.S., developed equity market multiples remain two standard deviations below their long-term averages on a forward earnings basis. Both the MSCI EAFE and MSCI Europe indexes currently trade at about 0.7 times the forward P/E of the S&P 500, below their long-term averages of 0.9 times apiece.

MSCI EAFE vs. S&P 500

MSCI Europe vs. S&P 500

Both markets’ relative valuations steadily declined over the past decade, indicative of the “melt-up” in U.S. equities while overseas investors preferred cheaply valued shares. The trend is similar in Japan, which currently trades at 0.8 times the U.S. forward P/E, well below its 1.3 times long-term average.

The average relative multiples imply that EAFE and Europe historically traded at slight discounts to the U.S., which is reasonable considering that the latter has been the preeminent return driver in global equity markets. Japan, however, historically commands a premium to the U.S., which is unusual since it has been mired in a low-growth environment for most of our recent memory.

With current valuations for all three markets comfortably below their long-term averages (and some rejecting historical relationships in the process), the prevailing discounts are compelling when coupled with robust equity fundamentals fueling long-term returns. For investors looking to increase exposure to EAFE, we believe the WisdomTree International Quality Dividend Growth Fund (IQDG) could be well positioned to capitalize on these market trends.

To access the complete developed international market insight, click here.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Heightened sector exposure increases the Fund’s vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.