Is the SaaSacre behind Us? Our Conversation with Bessemer Venture Partners

We recently had the pleasure of speaking with Janelle Teng of Bessemer Venture Partners (BVP) as part of our series of Thematic Office Hours. Janelle is a vice president in BVP’s San Francisco office, and she is focused primarily on cloud software, infrastructure and developer platforms. For anyone unable to attend but still interested in software and cloud computing, we wanted to summarize the key takeaways from the discussion.

The SaaSacre1 of 2022

We had to start by recognizing the feeling of our current environment, which comes largely from what BVP has termed the “SaaSacre” of 2022. What is a SaaSacre? If one pulls up the return of the BVP Nasdaq Emerging Cloud Index during 2022 and sees a figure worse than -40%, then they will see it. The market underwent a complete adjustment to valuations across the board, going from the peak levels observed in late 2022 to levels much, much lower, reflecting, among other things, a higher general interest rate environment brought on by the U.S. Federal Reserve. Investors in SaaS companies tended to see an opposite relationship during 2022, where, as interest rates rose, SaaS valuations fell, and vice versa.2 While it is logical that companies that expect to deliver cash flows far into the future would see their valuations impacted by interest rates, the relationship is not always so stark.

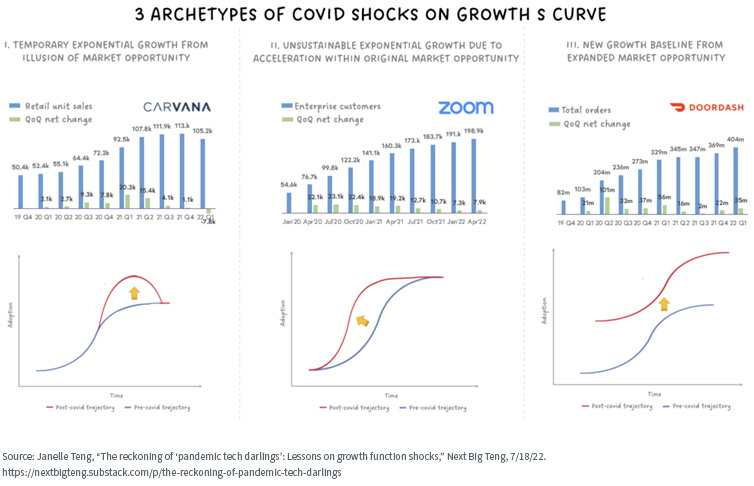

The Three Archetypes of COVID-19 Shocks on Growth S-Curves

The S-curve is a commonly used heuristic to help investors relate time, plotted on the horizontal axis, to adoption, plotted on the vertical axis. A steeper S-curve = faster adoption. An S-curve moved vertically upward = larger adoption. The COVID-19 pandemic was a shock that changed the position of the S-curves of various SaaS companies. If we can understand at least a few archetypes of how this occurred, it can help us to better evaluate how companies are doing now, largely on the other side of the shock. We show these examples in figure 1:3

- Temporary Exponential Growth from Illusion of Market Opportunity: This shock would appear as a bulge upward in the upper portion of the S-curve—telling us that adoption picked up rapidly for a time before dropping back to the original trend.

- Unsustainable Exponential Growth Due to Acceleration Within Original Market Opportunity: This shock would appear as a steeper S-curve, with the rising slope pulled further to the left telling us that adoption was occurring suddenly, faster—with the top level peaking at the same place as originally intended but just arriving there sooner. Many people are familiar with Zoom Video Communications; this company’s pandemic experience seems to be largely consistent with this archetype.

- New Growth Baseline from Expanded Market Opportunity: While it may be easy for CEOs to tell us all a story about how they now have a “new growth baseline,” it is far more difficult to actually deliver and execute on than it is to say. If there is one area where this happened, it was in food delivery, in that, after the pandemic, it is true that the general person does think differently about using certain services, be it Uber Eats or DoorDash.

Figure 1: Illustrating the Three Archetypes

The Difficulty of Making Predictions

In thematic topics, it is frequently difficult to make predictions about growth rates and the ultimate sizes of given markets. In the conversation, we talked about an example of some forecasts that Gartner had made regarding worldwide public cloud service revenues.4

- In April 2019, the prediction for 2022 was $331 billion.

- In April 2022, the prediction for 2022 was $495 billion, significantly higher.

Initial Public Offerings (IPOs) and Mergers & Acquisitions (M&A)

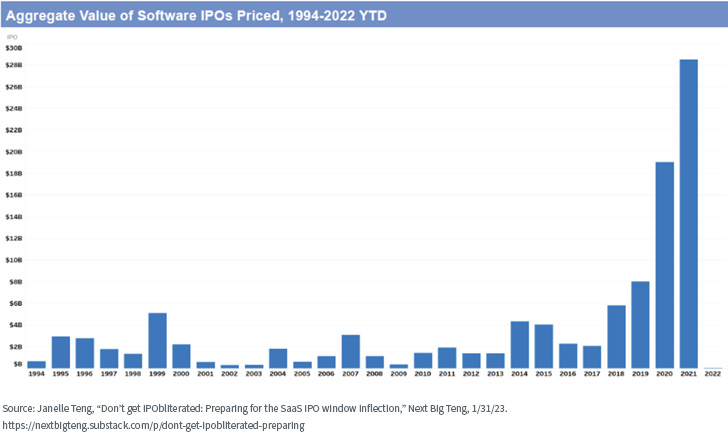

We spent time talking about what we were seeing—or, put more accurately, weren’t seeing—in 2022, and that was IPOs. A significant benefit of speaking with Janelle and BVP is that there is a sense of history. We can recognize that 2021 was an outlier year in that the aggregate value of software IPOs priced was in the vicinity of $28 billion. Even without the historic shift in policy at the U.S. Federal Reserve, figure 2 shows that matching anything close to 2021’s result was going to be difficult.

Figure 2: 2020 and 2021 Were HUGE Years in the Software IPO Market

Within the category of corporate actions, sometimes you see M&A—and Adobe’s intended purchase of Figma was a big example—and then sometimes you see private equity players making investments. So-called “take-privates” in 2022 were extremely active, and we saw many such examples throughout the year.

Growth vs. Profitability

One of the questions we often hear regards what is more important, growth or profitability? In recent years, maybe the real answer sounds something like, “It depends when you ask.” It’s very clear that those of us following the software space in 2018 and 2019 saw that growth was of the utmost importance. In 2022, on the other hand, we were hearing a lot more about profitability.

Janelle was able to walk through some work done by BVP within the 2023 State of the Cloud report, the gist of which was, when considering the impact on valuations:5

- November 2021: Revenue growth was about six times as impactful on valuations as profitability.

- October 2022: The importance of revenue growth and profitability were roughly equal in their impact on valuations.

- April 2023: Revenue growth was about two times as impactful on valuations as profitability.

The true conclusion: It is never all growth, and it is never all profitability, but it is important to be aware of how the focus on these measures can ebb and flow across time.

Generative AI Is Going to Be Everywhere

Janelle and I spoke the day after Microsoft reported its quarterly earnings for the period ended March 31, 2023. We briefly touched on this quote from Amy Hood, Executive Vice President and Chief Financial Officer:6

In Azure, we expect revenue growth to be 26% to 27% in constant currency, including roughly 1 point from AI services.

We can also note this statement from Satya Nadella, CEO:7

Our Azure OpenAI Service brings together advanced models, including ChatGPT and GPT-4, with the enterprise capabilities of Azure.

From Coursera and Grammarly, to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10X quarter-over-quarter.

Janelle and I discussed how the big companies—in this case represented by Microsoft—are important in that they tell us something about broader enterprise consumption and spending, leading to better clarity on the environment that the more “emerging” cloud companies have to operate within. Microsoft is sending a big signal on generative AI, and we believe we will continue to see it spreading across many different companies.

Bottom Line: Lots of Growth Catalysts for Those with More Time

Even if we recognize the uncertainty in the current 2023 economic environment, those investors with a longer time horizon can take advantage, positioning for important growth drivers looking forward. It is rare that companies with the largest market capitalizations in the world are able to announce something that could have a material impact on revenue growth—but that is just what generative AI seems to be as we write these words. For those interested in digging further:

The WisdomTree Cloud Computing Fund (WCLD) is tracking the returns of the BVP Nasdaq Emerging Cloud Index, providing a very direct exposure to more pure-play, emerging software companies.

The WisdomTree Artificial Intelligence & Innovation Fund (WTAI) is tracking the returns of the WisdomTree Artificial Intelligence & Innovation Index, which is seeking a diversified set of exposures to the AI ecosystem, with particular focus on being able to capitalize on generative AI to the extent possible within publicly listed firms.

For financial professionals interested in our upcoming office hours, you can check out the full calendar and register here.

1 SaaSacre is a term from BVP, combining “SaaS” [Software as a Service] and massacre to help illustrate in words the tough performance environment observed in 2022.

2 Source: https://www.bvp.com/atlas/state-of-the-cloud-2023?from=feature

3 Source: https://nextbigteng.substack.com/p/the-reckoning-of-pandemic-tech-darlings

4 Source: https://nextbigteng.substack.com/p/the-reckoning-of-pandemic-tech-darlings

5 Source: https://www.bvp.com/atlas/state-of-the-cloud-2023?from=feature

6 Source: https://www.microsoft.com/en-us/Investor/earnings/FY-2023-Q3/document/viewdocument/TranscriptFY23Q3.docx

7 Source: https://www.microsoft.com/en-us/Investor/earnings/FY-2023-Q3/document/viewdocument/TranscriptFY23Q3.docx

Important Risks Related to this Article

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISER TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.

Nasdaq® and the BVP Nasdaq Emerging Cloud Index are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.