What We Learned from BVPs "State of the Cloud" 2023

Each year, Bessemer Venture Partners (BVP) publishes their State of the Cloud report. Anyone interested in understanding how software-as-a-service (SaaS) companies are doing within the current market environment would benefit from reading this report, accessible here.

BVP is WisdomTree’s expert partner behind the BVP Nasdaq Emerging Cloud Index, called EMCLOUD, and this index is tracked by the WisdomTree Cloud Computing Fund (WCLD).

The following two areas in the BVP 2023 State of the Cloud report particularly caught our attention:

1. Profitability vs. growth tug-of-war: People like simpler answers. But for an SaaS business choosing profitability or growth, it is best to think of it like a slide rule along a spectrum—the middle signals both are equally important, while over time, the slider moves to one side or the other depending on the market’s preference. BVP’s analysis helps visualize how this slide rule has been moving around.

2. Artificial intelligence (AI): Particularly in the context of the large language models (LLMs) that characterize state-of-the-art generative AI. BVP makes a very clear connection between how many SaaS businesses will need to incorporate generative AI functionality if they want to be successful in the coming decade. If generative AI truly takes off, BVP makes a compelling case SaaS companies should be among the best beneficiaries.

To Focus on Growth or Profitability…Understanding the SaaS Slide Rule

For the majority of time between the 2008–09 global financial crisis and 2022, the Federal Reserve set its Federal Funds Rate very close to zero, creating an historically low cost of capital for all companies in the U.S. It was easy for founders to access greater sources of funding, and that funding was more easily seduced by great stories of large total addressable markets.

In 2022, the Fed and other central banks hiked rates dramatically. Suddenly, the cost of capital was no longer zero and interest rates, like gravity, began inexorably pulling harder on the sky-high valuations witnessed in late 2021 and early 2022 among SaaS businesses.

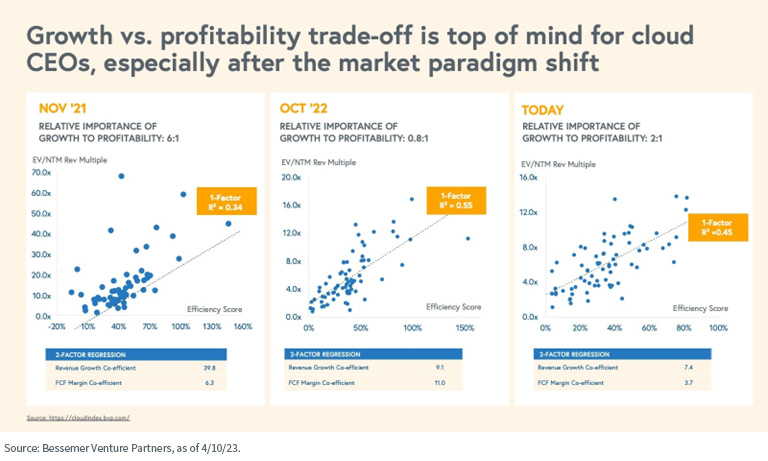

Figure 1 presents a noteworthy analysis done by BVP and available in full in the 2023 State of the Cloud report. From left to right:

• Nov ’21: The critical figures regard the coefficients, shown toward the bottom of the figure, within a 2-factor regression model. Simply put, a model like this uses two variables to try to predict another value—in this case revenue growth and free cash flow margin are the independent variables being used to predict the corresponding valuation impact, the dependent variable. You see 39.8 is roughly 6x 6.3, telling us that a 1% improvement in revenue growth was impacting valuations the same as a 6% improvement in profitability. That’s a HUGE premium focus on showing higher growth!

• Oct ’22: At this point, the middle chart, we see the relationship flip. Now we are seeing 9.1 is roughly 0.8x of 11.0, telling us that a 1% improvement in revenue growth was impacting valuations the same as a 0.8% improvement in profitability—close to 1-1 relationship and a MASSIVE change if we consider how this has to be viewed as a path—and we were all on the journey from something roughly 6:1 favoring growth to 1:1 now, where growth and profitability are closer to even.

• Today (Apr ’23): Currently, we see this relationship defined as a 1% improvement in revenue growth was impacting valuations the same as a 2% improvement in profitability. So, we have our answer—it looks like, roughly speaking, that growth is still important, roughly twice as important as improving profitability, at least within reason.

Figure 1: Growth or Profitability? A More Quantitative Look…

Generative AI: A Game-Changer

A big chunk of the 2023 State of the Cloud report discussed artificial intelligence, specifically how it could be used as an engine to supercharge growth and capability across SaaS companies. BVP believes companies with staying power over the coming decade will have to adopt generative AI features into their offering.

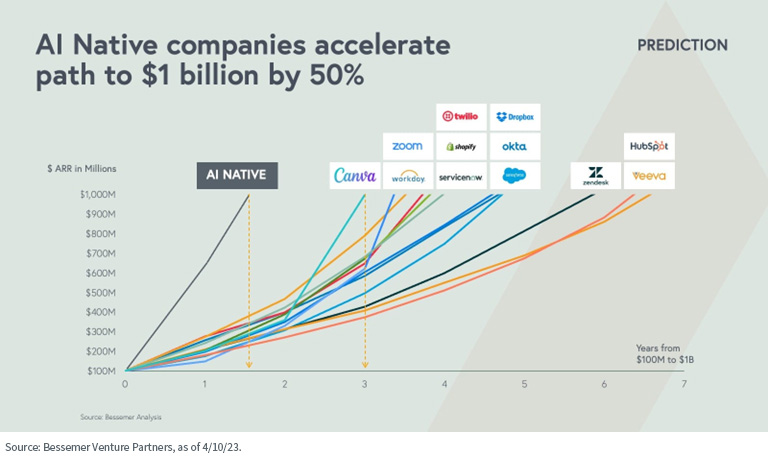

BVP also made reference to ‘AI native’ companies. BVP projects these companies can get to $1 billion in annual recurring revenue 50% faster than other SaaS companies achieved in the past.

BVP is focused on annual recurring revenue as opposed to valuation—the market was getting so frothy in the venture space there were simply too many unicorns being minted for the term to maintain its imprimatur of meaning.

Last year, BVP coined the term ‘Centaur,’ meaning a company able to achieve the milestone of 100 million in ARR—a big deal, and a better show of execution than simply a high valuation.

Only the top SaaS companies with strong execution and remarkable product-market-fit ever see $1 billion in ARR.

Figure 2: AI Native Cloud Companies Could Significantly Accelerate their Path to an Important ARR Milestone

Conclusion: Another Way to Consider a Generative AI Exposure?

As of this writing, OpenAI, the company responsible for putting out the viral ChatGPT, is not investable in the public market. Investors seeking exposure to the growth of generative AI therefore cannot easily invest in ChatGPT, but they might go about executing this thesis in a variety of ways:

• Certain tech giants, like Microsoft and Alphabet, could be integrating generative AI widely across their very broad, widely adopted platforms.

• For generative AI to work, there could be bigger demands for certain types of semiconductors to accelerate the hardware, so companies like Nvidia may be of interest.

• There are ETFs, like the WisdomTree Artificial Intelligence and Innovation Fund (WTAI), that seek a diversified exposure to the AI ecosystem.

However, if we learned anything within the tech space during the COVID-19 pandemic, it was the inherent scalability of the SaaS business model. These companies can grow very quickly and margins can be very, very high. If generative AI becomes a growth catalyst and it appears that growth is prized among SaaS investors…it could have the makings of a very interesting, and different, way to capitalize on an AI growth thesis.

Important Risks Related to this Article

Click here for a full list of WCLD’s Fund holdings. Holdings are subject to change and risk.

Click here for a full list of WTAI’s Fund holdings. Holdings are subject to change and risk.

There are risks associated with investing, including the possible loss of principal. WCLD invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and WCLD. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of its Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read WCLD’s prospectus for specific details regarding WCLD’s risk profile.

There are risks associated with investing, including the possible loss of principal. WTAI invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. WTAI invests in the securities included in, or representative of, its Index regardless of their investment merit and WTAI does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the WTAI’s prospectus for specific details regarding WTAI’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.