It’s an Interesting Time to Consider High Dividend International Equities

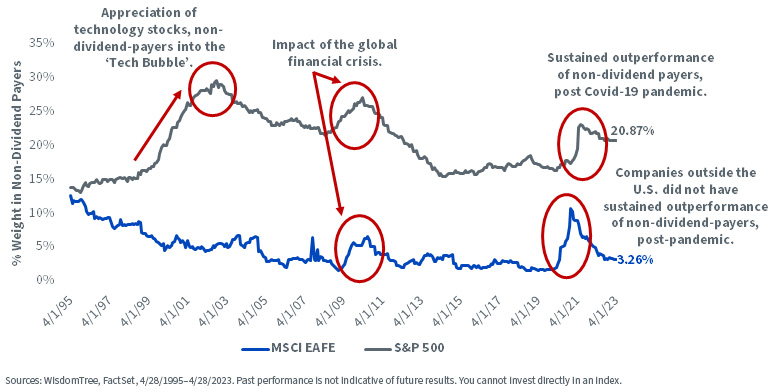

U.S. investors are most familiar with their home market, and the U.S. home market is unique in a very important respect: dividends.

Outside the U.S., dividends are an important signal that a company has attained maturity. Most non-U.S. companies do not specify an exact amount, but rather a ‘payout-ratio’ type of practice, where dividend payments can move up and down and sometimes be rather volatile.

In the U.S. market, some of the largest companies, like Alphabet, Amazon.com, Meta, Berkshire, Tesla and Netflix, do not pay dividends. Some of them will approve share buyback programs in the tens of billions of dollars—so it’s clear that if it was desirable to pay a dividend, it could be done. Therefore:

- In international markets, dividends can offer something close to a complete picture of the investment landscape.

- In domestic markets, dividends would systematically bias away from certain companies, some of them very large and in recent years responsible for driving the broader equity market performance higher.

Figure 1: The Superior Coverage of Developed International Dividends

For definitions of terms/indices in the chart above, please visit the glossary.

High Dividend Yielders Have Tended to Outperform Low Dividend Yielders in Most Environments

At WisdomTree, we have written frequently about long, historical time series of data showing different characterizations of equity market performance. One of our classics, which comes from Professor Jeremy Siegel, mentioned in both Stocks for the Long Run and The Future for Investors, involves cutting the S&P 500 Index into different quintiles by dividend yield.

Bottom line: The highest-yielding dividend quintile of the S&P 500 Index outperformed over the live calculation history of the S&P 500 Index (going back to before 1960) and did so with lower risk.

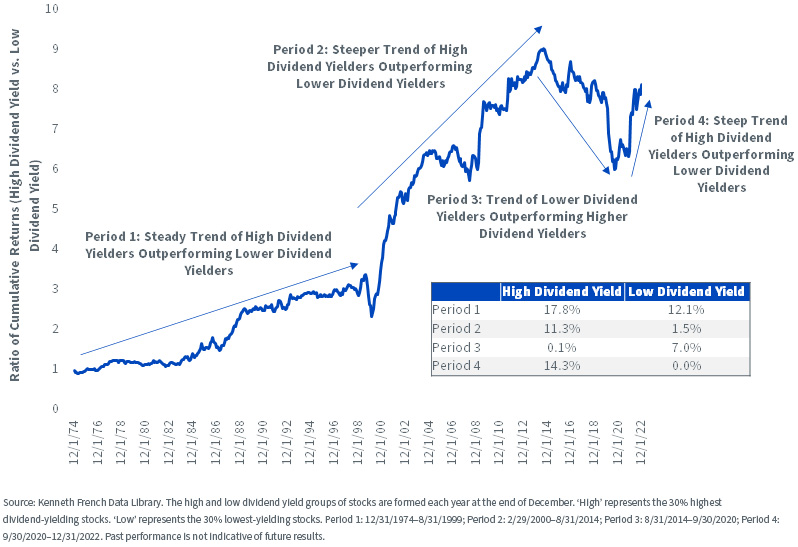

While we recognize that international markets are different from the U.S. market, we wanted to see if the result when slicing the groups of stocks in a similar way was similar to the U.S. result. In this case, we were able to work with a similarly long time series, going back to the mid-1970s, using data from the Kenneth French Data Library. Within figure 2:

- An upward slope in the line from left to right indicates that higher-yielding dividend payers are outperforming lower-yielding dividend payers. We can clearly see that, in general, the line ends the time series much higher than where it starts, indicating that higher dividend yielders did tend to outperform lower dividend yielders in international markets.

- Period 4 is notable in that the slope of the line tells us there was a very steep outperformance of higher dividend yielders over lower dividend yields. During this period, so far, we see annualized performance of about 14% per year for the higher yielders, whereas the lower yielders were annualizing at a rate of about 0% per year—a big difference.

Figure 2: Regimes of High vs. Low Dividend Yield Outperformance in Developed International Equities

As Interest Rates Have Risen, So Too Have Dividend Yields

If investors can get higher income in a short-term government fixed income strategy, the baseline of all income-oriented strategies has to be higher.

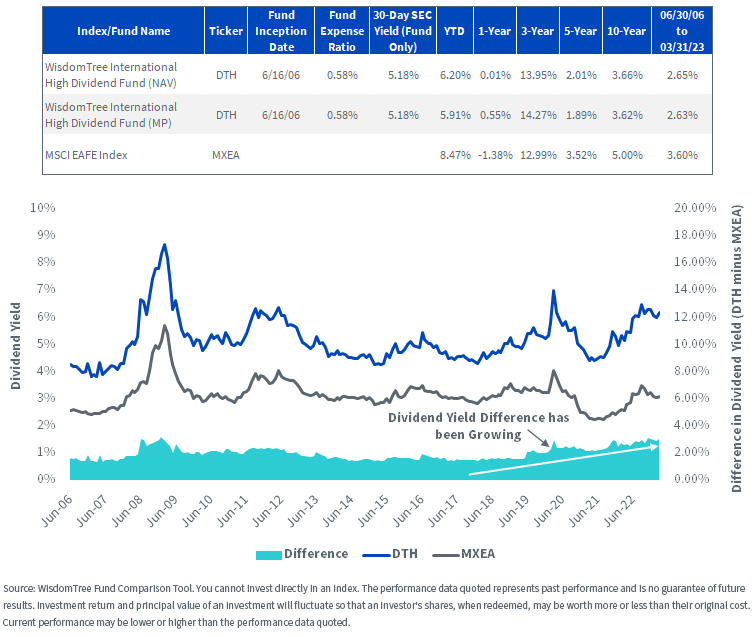

The WisdomTree International High Dividend Fund (DTH) tracks the performance of the WisdomTree International High Dividend Index, which, simply put, finds stocks that have high dividend yields in developed markets outside the U.S. Investors are often familiar with the MSCI EAFE Index benchmark, which is weighted by free float-adjusted market capitalization.

If one Index is focused on ‘high dividend yielders’ and another is weighted by ‘free float-adjusted market capitalization,’ the hypothesis is that the dividend yield of the Index—as well as the Fund designed to track it—that focuses on dividend yields should be higher than that of the broad benchmark.

What we found interesting in figure 3 is that the difference in these two yields is expanding. It is not the highest difference that we have seen going back to DTH's live inception in June 2006, but it is getting quite close and has exhibited a steady increase in recent years.

Figure 3: Trailing 12-Month Dividend Yield for DTH Has Been Increasing Relative to the MSCI EAFE Index

For the most recent month-end performance, click here.

Do You Think We Will Experience a Recession?

Instead of fixating on the recession/not recession call, we find it more productive to think about positioning in this way:

- If investors want to bet against a recession, there are ways to do that, by potentially thinking more cyclically and also of different catalysts—like maybe the Federal Reserve stops tightening in a way that is faster than expected.

- If investors want to be ready for slower economic growth or possible volatility, defensively oriented positioning makes sense.

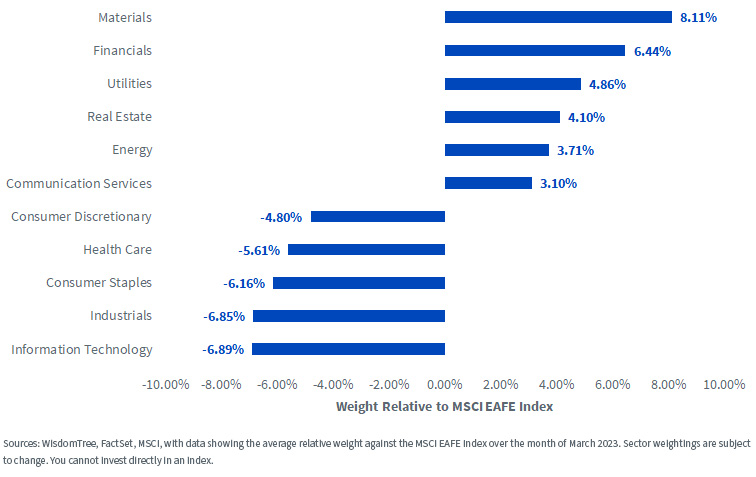

The WisdomTree International High Dividend Index, tracked by DTH, has been in live calculation since June 1, 2006, so is coming up on 17 years of live history. Over that period, we have tended to see certain over-weight exposures among those sectors that have higher dividend yields. Since the positioning has not been constant (we rebalance back to the dividend stream each year), we looked at the most recent month to get a sense of where the WisdomTree International High Dividend Index is relative to the MSCI EAFE Index.

- Materials is an interesting sector at present, in that raw materials are very much in focus during the energy transition.

- In Europe, Financials represent the transmission mechanism of economic activity to a much higher degree than in the U.S. In the developed international space, this is a big sector, whether viewed on a dividend or market cap basis.

- Utilities do have that classic, defensive orientation.

- Industrials and Tech represented the biggest relative under-weight allocations.

Figure 4: WisdomTree International High Dividend Yield Exhibited a Defensive Orientation Relative to the MSCI EAFE Index over its History

Conclusion: Venturing outside of the U.S. in Portfolios Could Be Important

At WisdomTree, we have been thinking about equity allocations outside of the U.S. for many years, and yet the U.S. equity market tended toward outperformance for an extended time following the global financial crisis of 2008–09. We think that it’s possible for this to shift, and a value-oriented high dividend approach could be an interesting approach to it for the long run.

Important Risks Related to this Article

Click here for a full list of Fund holdings. Holdings are subject to change.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.