Get Your Passport Ready—It’s Time for International Outperformance!

At WisdomTree, we have been writing for some time about international markets. Year after year, it felt like we would indicate a valuation advantage or other characteristic painting international equities in a favorable light, and year after year, the juggernaut of Amazon.com, Apple, Meta, Alphabet, Microsoft, etc., would drive the domestic indexes higher. Even if there were fits and sparks of international outperformance of U.S. equities, the general trend was certainly of the U.S. equity market vanquishing most other parts of a globally diversified portfolio.

But this may be about to shift.

Most Markets Move in Waves

There is a reason why such phrases as “the trend is your friend” become memorable and widespread—markets don’t tend to randomly just move one way or another. Investors tend to spot trends and behave in ways to take advantage of them, and in a way, the trends continue to perpetuate.

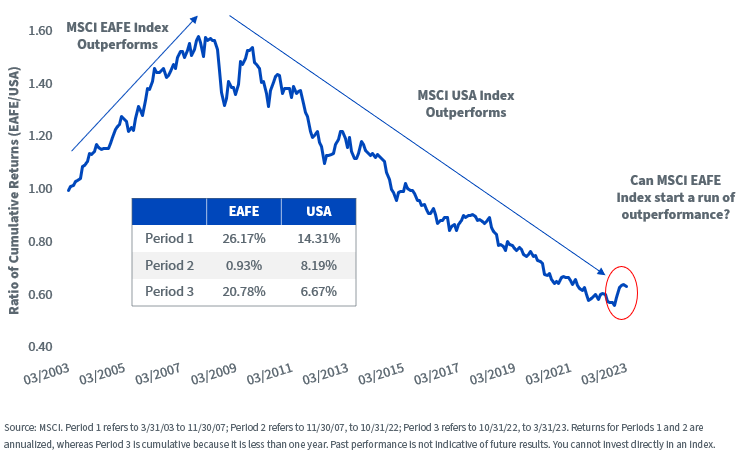

If we test out the concept of “international vs. U.S.” for equity market indexes, going back 20 years, we see two longer periods with the possibility of a new period or trend just poking its head up from the sand:

- Period 1: March 31, 2003, to November 30, 2007, saw the MSCI EAFE Index deliver 26.17% per year, against the MSCI USA Index delivering 14.31% per year.

- Period 2: November 30, 2007, to October 31, 2022, saw the MSCI EAFE Index deliver less than 1% per year, whereas the MSCI USA Index delivered better than 8% per year. This is the long period that we all most immediately remember—roughly 15 years—and it is what cemented in people’s minds the concept that U.S. markets have a massive tendency to outperform.

- Period 3: October 31, 2022, to March 31, 2023, saw the MSCI EAFE Index deliver a cumulative 20.78%, while the MSCI USA Index delivered a cumulative return of 6.67%.

Figure 1: Are We Witnessing the Birth of a New Trend?

Global Recession Fears? Step Up in Quality

Now, it feels like every single day we are hearing varied prognostications about if there will be a recession, if it will be a deep recession, if it will be a global recession, when it will happen, etc. What we know is that most investors, even if they are thinking a recession may come, do not zero out their equity exposures. In periods of uncertainty, we believe that exposures emphasizing the “quality factor” could be well-positioned in that these types of companies may have the most robust balance sheets.

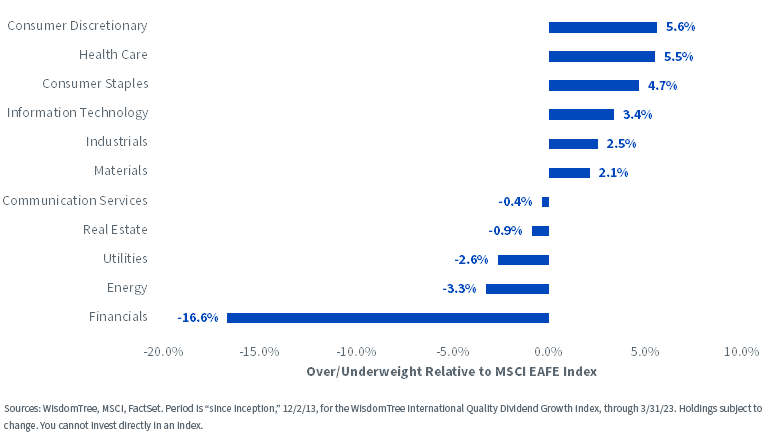

WisdomTree has been running the WisdomTree International Quality Dividend Growth Index since November 29, 2013 (the Index’s base date)—nearly 10 years. One of the most interesting ways, in our opinion, to look at the quality factor over a period of time regards sector positioning. If we look across the full history of live performance, we can see the average sector weights relative to the well-known and widely followed MSCI EAFE Index benchmark.

Figure 2 shows:

- Under-Weight in Financials: The most pronounced position of the WisdomTree International Quality Dividend Growth Index relative to the MSCI EAFE Index is the greater than 16.6% average under-weight in Financials. In developed international markets, these firms tend to be highly levered, and WisdomTree’s approach to quality does tend to steer fairly clear of more highly levered firms.

- Over-Weight in Discretionary, Health Care and Staples: The most pronounced over-weights—again, for the full period of live history—are in Discretionary, Health Care and Staples. One can look in particular at Health Care and Staples and may see a “defensive ballast” to at least this portion of the equity position.

Figure 2: Positioning away from Higher Degrees of Leverage

Is International Quality Capturing the Current Uptick in Developed International Equities?

So far, we have what could be the beginnings of a new trend of international equity outperformance, and we have the concept of “quality” for a more uncertain macroeconomic picture.

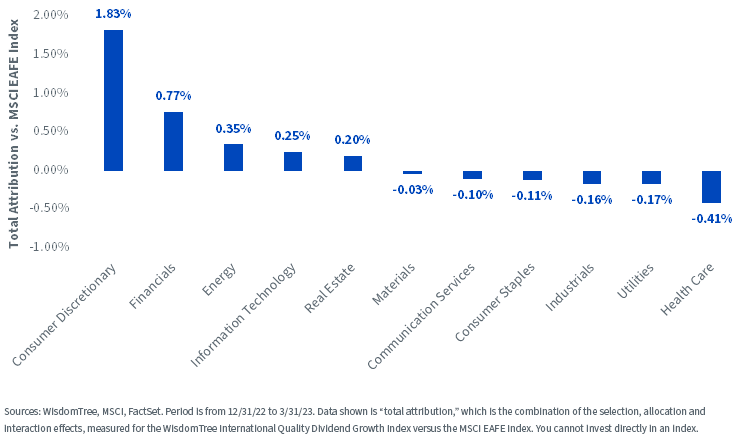

But is the WisdomTree International Quality Dividend Growth Index actually capturing the boost to international equity returns that we have been seeing? For the first quarter of 2023, we saw:

- The WisdomTree International Quality Dividend Growth Index returned 10.89%, whereas the MSCI EAFE Index returned 8.47%. This means that the WisdomTree approach outperformed by 2.42%, at least showing us that the first part of this potential trend in favor of developed international equities is being captured.

- Breaking out the attribution by sector, we see that Consumer Discretionary was the primary driver of this outperformance, with Financials in the second position. While Financials was mostly driven by the under-weight against the MSCI EAFE Index, Consumer Discretionary picked up ground on stock selection as well as the nearly 8% over-weight allocation.

Figure 3: Capturing Outperformance over the MSCI EAFE Index during Q1 2023

Introducing the WisdomTree International Quality Dividend Growth Fund (IQDG) and its history of showcasing higher-quality metrics.

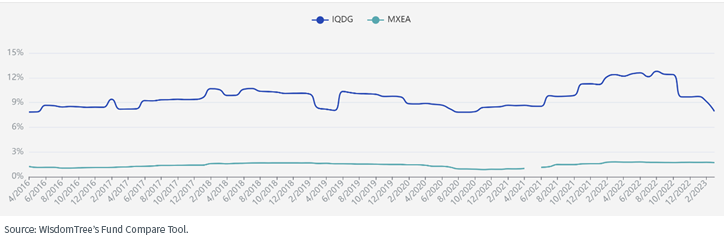

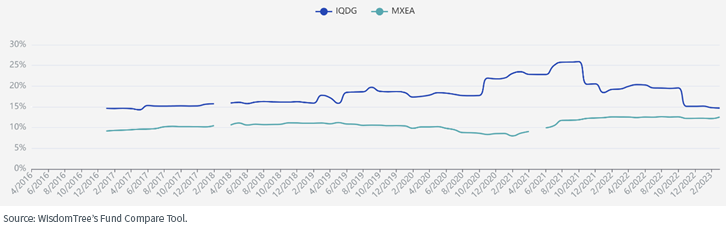

While we have been discussing the WisdomTree International Quality Dividend Growth Index, IQDG is the actual Fund designed for investors interested in capturing this stream of returns. WisdomTree has a series of tools on its website, one of which allows the user to “test” IQDG by many different metrics against the MSCI EAFE Index (MXEA) benchmark. In figures 4a, 4b and 4c, we show three ways in which IQDG has been able to exhibit strong quality metrics against MXEA.

Remember, if anyone is thinking “why quality,” the degree of strength to put behind that answer directly relates to the degree of macroeconomic uncertainty; i.e., if you are more concerned about a recession, it may make sense to think more closely about quality.

In figure 4a, we see how IQDG has consistently exhibited a higher return on equity than MXEA, going back over the full available history horizon to 2016. We’d note that within the methodology of the WisdomTree International Quality Dividend Growth Index, return on equity is focused on, so this result is not wholly unexpected.

Figure 4a: Return on Equity

Within figure 4b, we see that IQDG has also been about to exhibit higher returns on assets relative to the MXEA Index over the full available horizon. Like return on equity, return on assets is also in focus within the methodology of the WisdomTree International Quality Dividend Growth Index, so what we see in figure 4b is also not wholly unexpected.

Figure 4b: Return on Assets

Figure 4c is different in that we are now looking at a metric that is not focused on directly within the methodology of the WisdomTree International Quality Dividend Growth Index: operating margin. We see that IQDG did exhibit a higher operating margin across the full range of available data history relative to MXEA. In a more uncertain environment, this could signal potential strength and greater capability to withstand difficulties, should they occur.

Figure 4c: Operating Margin

Bottom Line: It’s Time to Look beyond U.S. Borders for Equity Return Opportunities

While no one has a direct crystal ball telling us with certainty exactly what will and won’t outperform in a given portfolio allocation, after an extended nearly 15-year period of U.S. equity outperformance, we can say we like the chances for a trend favoring developed international stocks. These stocks have started 2023 off strongly, and if people are thinking about increasing economic uncertainty—for any reason—we like layering on a quality tilt to this focus.

Important Risks Related to this Article

Click here for a full list of Fund holdings. Holdings are subject to change.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Heightened sector exposure increases the Fund’s vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.