Golden Shares: The Government’s Role in Chinese Companies

The History of Golden Shares, from European Privatization to Chinese Use

Golden shares, which give the holder 1% of equity and one board seat, have recently been used by the Chinese government to maintain control of certain private enterprises.

Although most of the reported cases of golden shares are concentrated in media companies, it’s important to understand China’s economy and the government’s method of control to fully grasp their significance.

In this article, we’ll explore the history of golden shares, their current use in China and which sectors the government is likely to continue to exert control over.

The concept of golden shares was first introduced in the UK in 1981 to privatize state-owned telecommunications companies.

It was later used extensively by other European countries to transition from state-owned companies to a more private role.

China saw this as a successful example of reducing state ownership and interference in companies’ operations while maintaining some state control.

Current Landscape of Golden Shares in China

All known cases of golden shares in China are in new media companies, such as video streaming subsidiaries of ByteDance, the parent company of TikTok. They are also in small subsidiaries rather than the parent company, which is a common misunderstanding. There’s no systematic database to identify which companies’ subsidiaries have golden shares, but they are not as widespread as some reports suggest. For now, equity ownership remains China’s main method of state control.

Energy, Finance and Media Are Sectors in Which the Chinese Government Will Continue to Exert Significant State Control

Energy and Finance are sectors dominated by state-owned companies, while media companies are always state-owned and mostly not publicly listed as long as the Communist Party is in power.

However, the rise of tech has given rise to wholly private media companies like Tencent, Baidu, ByteDance and Kuaishou that present a challenge to the government’s control. To exert some control over these companies, the Chinese government could take significant equity or use golden shares.

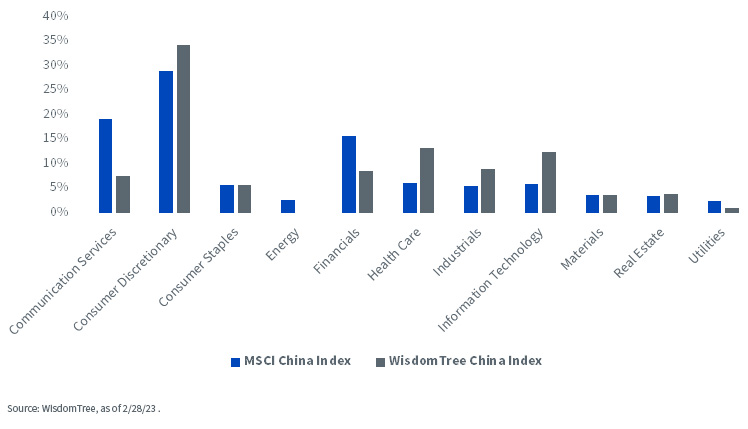

Sector Weight

In summary, golden shares are a lighter tool of state control than significant equity ownership, mainly used for new media companies.

They do have some influence, but the worries that they will lead to significant operational control loss are overblown. For now, they are not the dominant form of state control, but if China were to privatize state-owned enterprises, they could be incorporated as a systematic decision variable.

For more insights on the latest investing risks and opportunities in China, check out our China of Tomorrow podcast series.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.