USFR: A Low-Volatility Call Option on U.S. Government Dysfunction?

The current question on every investor’s mind is, what happens should the U.S. Congress not reach a deal on extending the debt ceiling? On April 25, the head of a large European Bank research team asked for our thoughts on this issue. While we remain hopeful that a deal can be reached to avoid unnecessary market turbulence, our best (and most perverse) thought may be to consider owning U.S. Treasury debt in the form of U.S. floating rate notes.

As my colleague Kevin Flanagan noted during the last impasse, in 2011 when the U.S. government ran debt ceiling negotiations to the brink, Standard & Poor’s responded by downgrading the credit rating on U.S. government debt from AAA to AA+. In a counterintuitive market reaction, longer-maturity U.S. bond yields actually declined on this move. But on April 24, four markets appeared to be reacting to a higher risk of a deal not being reached:

- U.S. equity markets declined

- The cost of insuring U.S. Treasury debt from default in the credit default swaps market rose to all-time highs

- Longer-maturity U.S. bond yields declined

- Yields on 1-Month U.S. Treasury bonds that mature before the current debt limit runs out continued to decline

When multiple markets are trading in the same direction due to a specific event risk, investors should take note.

U.S. Credit Default Swaps Rise to All-Time High

While everyone believes that the U.S. government will eventually make good on its debts, the real risk posed to the economy is one of unintended consequences. The risk that many emerging markets have learned over time is that when a country defaults, the banking system faces an extreme risk of collapse. Since banking systems are built around assets (U.S. Treasuries, loans) and liabilities (deposits), even a temporary disruption in the timing of U.S. Treasury Bills (t-bills) being funded could result in a cascading effect on bank balance sheets that are already reeling on the back of rising U.S. interest rates and deposit flight. This is the risk that U.S. Treasury Secretary Yellen has been mentioning in nearly all of her public comments.

Looking to the History

While not completely related to the debt ceiling, many reports have pointed to the U.S. government failing to pay investors back their principal on time due to operational issues during the Carter Administration.

In The Financial Review,1 researchers Terry Zivney and Richard Marcus wrote in 1989:

“Investors in T-bills maturing April 26, 1979 were told that the U.S. Treasury could not make its payments on maturing securities to individual investors. The Treasury was also late in redeeming T-bills which become due on May 3 and May 10, 1979. The Treasury blamed this delay on an unprecedented volume of participation by small investors, on failure of Congress to act in a timely fashion on the debt ceiling legislation in April, and on an unanticipated failure of word processing equipment used to prepare check schedules.“

The reaction to Treasury being unable to make these payments resulted in a one-day spike in U.S. t-bill yields of sixty basis points despite this issue being related only to retail holders of these securities. They also found that higher results persisted for several months due to fears of another delay in payment to larger institutional investors.

Timing of Risk

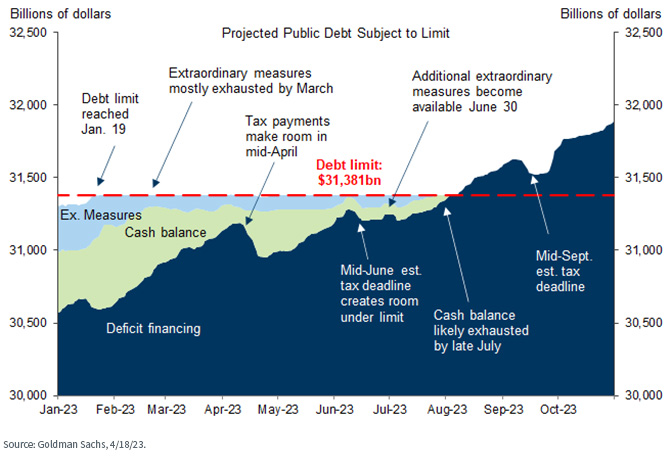

While this is not our base case for the current situation, investors may begin to shun debt that matures around this event period, resulting in higher yields. A report recently released by Goldman Sachs shows that the U.S. may exhaust all of its resources by late July on account of weaker tax receipts:

Debt Limit Timeline

In order to avoid this issue, they note that Congress will need to address the debt limit issue by early June. Working backward, this implies that we may begin to see an uptick in 3-Month Treasury Bill yields in the coming weeks.

Conclusion

In our view, the best option for investors seeking to potentially capitalize on this risk without using derivatives may be to invest in U.S. floating rate debt via the WisdomTree Floating Rate Treasury Fund (USFR):

- The Fund holds U.S. floating rate notes whose principal matures in two years, well past the current risk of selective non-payment.

- Additionally, USFR sells its floating rate notes with one year remaining to maturity, increasing the frequency of the rate reset.

- The yield on the notes resets weekly based on the yield of 3m t-bills + a spread set when the notes are originally auctioned.

Should rates begin to rise in anticipation of an earlier-than-expected exhaustion of the debt ceiling, we believe this is the most straightforward way to potentially capitalize on U.S. government dysfunction.

1 Terry L. Zivney and Richard Marcus, “The Day the United States Defaulted on Treasury Bills,” The Financial Review, 1989, vol. 24, issue 3, 475–89.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new, and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.