Values Strong Run in Emerging Markets

The value factor continues to outperform in emerging markets (EM). In contrast, value’s victory lap in developed markets (DM) in 2022 ended with the growth factor taking back control in 2023. This is largely due to the market expecting an earlier Federal Reserve (Fed) pivot, owing to falling inflation, the banking crisis and further signs of an economic slowdown. As a result, investors rotated out of low-duration value sectors into high-duration growth sectors as future interest rate expectations were lowered, making growth appear attractive again.

Scarcity Premium of the Growth Factor Recedes during Higher EM Economic Growth

However, value continues to outperform growth in EM, extending the trend of the last three years. According to the International Monetary Fund’s latest report, EMs are expected to grow at 3.9% in 2023, led by China and India achieving a growth rate of 5.2% and 5.9%, respectively.1 EM’s growth is expected to outpace that of DM in 2023 and 2024, according to the IMF’s latest projections.

While it might seem counterintuitive, value stocks tend to benefit more than growth during periods of accelerating growth. This is because as economic growth weakens, companies that are able to generate higher earnings growth look relatively attractive and benefit from a scarcity premium. So as overall economic growth declines, the growth factor generally outperforms. However, as overall growth rates pick up in EM, growth stocks command less of a scarcity premium and value stocks appear relatively well priced.

Value in EM is dominated by financials, asset-heavy cyclical commodity or manufacturing businesses and state-owned enterprises (SOEs).

Factor Performance in Emerging & Developed Markets over Three Years

EM Banks—Slow and Steady Wins the Race

The banking crisis triggered by the failure of Silicon Valley Bank and Signature Bank and the forced takeover of Credit Suisse by rival UBS in March 2023 tarnished sentiment toward the financial sector across DM.

However, EM banks, owing to their conservative approach and tighter regulation, escaped unscathed. The divergence in interest rate cycles has an important role to play here. While DM central banks saw a uniform increase in interest rates, EM central banks followed divergent policies. For instance, the Chinese central bank cut interest rates and Brazil’s central bank is expected to cut rates. In addition, interest rates in EM averaged at a higher level than DM, which helped EM banks avoid a squeeze on net interest margins. EM banks also avoided buying large quantities of government bonds as credit demand remained resilient. In the aftermath of the banking crisis, DM banks will likely be required to hold more capital, reduce dividends and bear the brunt of a higher cost of funding. In comparison, EM banks’ capital levels are significantly above international levels and local regulatory requirements, which supports a more conservative approach to bank regulation.

China’s Consumption Rebound Is Underway

China’s post-Covid recovery is well on track, supported by consumption, exports and services. Recovery in sales is leading property stabilization. The support measures implemented by the authorities have helped the stem the crisis in the real estate sector. Growth in the industrial sector was held back by the contraction in computer and semiconductor production, owing to the turnaround of the global electronic cycle as well as very strict controls imposed by Washington on electronic component sales to Chinese companies. In Q1 2023, Chinese economic growth stood at 2.2% quarter on quarter. We expect real GDP growth to accelerate further in Q2 2023.2

A combination of improving growth rates in EM, higher dividend yields, lower valuations, a resilient Chinese re-opening and a weaker U.S. dollar are important drivers for the next stage of the recovery.

EMs have received $16 billion in exchange-traded funds (ETF) inflows in 2023, marking the second-highest geographic region after international markets. In a similar vein, the WisdomTree Emerging Markets High Dividend Fund (DEM) saw the highest inflows in 11 years, amounting to $351 million,3 reflecting the improvement in sentiment toward EMs and the preference for maintaining a value tilt.

Maintaining a Value Tilt in a Diverse EM Universe

The WisdomTree Emerging Markets High Dividend Total Return Index (WTEMHY) aims to provide investors access to high-dividend-yielding EM stocks. The strategy uses aggregate cash dividends paid by each company to weight the constituents on an annual basis, which introduces valuation discipline and helps avoid value traps.

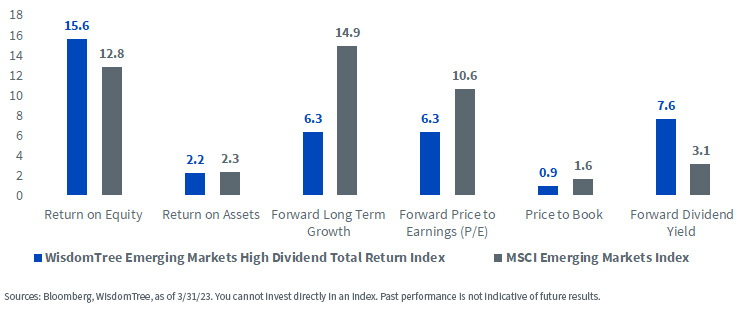

The Index trades at a 6.3x price-to-earnings ratio, marking a 40% discount to the benchmark MSCI EM total return index, highlighting the positive tilt toward value. In addition to the valuation discount, the Index continues to exhibit comparable quality characteristics with an average return on equity (ROE) of 15.6 (benchmark 12.8) and return on assets (ROA) of 2.2 (benchmark 2.3). The Index’s dividend yield is high at 7.6% versus 3.1% for the benchmark.

Comparison of Fundamentals

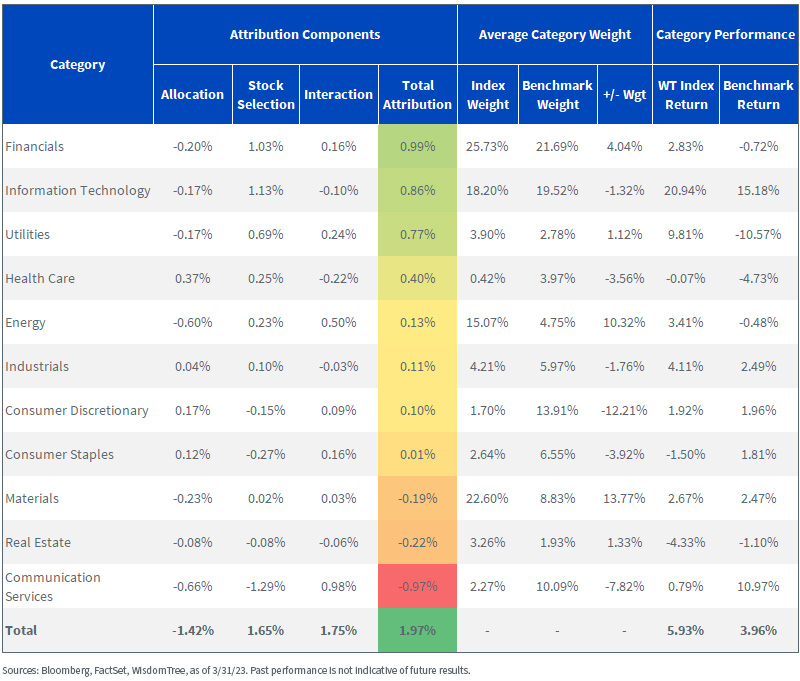

Since the start of 2023, the Index has outperformed the benchmark by 1.97%, benefitting from its higher exposure to sectors such as financials, information technology and utilities. From a geographic perspective, the higher allocation to countries such as Taiwan and India have helped the Index outperform the benchmark.

Sector Attribution

1 IMF World Economic Outlook, April 2023

2 National Bureau of Statistics, as of 4/18/23

3 As of 4/21/23

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.